- United Kingdom

- /

- Specialty Stores

- /

- LSE:JD.

GlobalData And 2 UK Stocks Possibly Trading Below Fair Value

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faltered, closing lower after weak trade data from China indicated ongoing struggles in the global economy. In such a volatile market, identifying undervalued stocks can offer potential opportunities for investors looking to capitalize on discrepancies between current prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topps Tiles (LSE:TPT) | £0.44 | £0.87 | 49.5% |

| Gaming Realms (AIM:GMR) | £0.401 | £0.76 | 47% |

| Victrex (LSE:VCT) | £9.41 | £17.23 | 45.4% |

| Informa (LSE:INF) | £8.346 | £16.21 | 48.5% |

| Redcentric (AIM:RCN) | £1.30 | £2.44 | 46.6% |

| SysGroup (AIM:SYS) | £0.34 | £0.65 | 48% |

| Foxtons Group (LSE:FOXT) | £0.626 | £1.18 | 46.9% |

| Hochschild Mining (LSE:HOC) | £1.87 | £3.53 | 47.1% |

| BATM Advanced Communications (LSE:BVC) | £0.20 | £0.36 | 45.1% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.135 | £2.05 | 44.6% |

We'll examine a selection from our screener results.

GlobalData (AIM:DATA)

Overview: GlobalData Plc, with a market cap of £1.66 billion, operates in Europe, North America, and the Asia Pacific providing business information through proprietary data, analytics, and insights.

Operations: GlobalData generates revenue of £276.80 million from its proprietary data, analytics, and insights across Europe, North America, and the Asia Pacific.

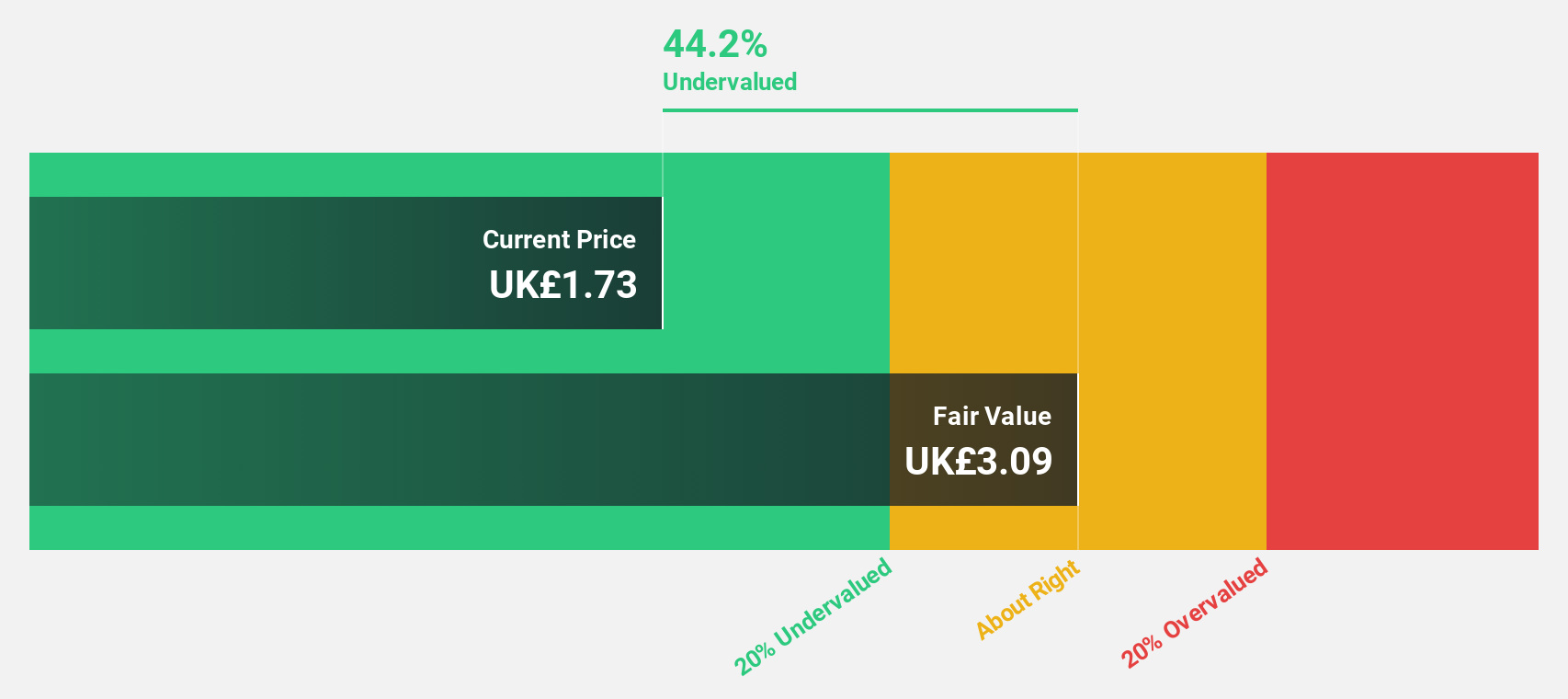

Estimated Discount To Fair Value: 44.2%

GlobalData is trading at £2.07, significantly below its estimated fair value of £3.71, suggesting it is undervalued based on cash flows. The company forecasts strong earnings growth of 27.69% per year, outpacing the UK market's 14.2%. However, recent insider selling and a dividend yield of 2.27%, which isn't well covered by earnings, are potential concerns. Recent buyback announcements and solid half-year earnings results further support its valuation prospects.

- Our comprehensive growth report raises the possibility that GlobalData is poised for substantial financial growth.

- Get an in-depth perspective on GlobalData's balance sheet by reading our health report here.

JD Sports Fashion (LSE:JD.)

Overview: JD Sports Fashion Plc is a retailer of branded sports fashion and outdoor clothing, footwear, accessories, and equipment for all ages across the UK, Republic of Ireland, Europe, North America, and internationally with a market cap of £7.98 billion.

Operations: The company's revenue segments include £9.98 billion from Sports Fashion and £559.90 million from Outdoor products.

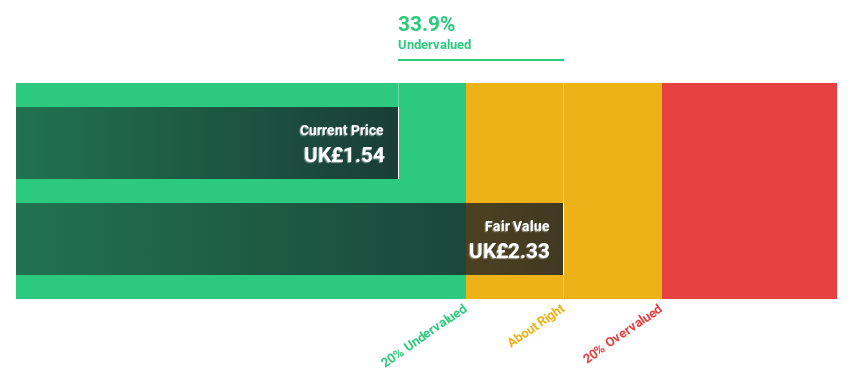

Estimated Discount To Fair Value: 34%

JD Sports Fashion is trading at £1.54, significantly below its estimated fair value of £2.33, indicating it is undervalued based on cash flows. Despite high volatility in its share price over the past three months, JD Sports forecasts earnings growth of 15.87% per year and revenue growth of 9% per year, outpacing the UK market's 3.7%. Recent board changes and confirmed lower-end earnings guidance for 2024 are factors to monitor closely.

- Our earnings growth report unveils the potential for significant increases in JD Sports Fashion's future results.

- Delve into the full analysis health report here for a deeper understanding of JD Sports Fashion.

NCC Group (LSE:NCC)

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe, with a market cap of £530.83 million.

Operations: The company generates revenue from two main segments: Cyber Security (£258.50 million) and Escode (£65.90 million).

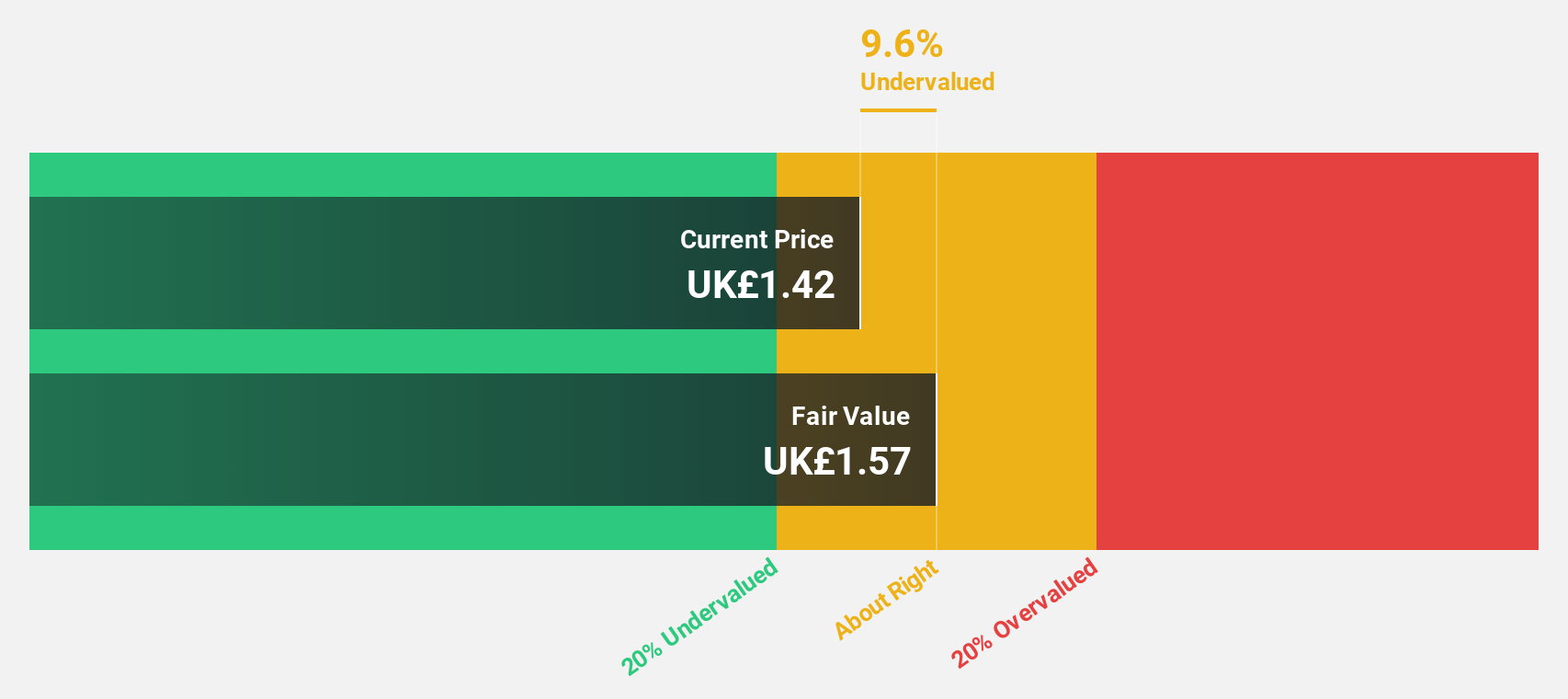

Estimated Discount To Fair Value: 36.4%

NCC Group is trading at £1.7, well below its estimated fair value of £2.67, indicating it is undervalued based on cash flows. Despite a net loss of £24.9 million for the year ended May 31, 2024, earnings are forecast to grow significantly at 87.41% per year over the next three years, with profitability expected within this period. Recent projects like the SEK 450 million water network upgrade in Ale and the SEK 250 million Mariestad correctional facility expansion bolster future revenue prospects.

- Insights from our recent growth report point to a promising forecast for NCC Group's business outlook.

- Click here to discover the nuances of NCC Group with our detailed financial health report.

Taking Advantage

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 61 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:JD.

JD Sports Fashion

Engages in the retail of branded sports fashion and outdoor clothing, footwear, accessories, and equipment for kids, women, and men in the United Kingdom, Republic of Ireland, Europe, North America, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives