- United Kingdom

- /

- Retail Distributors

- /

- LSE:INCH

Do Inchcape's (LON:INCH) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Inchcape (LON:INCH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Inchcape with the means to add long-term value to shareholders.

See our latest analysis for Inchcape

How Fast Is Inchcape Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Inchcape's EPS went from UK£0.12 to UK£0.68 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

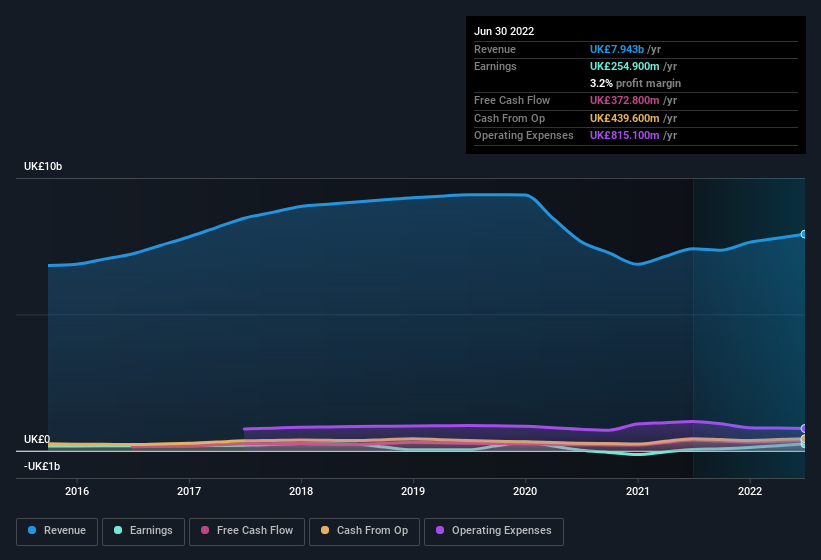

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Inchcape shareholders can take confidence from the fact that EBIT margins are up from -0.7% to 4.6%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Inchcape's future EPS 100% free.

Are Inchcape Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

A great takeaway for shareholders is that company insiders within Inchcape have collectively spent UK£9.1k acquiring shares in the company. While this investment may be modest, it is great considering the lack of insider selling.

Along with the insider buying, another encouraging sign for Inchcape is that insiders, as a group, have a considerable shareholding. Holding UK£58m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This should keep them focused on creating long term value for shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Inchcape's CEO, Duncan Tait, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Inchcape with market caps between UK£1.7b and UK£5.4b is about UK£2.6m.

Inchcape offered total compensation worth UK£2.1m to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Inchcape To Your Watchlist?

Inchcape's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Inchcape belongs near the top of your watchlist. It is worth noting though that we have found 2 warning signs for Inchcape that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Inchcape isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Inchcape, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:INCH

Very undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives