- United Kingdom

- /

- Specialty Stores

- /

- LSE:CURY

Does It Make Sense To Buy Dixons Carphone plc (LON:DC.) For Its Yield?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at Dixons Carphone plc (LON:DC.) from a dividend investor's perspective. Owning a strong dividend company and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

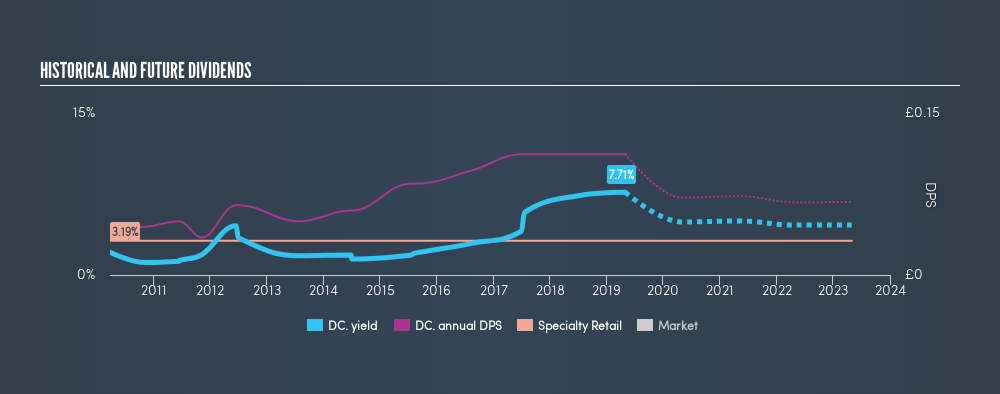

In this case, Dixons Carphone likely looks attractive to dividend investors, given its 7.7% dividend yield and nine-year payment history. We'd agree the yield does look enticing. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. While Dixons Carphone pays a dividend, it reported a loss over the last year. When a company recently reported a loss, we should investigate if its cash flows covered the dividend.

With a loss in the last year, it becomes even more important to evaluate if the company is generating enough cash flow to pay its dividend and meet its obligations. Dixons Carphone paid out 191% of its free cash last year. Cash flows can be lumpy, but paying out this much cash is not ideal. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely.

Is Dixons Carphone's Balance Sheet Risky?

Given Dixons Carphone is paying a dividend but reported a loss over the past year, we need to check its balance sheet for signs of financial distress. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA measures a company's total debt load relative to its earnings (lower = less debt), while net interest cover measures the company's ability to pay the interest on its debt (higher = greater ability to pay interest costs). Dixons Carphone has net debt of 0.66 times its earnings before interest, tax, depreciation and amortisation (EBITDA), which is generally seen as an acceptable level of debt.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Dixons Carphone has EBIT of 10.32 times its interest expense, which we think is adequate.

Remember, you can always get a snapshot of Dixons Carphone's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Dixons Carphone paid its first dividend at least nine years ago. It's good to see that Dixons Carphone has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past nine-year period, the first annual payment was UK£0.044 in 2010, compared to UK£0.11 last year. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time. Dixons Carphone's dividend payments have fluctuated, so it hasn't grown 11% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Dixons Carphone has grown its earnings per share at 4.7% per annum over the past five years. A payout ratio below 50% leaves ample room to reinvest in the business, and provides finanical flexibility. However, earnings per share are unfortunately not growing much. Might this suggest that the company should pay a higher dividend instead?

Conclusion

To summarise, shareholders should always check that Dixons Carphone's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with Dixons Carphone paying out a high percentage of both its cashflow and earnings. Unfortunately, earnings growth has also been mediocre, and the company has cut its dividend at least once in the past. There are a few too many issues for us to get comfortable with Dixons Carphone from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 10 analysts we track are forecasting for Dixons Carphone for free with public analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:CURY

Currys

Operates as a omnichannel retailer of technology products and services in the United Kingdom, Ireland, Norway, Sweden, Finland, Denmark, Iceland, Greenland, and the Faroe Islands.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)