- United Kingdom

- /

- Specialty Stores

- /

- AIM:VTU

CML Microsystems Leads These 3 UK Penny Stocks To Watch

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100, influenced by weaker trade data from China, investors are increasingly looking for opportunities beyond the blue-chip indices. Penny stocks, though often overlooked and considered a relic of past trading days, continue to present intriguing possibilities when backed by strong financials. These smaller or newer companies can offer unique value and growth potential that larger firms might miss, making them worthy of attention for those seeking under-the-radar investment opportunities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Supreme (AIM:SUP) | £2.01 | £235.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.22 | £474.08M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.40 | £355.46M | ✅ 5 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.802 | £1.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.442 | £47.82M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.44 | £428.04M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.14 | £323.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.91M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.20 | £68.45M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 302 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc designs, manufactures, and markets semiconductor products for the communications industries globally, with a market cap of £39.01 million.

Operations: The company's revenue is primarily generated from its semiconductor components for the communications industry, amounting to £22.90 million.

Market Cap: £39.01M

CML Microsystems, with a market cap of £39.01 million, focuses on semiconductor products for the communications industry, generating revenue of £22.90 million. Despite being unprofitable this year with a net loss of £0.018 million compared to last year's net income, the company maintains financial stability through its debt-free status and strong asset position—short-term assets (£21.5M) exceed both short-term (£5.5M) and long-term liabilities (£8.7M). Recent activities include completing a share buyback and declaring dividends totaling 11 pence per share for the year ended March 31, 2025, reflecting shareholder value efforts despite earnings challenges.

- Navigate through the intricacies of CML Microsystems with our comprehensive balance sheet health report here.

- Evaluate CML Microsystems' historical performance by accessing our past performance report.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Personal Group Holdings Plc provides employee services and salary sacrifice technology products in the United Kingdom, with a market cap of £91.10 million.

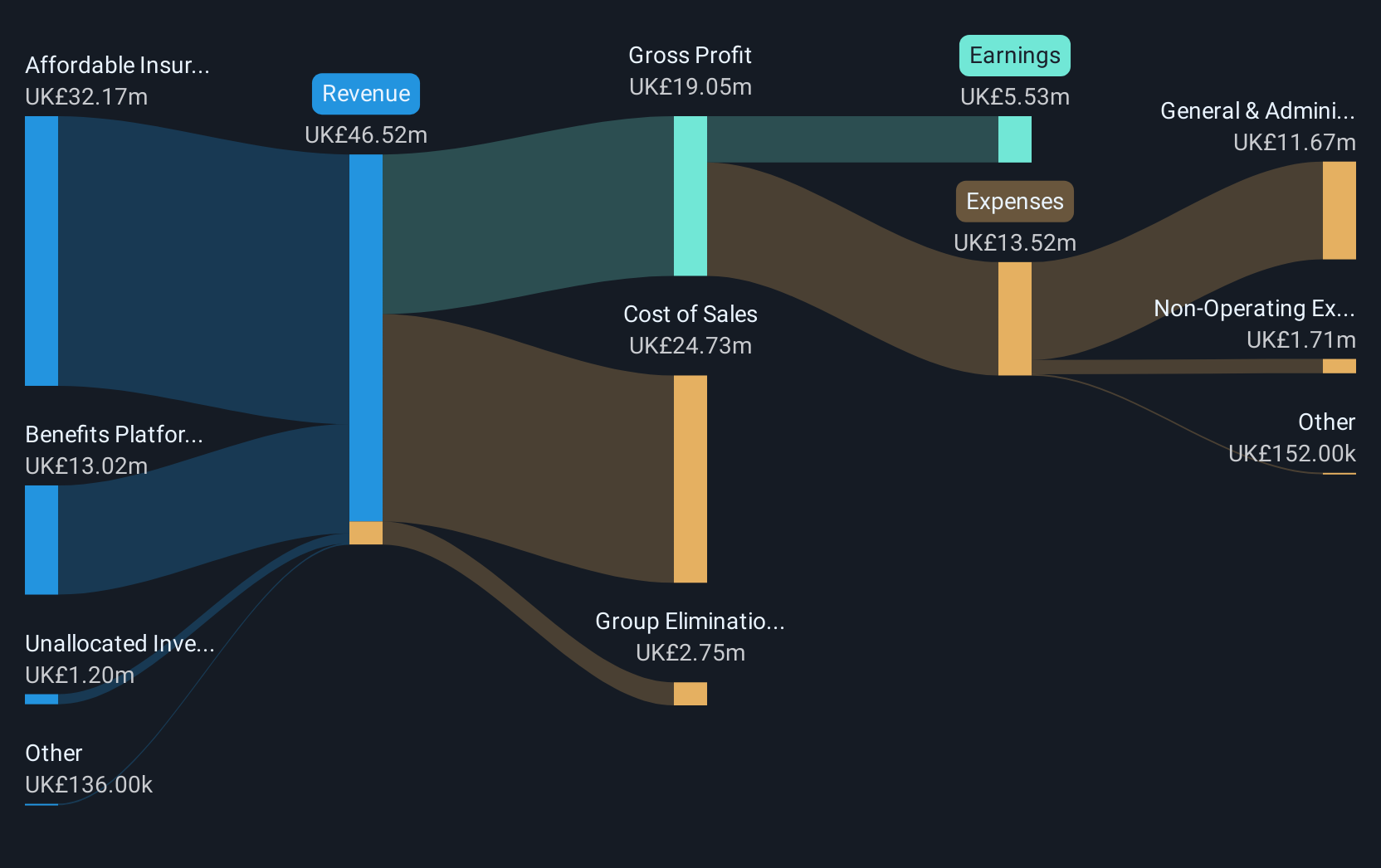

Operations: The company's revenue is primarily derived from two segments: Affordable Insurance, generating £32.17 million, and the Benefits Platform, contributing £13.02 million.

Market Cap: £91.1M

Personal Group Holdings, with a market cap of £91.10 million, derives significant revenue from its Affordable Insurance (£32.17M) and Benefits Platform (£13.02M) segments. The company recently expanded its partnership with Sage Group plc, enhancing its digital workforce engagement platform for SMBs, which now reaches over 62,000 employees and is set to offer premium products in 2025. Despite experiencing a decline in earnings over five years, recent profit growth of 32.3% outpaces industry averages and forecasts suggest continued growth at 18.71% annually. The firm remains debt-free but faces challenges with dividend sustainability and an inexperienced management team.

- Click to explore a detailed breakdown of our findings in Personal Group Holdings' financial health report.

- Evaluate Personal Group Holdings' prospects by accessing our earnings growth report.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer based in the United Kingdom with a market capitalization of £197.84 million.

Operations: The company generates revenue primarily from its gasoline and auto dealership operations, totaling £4.76 billion.

Market Cap: £197.84M

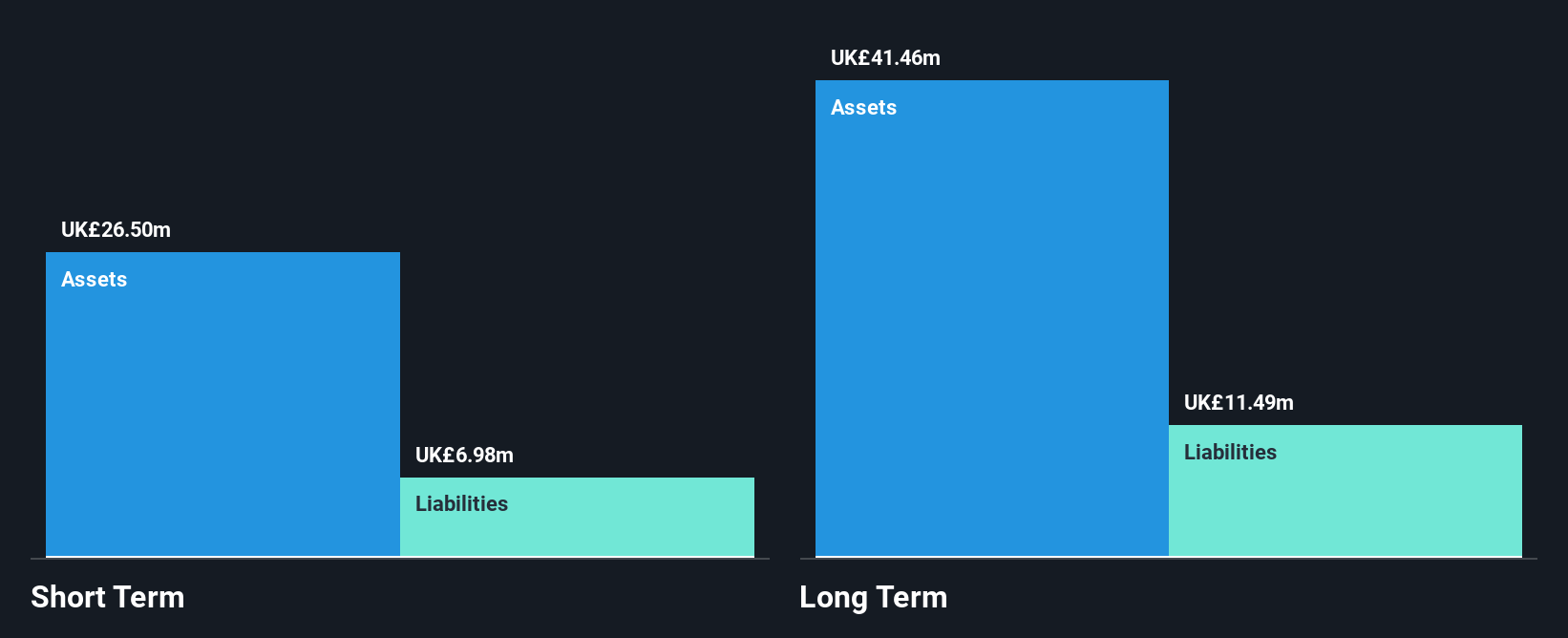

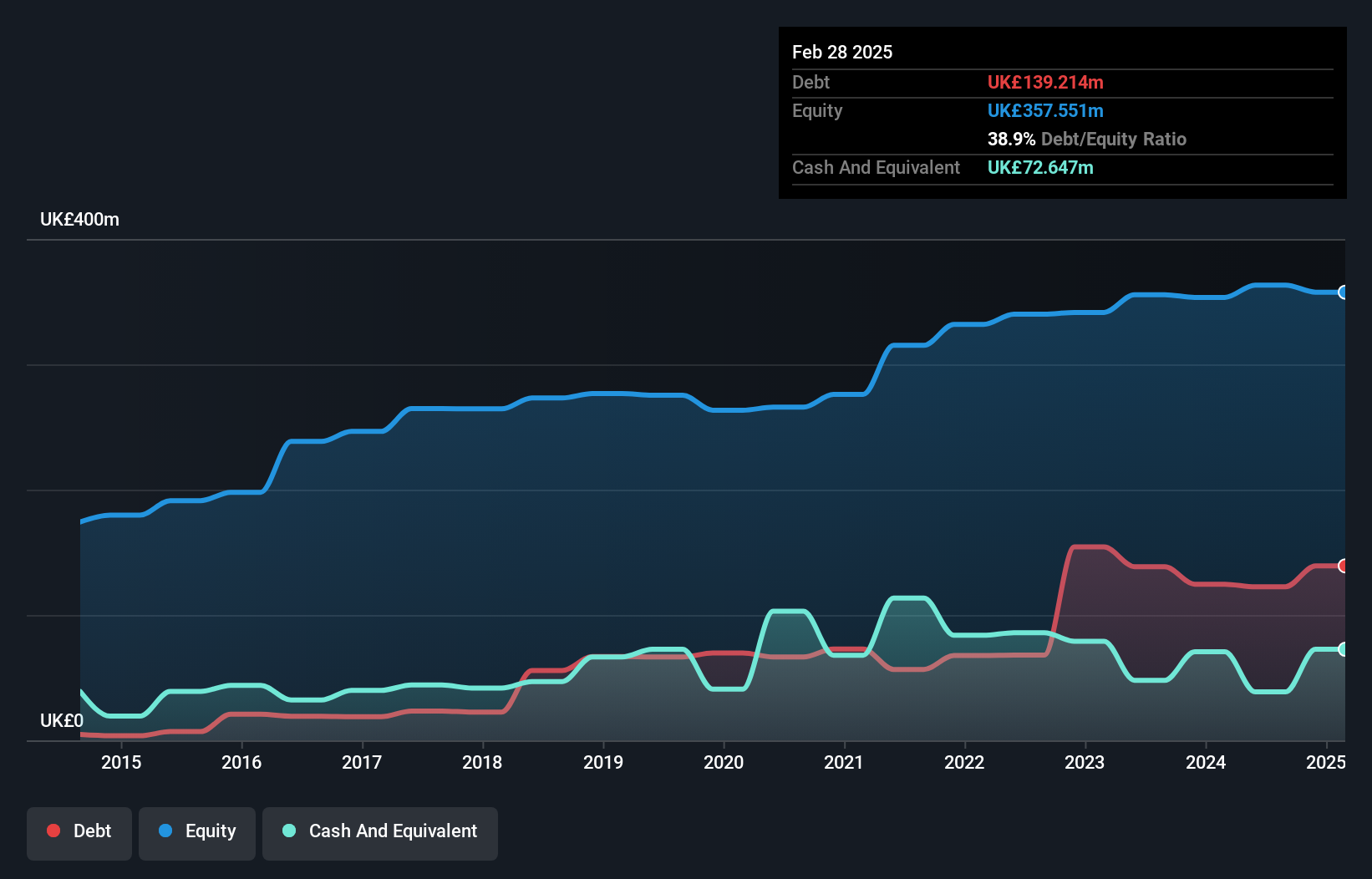

Vertu Motors, with a market cap of £197.84 million, is navigating sector uncertainties by focusing on acquisitions and stringent cost control measures. Despite a decline in net income to £18.1 million from the previous year's £25.71 million, the company maintains a strong balance sheet with short-term assets exceeding both long-term and short-term liabilities. The management team is experienced with an average tenure of 6.5 years, and the board has similar experience levels. While profit margins have slightly decreased to 0.4%, Vertu's debt is well-managed with satisfactory coverage by operating cash flow and interest payments by EBIT at 3.1x coverage.

- Click here to discover the nuances of Vertu Motors with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Vertu Motors' future.

Seize The Opportunity

- Embark on your investment journey to our 302 UK Penny Stocks selection here.

- Searching for a Fresh Perspective? Uncover 18 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VTU

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives