- United Kingdom

- /

- Professional Services

- /

- AIM:BEG

UK Penny Stocks Worth Watching In March 2025

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 index closing lower amid weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market challenges, penny stocks—often representing smaller or newer companies—continue to attract attention for their potential growth opportunities. While traditionally considered high-risk, focusing on those with strong financial health can reveal promising prospects for investors seeking value and growth beyond blue-chip stocks.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.65 | £415.17M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.955 | £293.89M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.29 | £413.54M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.782 | £66.29M | ★★★★★★ |

| RTC Group (AIM:RTC) | £1.00 | £13.61M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.392 | £214.69M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.05 | £146.25M | ★★★★★☆ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, corporations, and financial institutions in the UK with a market cap of £148.21 million.

Operations: The company's revenue is derived from two main segments: Property Advisory, which generated £44.96 million, and Business Recovery and Advisory, contributing £102.18 million.

Market Cap: £148.21M

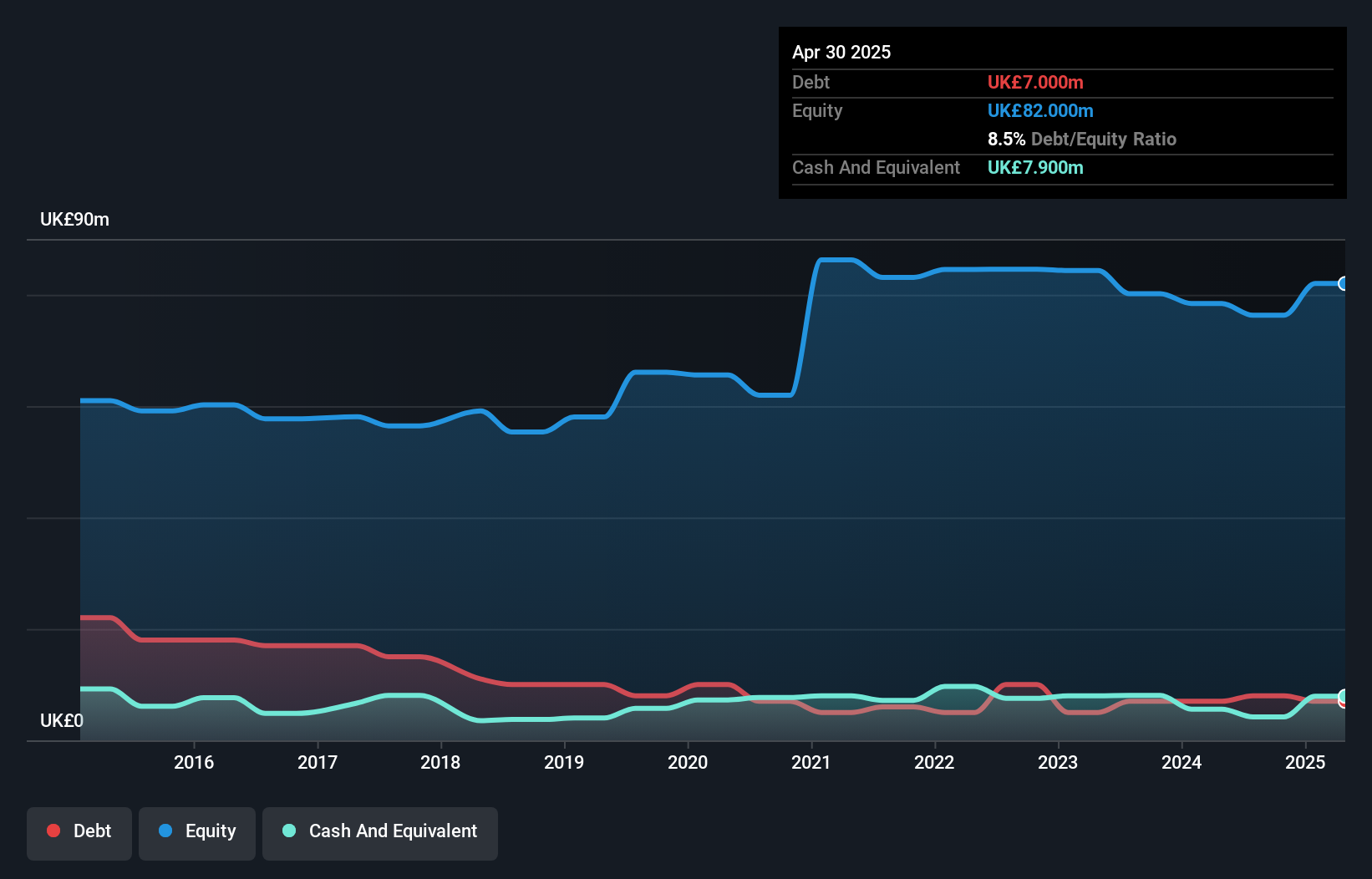

Begbies Traynor Group plc, with a market cap of £148.21 million, shows promising potential in the penny stock arena due to its strong financial structure and growth trajectory. The company's earnings have surged by 528.7% over the past year, outpacing industry averages, although a significant one-off loss of £10.6 million impacted recent results. Its seasoned management and board provide stability, while short-term assets comfortably cover both short and long-term liabilities. Despite low return on equity at 3.2%, debt levels are well-managed with interest payments covered 9.8 times by EBIT, indicating solid financial health amidst recent executive changes.

- Take a closer look at Begbies Traynor Group's potential here in our financial health report.

- Gain insights into Begbies Traynor Group's future direction by reviewing our growth report.

CMO Group (AIM:CMO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CMO Group PLC is an online retailer of building materials and supplies in the United Kingdom with a market cap of £2.05 million.

Operations: The company generates revenue of £64.95 million from retailing construction materials.

Market Cap: £2.05M

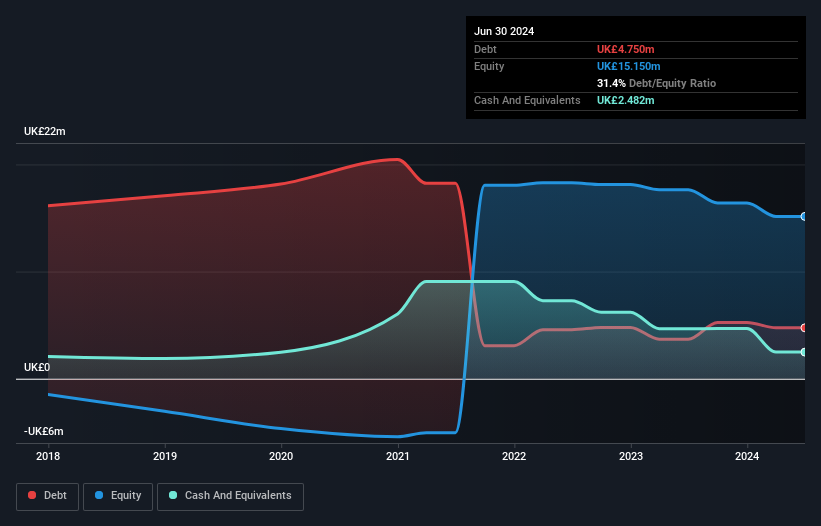

CMO Group PLC, with a market cap of £2.05 million, presents mixed signals as a penny stock in the UK. Despite trading at 90.8% below its estimated fair value and having sufficient cash runway for over a year, the company remains unprofitable with declining earnings over five years. Its management and board are experienced, but increased volatility and negative return on equity (-16.23%) highlight risks. While short-term assets exceed long-term liabilities (£5.4M), they fall short of covering short-term obligations (£16M). The upcoming earnings release may provide further insights into its financial trajectory amidst these challenges.

- Click to explore a detailed breakdown of our findings in CMO Group's financial health report.

- Understand CMO Group's earnings outlook by examining our growth report.

Polar Capital Holdings (AIM:POLR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Polar Capital Holdings plc is a publicly owned investment manager with a market cap of £413.54 million.

Operations: The company generates revenue of £212.74 million from its investment management business.

Market Cap: £413.54M

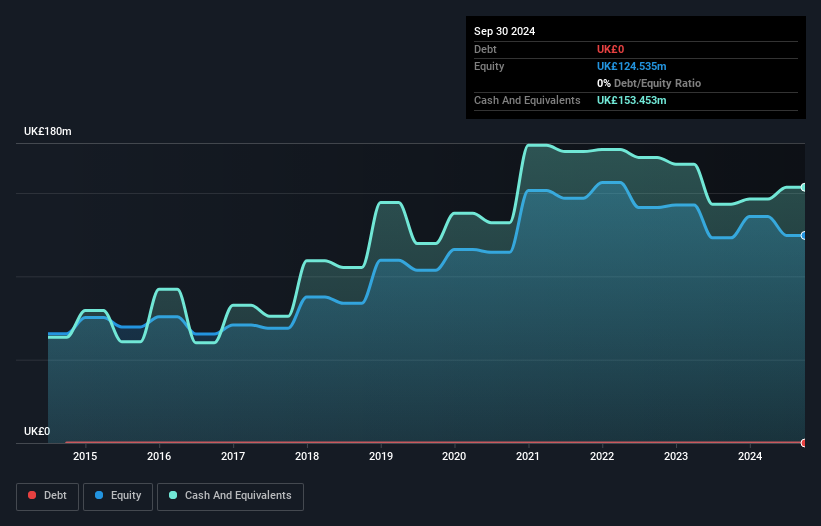

Polar Capital Holdings plc, with a market cap of £413.54 million, stands out in the UK penny stock landscape due to its robust financial health and growth prospects. The company is debt-free and exhibits high-quality earnings, with recent profit growth of 22.4% surpassing industry averages. Its return on equity is notably high at 33.6%, and it trades at a significant discount to estimated fair value. Although its dividend yield of 10.72% isn't fully covered by earnings, Polar Capital's strong asset position covers both short- and long-term liabilities comfortably, supported by an experienced management team averaging 6.8 years tenure.

- Unlock comprehensive insights into our analysis of Polar Capital Holdings stock in this financial health report.

- Gain insights into Polar Capital Holdings' outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Click here to access our complete index of 442 UK Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Begbies Traynor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BEG

Begbies Traynor Group

Provides professional services to businesses, professional advisors, large corporations, and financial institutions in the United Kingdom.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives