- United Kingdom

- /

- Consumer Finance

- /

- AIM:RFX

Spotlight On UK Penny Stocks For January 2025

Reviewed by Simply Wall St

The UK market has been facing challenges recently, with the FTSE 100 experiencing a downturn due to weak trade data from China, affecting companies closely tied to its economy. Despite these broader market concerns, there are still opportunities for investors interested in exploring smaller or newer companies. Penny stocks, though an older term, continue to be relevant for those seeking growth potential and financial resilience in less prominent sectors.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.015 | £759.28M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £156.82M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £418.56M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.60 | £358.04M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.085 | £92.7M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.05 | £193.15M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.224 | £188.78M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

Click here to see the full list of 441 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

N Brown Group (AIM:BWNG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: N Brown Group plc is a digital retailer specializing in clothing and footwear in the United Kingdom, with a market capitalization of £186.38 million.

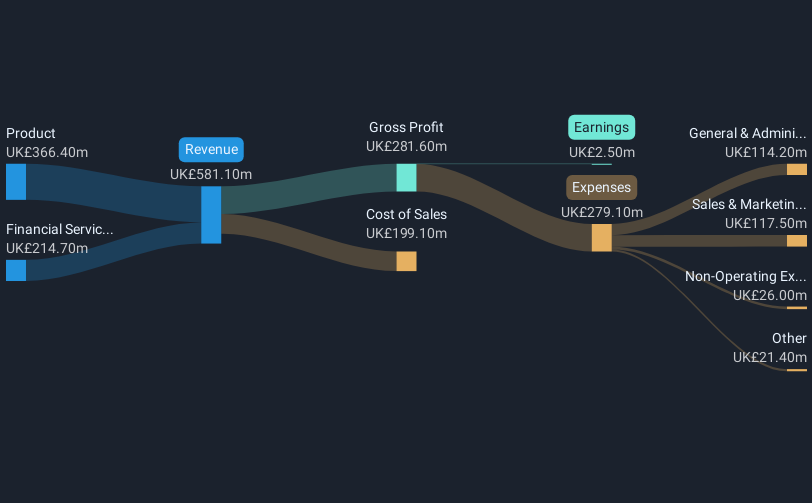

Operations: The company's revenue is derived from two main segments: Product, contributing £366.4 million, and Financial Services, generating £214.7 million.

Market Cap: £186.38M

N Brown Group has recently become profitable, with a significant reduction in debt-to-equity ratio from 173.4% to 73.5% over five years, indicating improved financial health. However, interest payments are not well-covered by earnings, and return on equity remains low at 0.7%. Despite trading significantly below estimated fair value and having strong short-term asset coverage of liabilities, the company's shares will be delisted following a cash acquisition by Falcon 24 Topco Limited in February 2025. This acquisition marks a pivotal change as it transitions away from public trading on AIM.

- Navigate through the intricacies of N Brown Group with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into N Brown Group's future.

Mineral & Financial Investments (AIM:MAFL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mineral & Financial Investments Limited is an investment company focused on natural resources, minerals, metals, and oil and gas projects in the Cayman Islands with a market cap of £5.75 million.

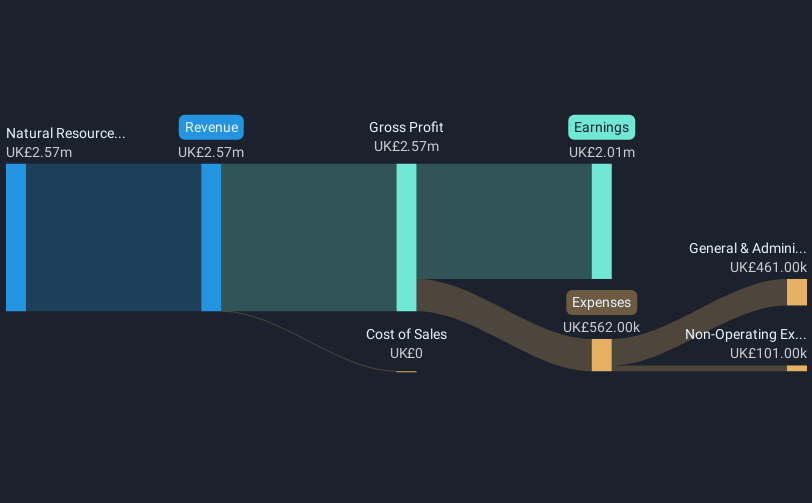

Operations: The company's revenue is primarily derived from its involvement in natural resources, minerals, metals, and oil and gas projects, totaling £2.57 million.

Market Cap: £5.75M

Mineral & Financial Investments Limited, with a market cap of £5.75 million, has shown robust earnings growth of 29.4% over the past year, outpacing its five-year average and the broader Capital Markets industry. The company reported revenues of £2.57 million for the full year ending June 2024, with net income rising to £2.01 million from the previous year’s £1.55 million. It maintains strong short-term asset coverage over liabilities and has reduced its debt-to-equity ratio significantly over five years; however, operating cash flow remains negative, indicating potential liquidity challenges despite having more cash than total debt.

- Click here and access our complete financial health analysis report to understand the dynamics of Mineral & Financial Investments.

- Gain insights into Mineral & Financial Investments' past trends and performance with our report on the company's historical track record.

Ramsdens Holdings (AIM:RFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ramsdens Holdings PLC provides diversified financial services in the United Kingdom and internationally, with a market capitalization of £75.91 million.

Operations: The company's revenue segments include Pawnbroking (£13.41 million), Retail Jewellery Sales (£35.61 million), Foreign Currency Margin (£14.88 million), Purchases of Precious Metals (£31.15 million), and Income from Other Financial Services (£0.56 million).

Market Cap: £75.91M

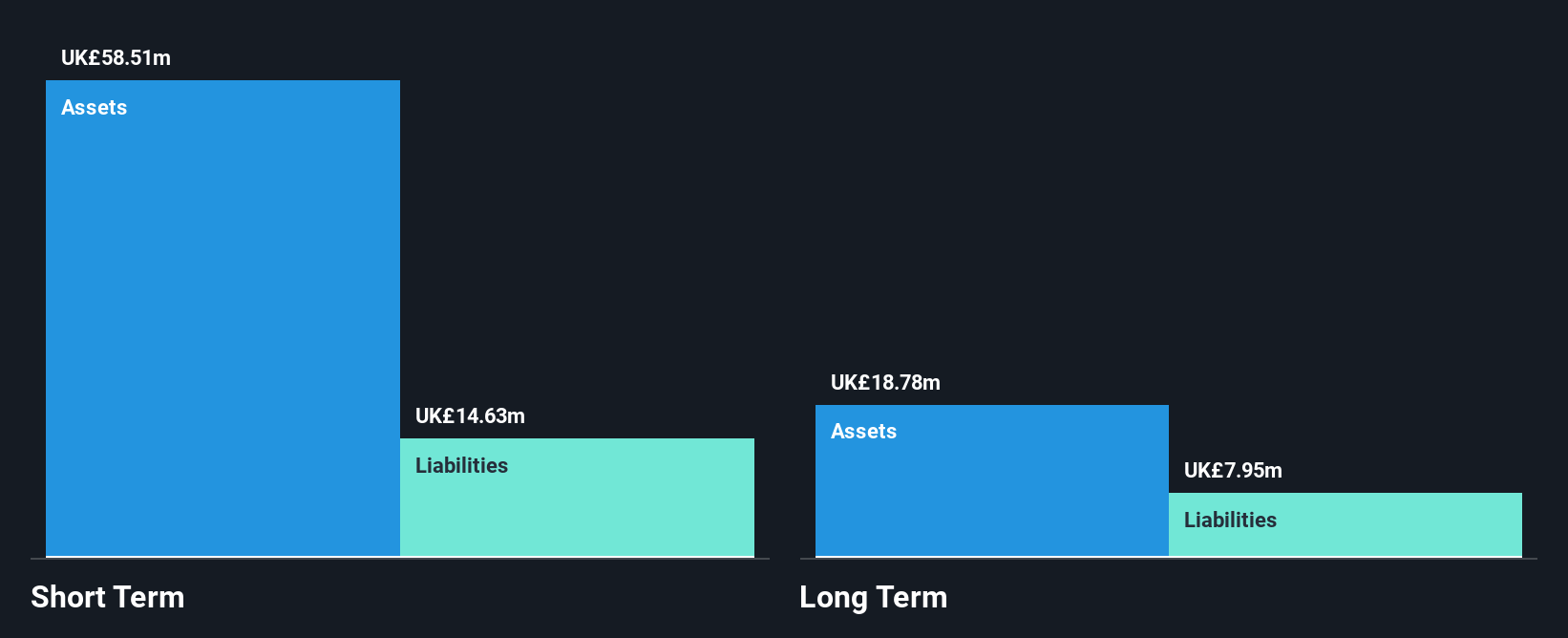

Ramsdens Holdings PLC, with a market cap of £75.91 million, reported increased sales of £95.61 million for the year ending September 30, 2024, up from £83.81 million the previous year. Net income rose to £8.3 million from £7.76 million, while earnings per share also improved slightly. The company has high-quality earnings and its debt is well covered by operating cash flow, suggesting financial stability despite a low return on equity of 15.5%. The board proposed an increased final dividend of 7.6 pence per share, reflecting its commitment to a progressive dividend policy amidst stable revenue growth forecasts.

- Dive into the specifics of Ramsdens Holdings here with our thorough balance sheet health report.

- Evaluate Ramsdens Holdings' prospects by accessing our earnings growth report.

Seize The Opportunity

- Discover the full array of 441 UK Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RFX

Ramsdens Holdings

Engages in the provision of diversified financial services in the United Kingdom and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives