- United Kingdom

- /

- Health Care REITs

- /

- LSE:THRL

Bytes Technology Group Leads Trio Of Undervalued Small Caps With Insider Buying Insight

Amidst a backdrop of rebounding indices and easing political concerns in Europe, the United Kingdom's market landscape appears cautiously optimistic as it breaks a three-day losing streak. In such an environment, identifying undervalued small-cap stocks with potential for growth becomes particularly compelling.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Speedy Hire | NA | 0.3x | 35.75% | ★★★★★☆ |

| THG | NA | 0.4x | 34.29% | ★★★★★☆ |

| Bytes Technology Group | 28.7x | 6.5x | 12.22% | ★★★★☆☆ |

| Ultimate Products | 9.4x | 0.7x | 19.32% | ★★★★☆☆ |

| Bodycote | 15.8x | 1.7x | 18.05% | ★★★★☆☆ |

| Eurocell | 14.6x | 0.4x | 24.23% | ★★★★☆☆ |

| H&T Group | 7.7x | 0.7x | -8.97% | ★★★☆☆☆ |

| Robert Walters | 20.7x | 0.3x | 35.40% | ★★★☆☆☆ |

| Savills | 37.8x | 0.7x | 23.04% | ★★★☆☆☆ |

| Hochschild Mining | NA | 1.7x | 37.70% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

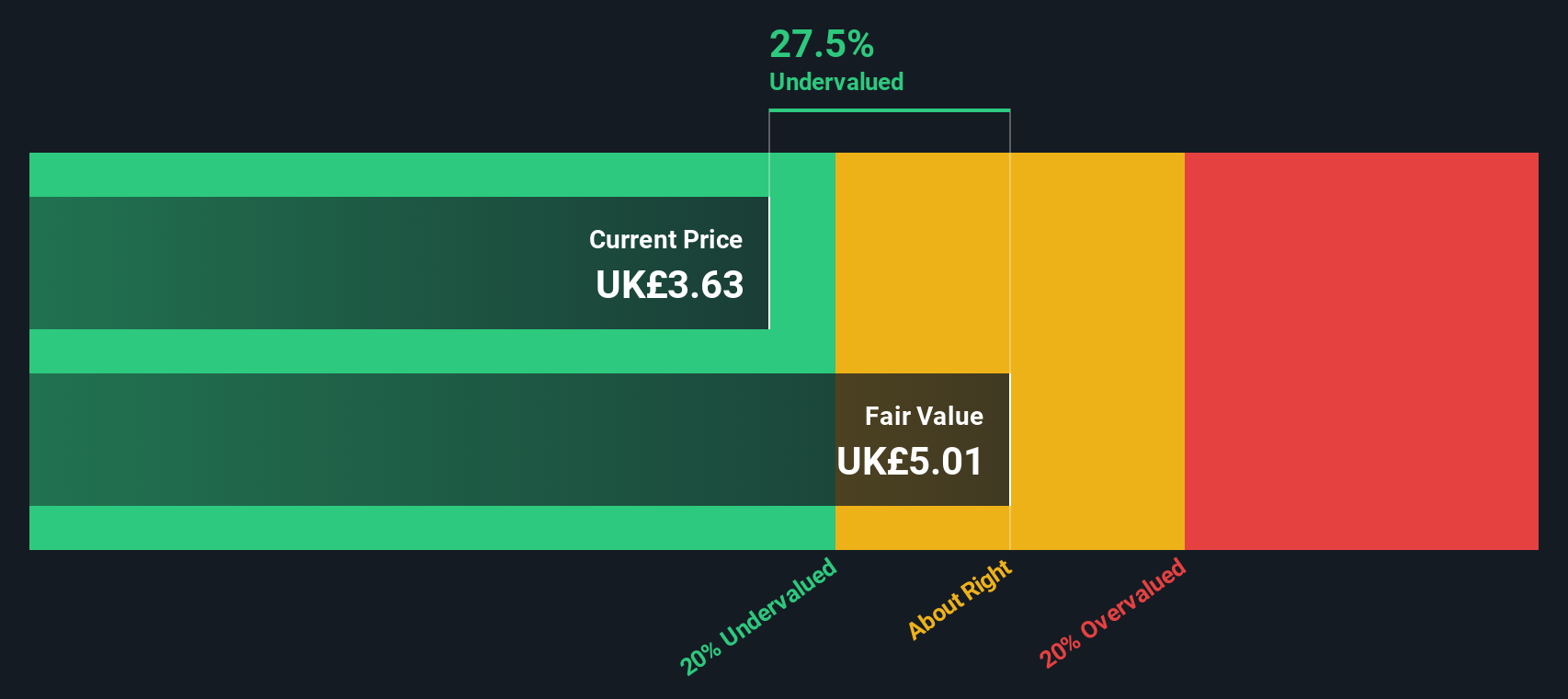

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is a company that specializes in providing IT solutions.

Operations: IT Solutions Provider has seen a substantial increase in gross profit margin, rising from 13.53% in early 2018 to 70.42% by mid-2024, reflecting significant operational efficiency improvements over the period. The company's net income also grew impressively, from £8.09 million to £46.85 million over the same timeframe, indicating robust profitability growth alongside revenue expansion from £321.89 million to £207.02 million.

PE: 28.7x

Bytes Technology Group, a lesser-known entity in the UK market, recently showcased strong financial growth with a year-on-year sales increase to £207 million and net income rising to £46.85 million. This performance was complemented by an earnings boost per share, reflecting operational efficiency and market resilience. Notably, insider confidence is evident as executives have not engaged in recent share purchases. The firm also announced a significant dividend hike of 16%, aligning with its robust profit growth—a move that may appeal to value-focused investors looking for potential amidst smaller companies with solid fundamentals and strategic leadership enhancements, including the appointment of experienced executives poised to steer future expansions.

- Click to explore a detailed breakdown of our findings in Bytes Technology Group's valuation report.

-

Understand Bytes Technology Group's track record by examining our Past report.

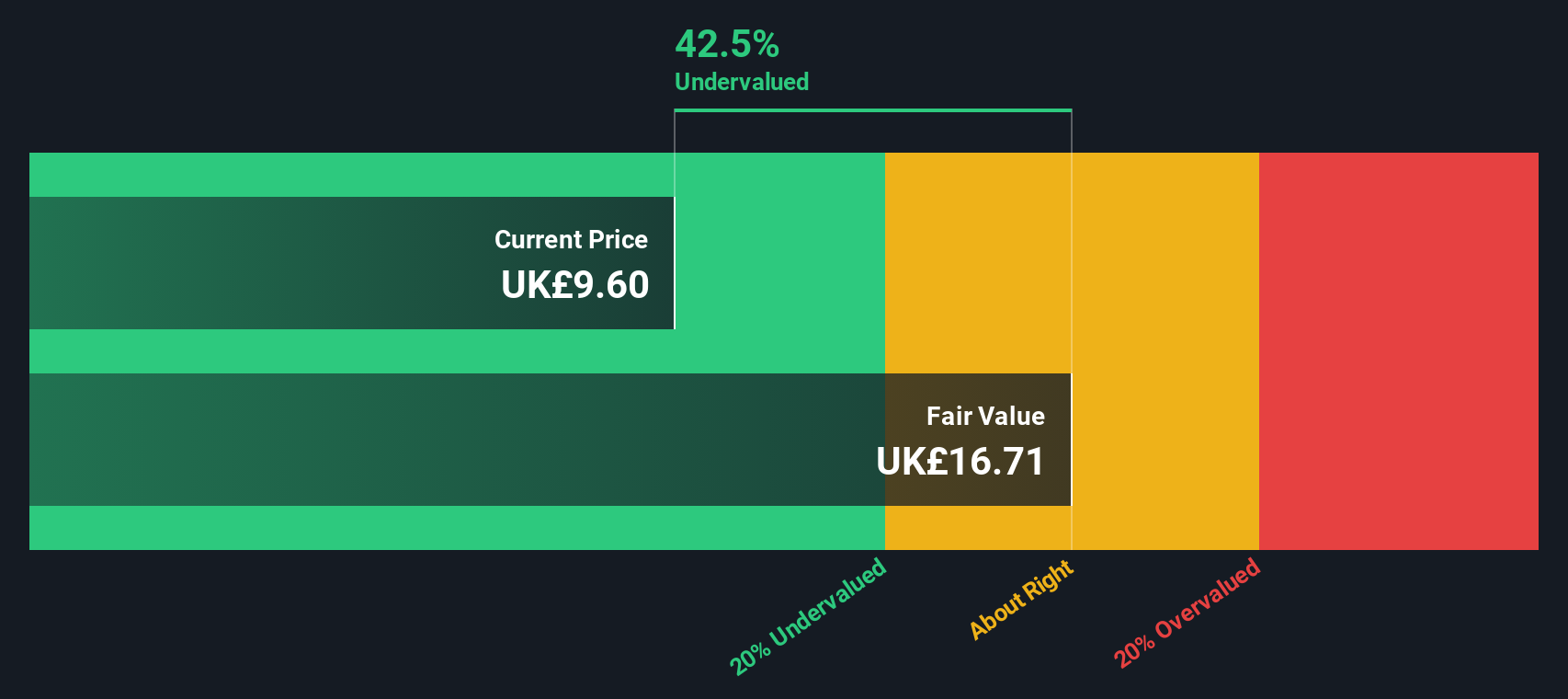

Savills (LSE:SVS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Savills is a global real estate services provider involved in consultancy, transaction advisory, investment management, and property and facilities management.

Operations: The company's net income margin has fluctuated over the years, peaking at 0.068% in late 2021 and then declining to 0.018% by the end of 2023, reflecting varying profitability against a backdrop of consistently high gross profit margins maintained at 100%. General and administrative expenses have steadily increased, reaching £1.47 billion by late 2023, indicating rising operational costs impacting overall financial performance.

PE: 37.8x

Savills, a notable player in the UK's commercial real estate sector, recently declared a dividend increase to 13.9p per share and is advising The Gym Group on its UK expansion. With recent leadership appointments in strategic regions like Florida and Canada, the firm is poised for growth. Insider confidence is evident as insiders have recently purchased shares, signaling trust in the company's direction despite a dip in profit margins from last year to 1.8%. These moves underscore Savills' potential as an undervalued entity with promising prospects.

- Click here and access our complete valuation analysis report to understand the dynamics of Savills.

-

Review our historical performance report to gain insights into Savills''s past performance.

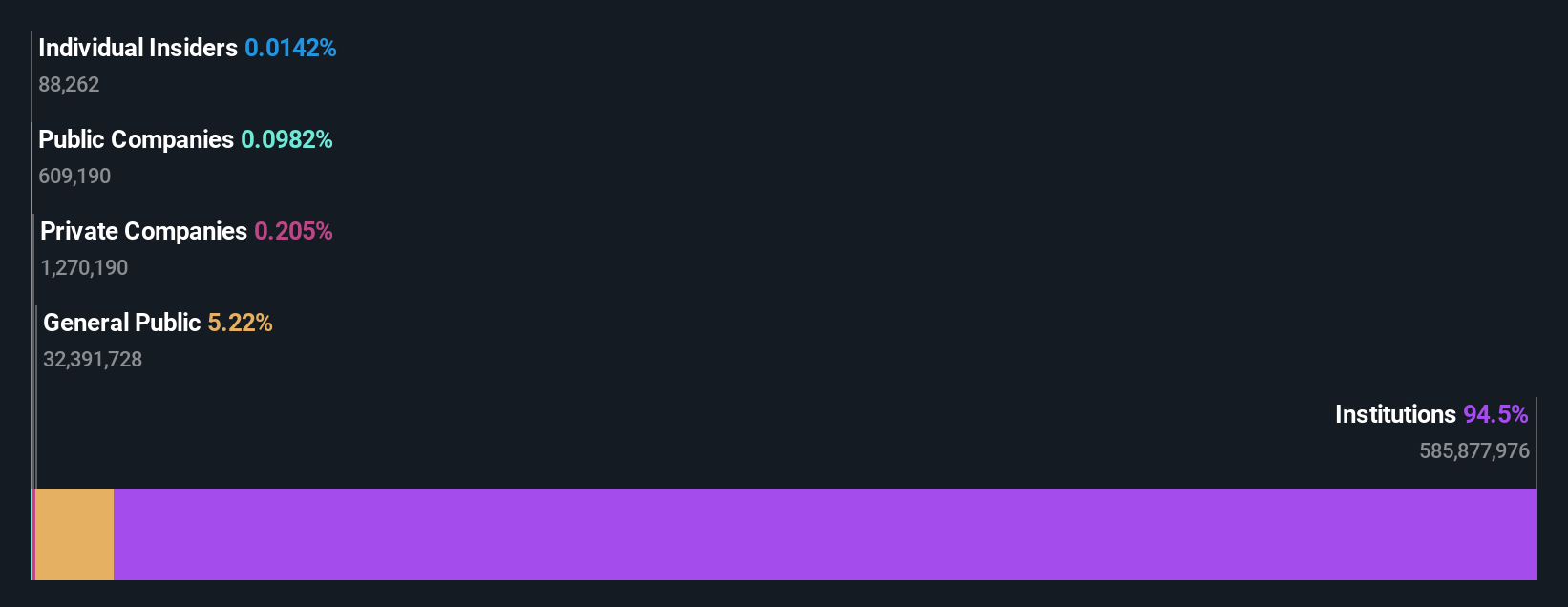

Target Healthcare REIT (LSE:THRL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Target Healthcare REIT is a real estate investment trust specializing in UK care homes, with a market capitalization of approximately £450 million.

Operations: The company generates revenue primarily through property investment, with a notable gross profit margin of 89.22% as of the latest reporting period. Over recent years, it has experienced fluctuations in net income margins, peaking at 86.12% in the same period.

PE: 8.7x

Recently, Target Healthcare REIT has demonstrated financial resilience by declaring a steady interim dividend of 1.428 pence per share, reflecting confidence in their ongoing operations despite relying solely on external borrowing—a higher risk funding strategy. This move, coupled with insider confidence shown through recent share purchases, suggests a robust belief in the company's future prospects. These elements position Target Healthcare as an intriguing consideration for those looking into underappreciated opportunities within the UK market.

Key Takeaways

- Click here to access our complete index of 32 Undervalued Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target Healthcare REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:THRL

Target Healthcare REIT

UK listed Target Healthcare REIT plc (THRL) is an externally managed Real Estate Investment Trust which provides shareholders with an attractive level of income, together with the potential for capital and income growth, from investing in a diversified portfolio of modern, purpose-built care homes.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives