- United Kingdom

- /

- Specialty Stores

- /

- AIM:VIC

3 UK Exchange Stocks Estimated To Be Undervalued By Up To 49.5%

Reviewed by Simply Wall St

The market in the United Kingdom has climbed 1.2% over the last week and is up 7.1% over the past 12 months, with earnings forecasted to grow by 14% annually. In this environment, identifying undervalued stocks can provide significant opportunities for investors looking to capitalize on potential growth and value discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topps Tiles (LSE:TPT) | £0.44 | £0.88 | 49.7% |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.657 | £1.30 | 49.5% |

| Gaming Realms (AIM:GMR) | £0.39 | £0.76 | 48.5% |

| Fevertree Drinks (AIM:FEVR) | £7.725 | £14.20 | 45.6% |

| Victrex (LSE:VCT) | £9.53 | £17.29 | 44.9% |

| Redcentric (AIM:RCN) | £1.2925 | £2.45 | 47.2% |

| Moonpig Group (LSE:MOON) | £2.005 | £3.69 | 45.7% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

| SysGroup (AIM:SYS) | £0.34 | £0.66 | 48.3% |

| Foxtons Group (LSE:FOXT) | £0.63 | £1.19 | 47% |

We're going to check out a few of the best picks from our screener tool.

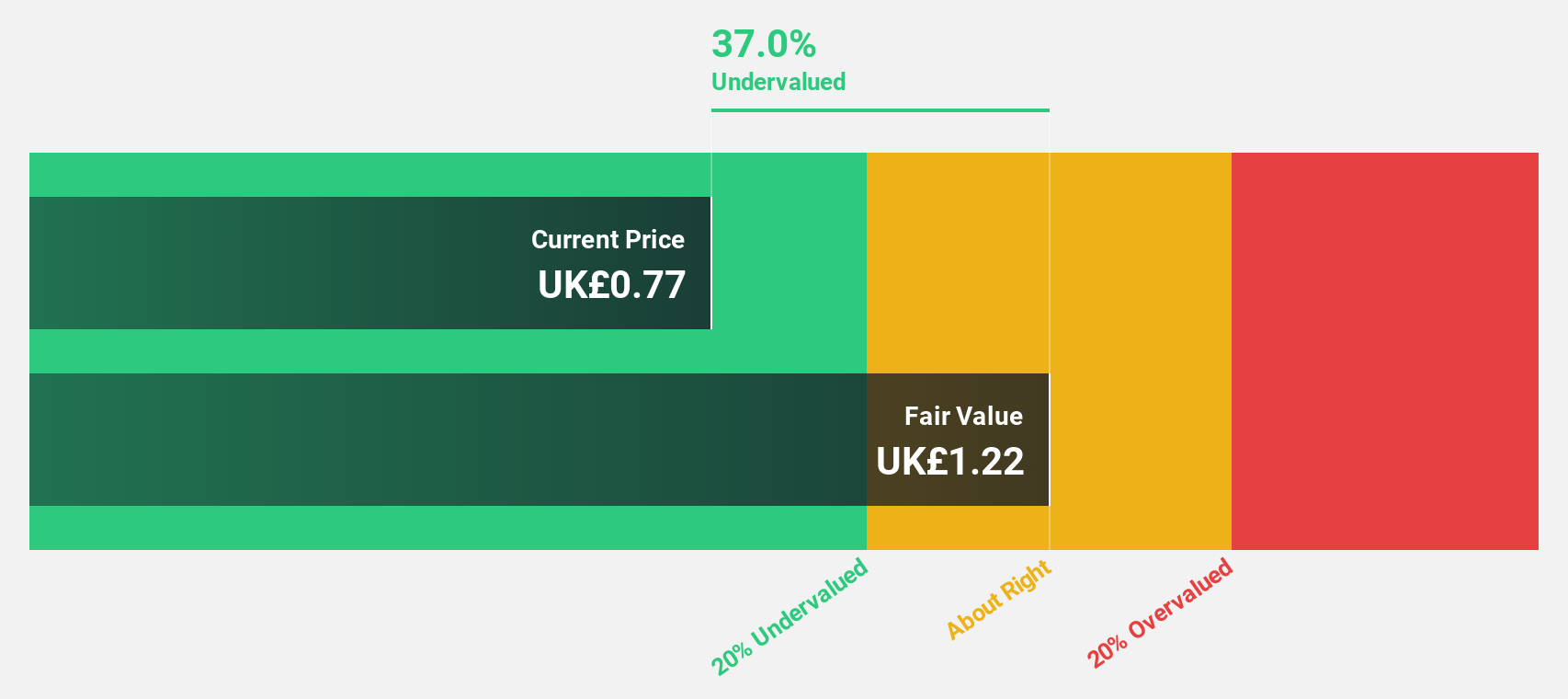

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer of bathroom products and accessories in the United Kingdom, with a market cap of £363.15 million.

Operations: The company's revenue segment consists of £282.90 million from online retailing of bathroom products and accessories.

Estimated Discount To Fair Value: 40.2%

Victorian Plumbing Group (£1.12) is trading 40.2% below its estimated fair value (£1.86), highlighting its potential as an undervalued stock based on cash flows. Earnings grew by 6.1% over the past year and are forecast to grow significantly, at 33.9% per year, outpacing the UK market's expected growth of 14.2%. However, there has been significant insider selling over the past three months which could be a concern for some investors.

- In light of our recent growth report, it seems possible that Victorian Plumbing Group's financial performance will exceed current levels.

- Navigate through the intricacies of Victorian Plumbing Group with our comprehensive financial health report here.

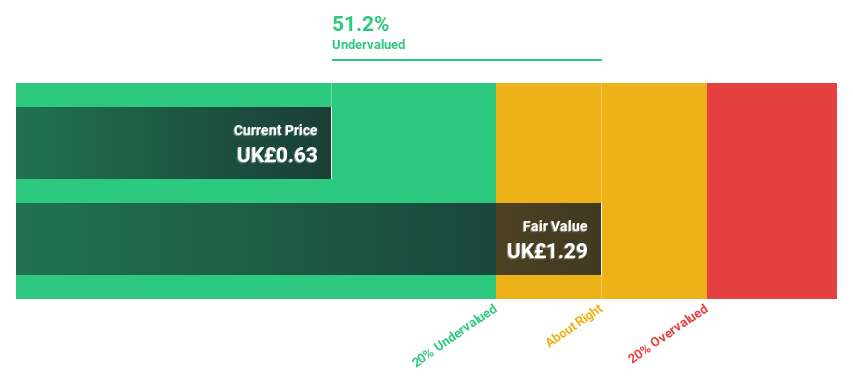

Triple Point Social Housing REIT (LSE:SOHO)

Overview: Triple Point Social Housing REIT plc is a Real Estate Investment Trust incorporated in England and Wales that focuses on investing in social housing properties, with a market cap of £258.51 million.

Operations: The company's revenue segments include investments in social housing properties.

Estimated Discount To Fair Value: 49.5%

Triple Point Social Housing REIT (£0.66) is trading 49.5% below its estimated fair value (£1.3), suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 27% per year, outpacing the UK market's expected growth of 14.2%. Recent earnings showed revenue increased to £19.11 million from £16.42 million a year ago, though net income declined to £5.3 million from £14.62 million, highlighting some financial volatility.

- Insights from our recent growth report point to a promising forecast for Triple Point Social Housing REIT's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Triple Point Social Housing REIT.

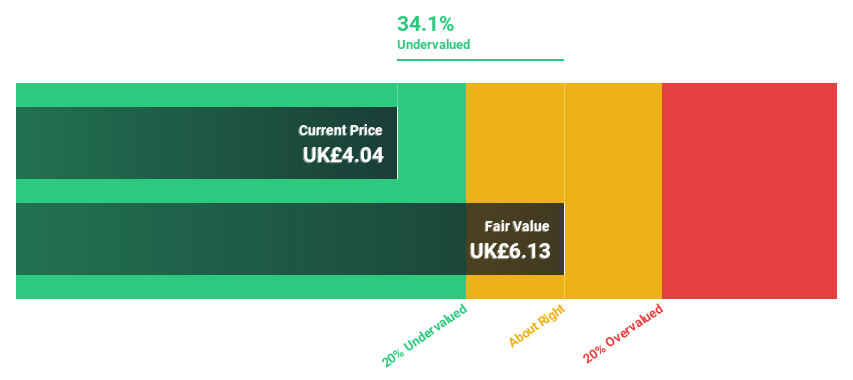

Zotefoams (LSE:ZTF)

Overview: Zotefoams plc, with a market cap of £205.13 million, manufactures, distributes, and sells polyolefin block foams in the United Kingdom, Europe, North America, and internationally.

Operations: The company's revenue segments include Polyolefin Foams (£64.39 million), Mucell Extrusion LLC (MEL) (£1.21 million), and High-Performance Products (HPP) (£67.81 million).

Estimated Discount To Fair Value: 31.9%

Zotefoams plc (£4.22) is trading 31.9% below its estimated fair value (£6.19), indicating it is undervalued based on cash flows. Earnings are forecast to grow 20% annually, outpacing the UK market's expected growth of 14.2%. Recent earnings for H1 2024 showed sales increased to £71.06 million from £64.63 million, with net income rising to £6.28 million from £5.59 million, reflecting solid financial performance despite share price volatility over the past three months.

- The growth report we've compiled suggests that Zotefoams' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Zotefoams.

Next Steps

- Click here to access our complete index of 55 Undervalued UK Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VIC

Victorian Plumbing Group

Operates as an online retailer of bathroom products and accessories in the United Kingdom.

Flawless balance sheet with high growth potential.