- United Kingdom

- /

- Retail REITs

- /

- LSE:HMSO

Top Undervalued Small Caps With Insider Buying In United Kingdom September 2024

Reviewed by Simply Wall St

The United Kingdom market has faced headwinds recently, with the FTSE 100 closing lower due to weak trade data from China and broader global economic concerns. Despite these challenges, small-cap stocks can present unique opportunities for investors, particularly those with insider buying which may signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 23.4x | 5.3x | 16.97% | ★★★★★☆ |

| Essentra | 768.2x | 1.5x | 42.90% | ★★★★★☆ |

| GB Group | NA | 2.8x | 38.44% | ★★★★★☆ |

| Genus | 153.5x | 1.8x | 6.18% | ★★★★★☆ |

| NWF Group | 8.4x | 0.1x | 37.55% | ★★★★☆☆ |

| CVS Group | 22.9x | 1.3x | 39.98% | ★★★★☆☆ |

| Norcros | 7.8x | 0.5x | -0.41% | ★★★☆☆☆ |

| Foxtons Group | 26.1x | 1.2x | 48.32% | ★★★☆☆☆ |

| Harworth Group | 14.3x | 7.5x | -524.44% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -3.79% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

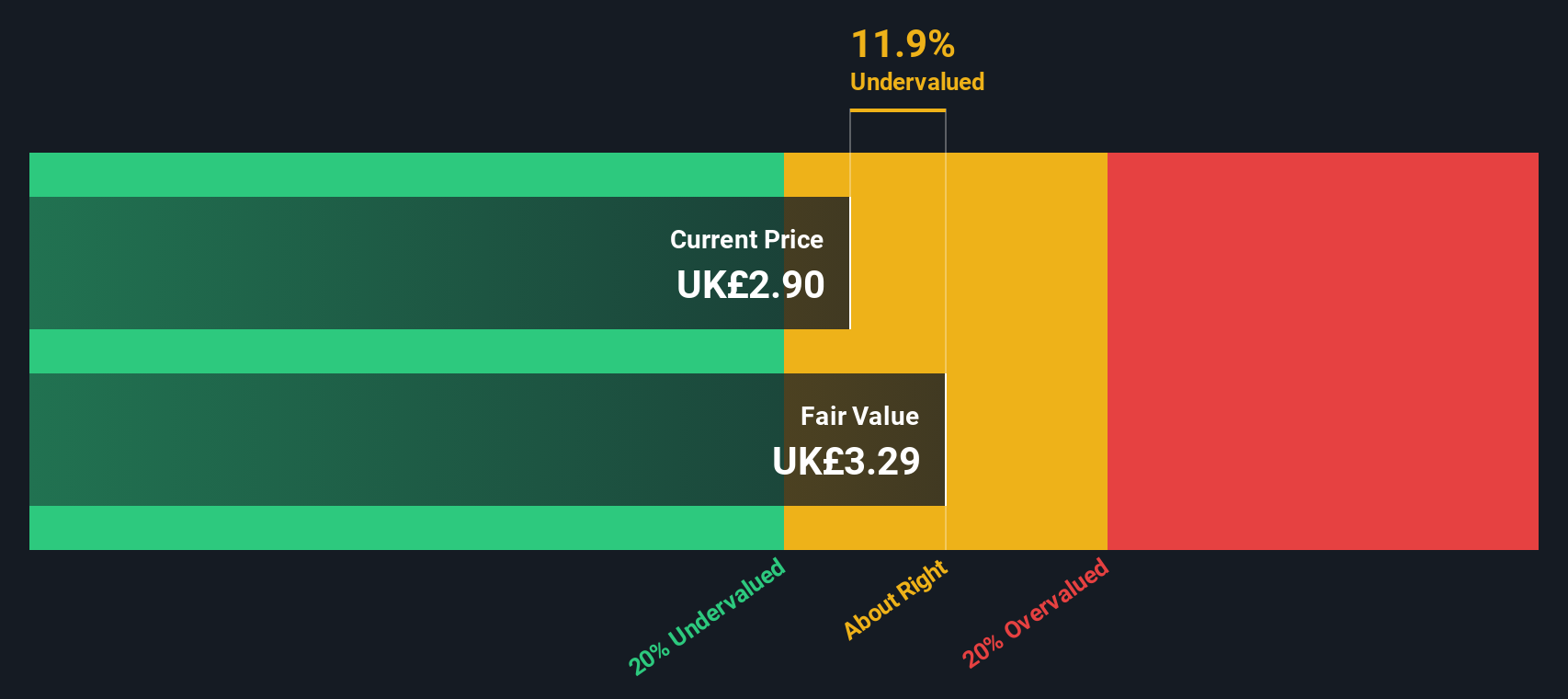

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a real estate investment company focused on developing, managing, and investing in flagship retail destinations across the UK, France, and Ireland with a market cap of approximately £1.04 billion.

Operations: The company's revenue streams primarily include its flagship destinations in the UK (£88.70 million), France (£53.20 million), and Ireland (£39.50 million). Gross profit margin has shown notable fluctuations, reaching as high as 87.12% and as low as 79.80% over the observed periods.

PE: -35.5x

Hammerson, a UK-based small cap, recently secured EUR 350 million in debt financing for Dundrum Town Centre, extending average debt maturity to 2.9 years. Despite reporting a GBP 516.7 million net loss for H1 2024, insider confidence is evident with recent share purchases by executives in July and August. The company declared an interim dividend of £0.00756 per share payable on September 30, indicating potential resilience and commitment to shareholder returns amidst challenging financials.

- Take a closer look at Hammerson's potential here in our valuation report.

Evaluate Hammerson's historical performance by accessing our past performance report.

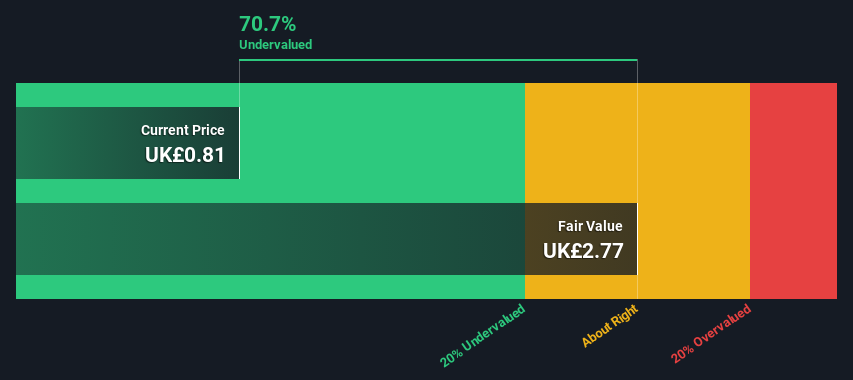

Rank Group (LSE:RNK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Rank Group operates gaming and betting services through its Mecca bingo halls, Grosvenor Casinos, Enracha venues in Spain, and various digital platforms with a market cap of approximately £0.57 billion.

Operations: Rank Group's revenue streams include Mecca (£138.90M), Digital (£226M), Enracha Venues (£38.50M), and Grosvenor Casinos (£331.30M). The company's gross profit margin has shown variability, with recent figures around 42.05% to 43.08%. Operating expenses have typically ranged between £207M to £276.8M over the periods analyzed, impacting net income margins which have fluctuated significantly from -29.43% to 9.85%.

PE: 30.8x

Rank Group has demonstrated steady financial improvement, reporting sales of £734.7 million for the year ending June 30, 2024, up from £681.9 million the previous year. This growth translated into a net income of £12.5 million compared to a net loss of £96.2 million previously. Insider confidence is evident with Richard Harris purchasing 102,100 shares valued at approximately £77,637 between July and August 2024, indicating potential optimism about future prospects despite reliance on higher-risk external borrowing for funding.

- Dive into the specifics of Rank Group here with our thorough valuation report.

Gain insights into Rank Group's historical performance by reviewing our past performance report.

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sirius Real Estate is a property investment company focused on owning and managing business parks, industrial complexes, and office spaces across Germany and the UK, with a market cap of approximately €1.43 billion.

Operations: Sirius Real Estate generates revenue primarily from property investment, with a gross profit margin of 57.50%. The company's operating expenses are €47.90 million, and it has a net income margin of 37.25%.

PE: 16.4x

Sirius Real Estate recently completed a £152.5 million follow-on equity offering, issuing 159.6 million shares at £0.94 each, to fund its acquisition strategy across Germany and the U.K. CEO Andrew Coombs highlighted the company's strong operational track record and ambitious growth plans, supported by consistent rental growth and dividend increases over ten years. Insider confidence is evident with recent share purchases in July 2024, reflecting positive sentiment towards future prospects despite reliance on external borrowing for funding.

- Navigate through the intricacies of Sirius Real Estate with our comprehensive valuation report here.

Understand Sirius Real Estate's track record by examining our Past report.

Turning Ideas Into Actions

- Gain an insight into the universe of 32 Undervalued UK Small Caps With Insider Buying by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammerson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HMSO

Hammerson

Hammerson is a cities business. An owner, operator and developer of prime urban real estate, with a portfolio value of £4.7billion (as at 30 June 2023), in some of the fastest growing cities in the UK, Ireland and France.

Moderate growth potential and slightly overvalued.