- United Kingdom

- /

- Building

- /

- LSE:NXR

Top 3 Undervalued Small Caps With Insider Buying In United Kingdom For September 2024

Reviewed by Simply Wall St

The United Kingdom market has been experiencing turbulence, with the FTSE 100 index closing lower due to weak trade data from China and a general decline in global economic indicators. Despite these challenges, there are opportunities within small-cap stocks that show potential for growth, particularly those with insider buying activities signaling confidence from within the company.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 23.4x | 5.3x | 17.09% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 48.58% | ★★★★★☆ |

| Essentra | 799.9x | 1.5x | 48.38% | ★★★★★☆ |

| GB Group | NA | 2.9x | 35.66% | ★★★★★☆ |

| NWF Group | 8.7x | 0.1x | 35.69% | ★★★★☆☆ |

| H&T Group | 7.5x | 0.7x | 12.13% | ★★★★☆☆ |

| CVS Group | 22.7x | 1.2x | 40.45% | ★★★★☆☆ |

| Norcros | 7.8x | 0.5x | -0.18% | ★★★☆☆☆ |

| Foxtons Group | 25.9x | 1.2x | 48.91% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -3.38% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Assura is a UK-based real estate investment trust specializing in the development and management of primary care medical centers, with a market cap of approximately £2.23 billion.

Operations: The company generates revenue primarily from its core segment, reporting £157.8 million in the latest period. Gross profit margins have shown a slight decline from 95.75% to 90.81% over the observed periods, while net income has fluctuated significantly, recently recording a loss of £28.8 million with a net income margin of -18.25%. Operating expenses have remained relatively stable around £14 million in recent periods.

PE: -45.5x

Assura, a small cap in the UK, is showing promising signs of growth with earnings forecasted to grow 41.82% annually. Despite past shareholder dilution, recent insider confidence is evident with purchases made from January to August 2024. The company announced a quarterly dividend of £0.0084 per share payable on October 9, 2024. An interesting move was the acquisition of a private hospital portfolio in August 2024, potentially boosting future revenues despite higher risk funding sources and debt concerns not well covered by operating cash flow.

- Get an in-depth perspective on Assura's performance by reading our valuation report here.

Review our historical performance report to gain insights into Assura's's past performance.

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a real estate investment trust focusing on the development and management of flagship retail destinations in the UK, France, and Ireland with a market cap of approximately £1.23 billion.

Operations: The company's revenue streams include flagship destinations in the UK, France, and Ireland, along with development projects. Over recent periods, its gross profit margin has varied between 79.90% and 87.12%.

PE: -33.9x

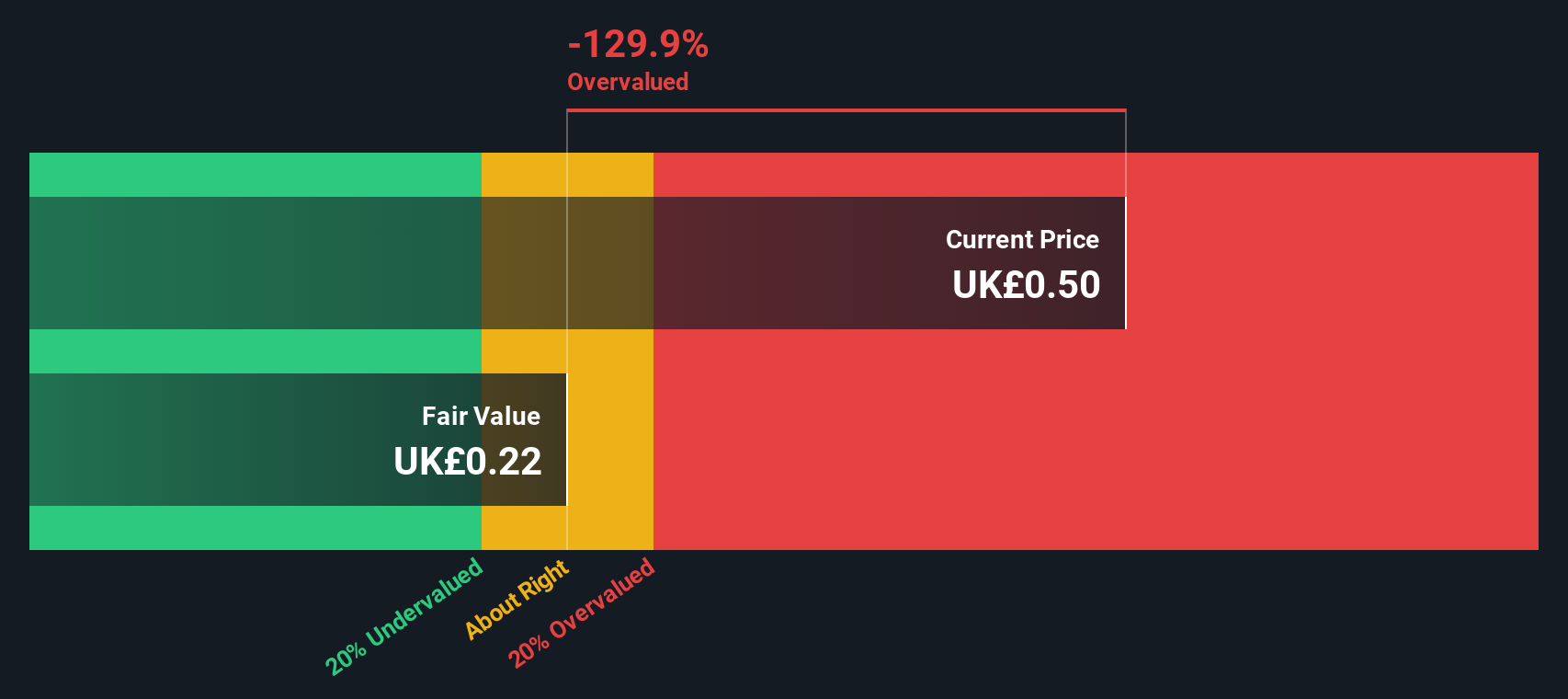

Hammerson, a UK-based retail property company, has seen insider confidence with notable share purchases in the past year. They recently arranged a €350 million non-recourse term loan for Dundrum Town Centre, extending debt maturity to 2031. Despite reporting a net loss of £516.7 million for H1 2024 and decreased sales to £40.1 million from £47.9 million last year, Hammerson declared an interim dividend of 0.756 pence per share payable on September 30, 2024.

- Take a closer look at Hammerson's potential here in our valuation report.

Evaluate Hammerson's historical performance by accessing our past performance report.

Norcros (LSE:NXR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Norcros is a company that specializes in building products with operations generating £392.10 million in revenue.

Operations: The company generates revenue primarily from its Building Products segment, with recent figures showing £392.1 million in revenue. Notably, the net income margin has shown variability over the periods, reaching 6.83% as of March 2024. Operating expenses have been significant, often exceeding £349 million in recent periods.

PE: 7.8x

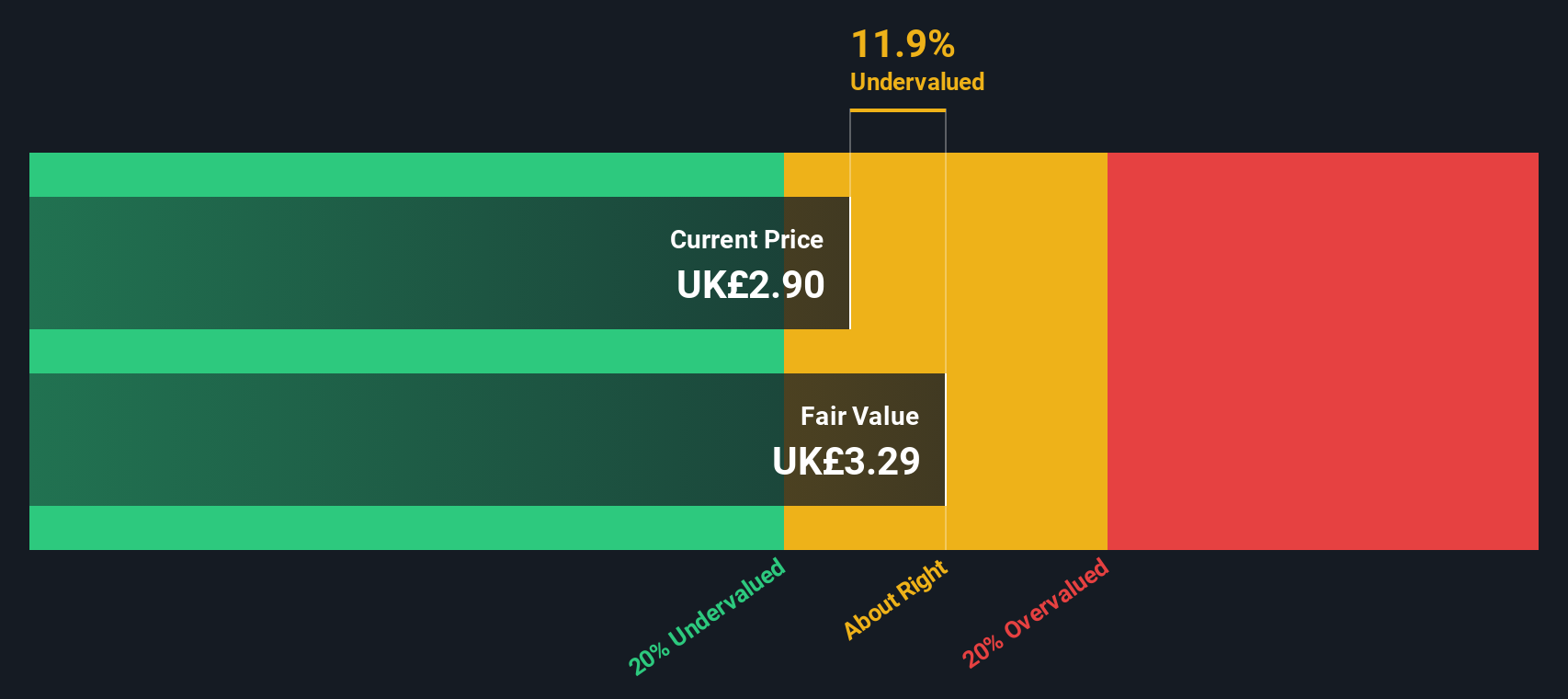

Norcros, a UK-based company, declared a final dividend of 6.8 pence per share for the year ending March 2024. Despite reporting lower group revenue by 5.9% for the recent quarter due to strategic exits, Norcros showed strong net income growth from £16.8 million to £26.8 million year-over-year. Earnings per share increased significantly as well, indicating financial resilience amidst challenges. Insider confidence is evident with notable purchases over recent months, suggesting potential undervaluation and future growth prospects despite forecasted earnings decline of 0.7% annually over the next three years.

- Delve into the full analysis valuation report here for a deeper understanding of Norcros.

Understand Norcros' track record by examining our Past report.

Seize The Opportunity

- Click here to access our complete index of 27 Undervalued UK Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norcros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NXR

Norcros

Develops, manufactures, and markets bathroom and kitchen products in the United Kingdom, Ireland, and South Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives