- United Kingdom

- /

- Hospitality

- /

- LSE:SSPG

Top 3 Undervalued Small Caps With Insider Action In United Kingdom August 2024

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index falters amid weak trade data from China, investors are increasingly looking towards small-cap stocks for potential opportunities. With broader market sentiment impacted by global economic uncertainties, identifying undervalued small caps with insider action can be a strategic move in navigating these challenging times.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.5x | 5.5x | 12.70% | ★★★★★☆ |

| Domino's Pizza Group | 15.5x | 1.8x | 34.86% | ★★★★★☆ |

| Essentra | 817.3x | 1.6x | 49.06% | ★★★★★☆ |

| GB Group | NA | 3.0x | 33.04% | ★★★★★☆ |

| Norcros | 7.5x | 0.5x | 3.48% | ★★★★☆☆ |

| NWF Group | 9.2x | 0.1x | 31.55% | ★★★★☆☆ |

| CVS Group | 22.4x | 1.2x | 40.83% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.7x | 41.24% | ★★★★☆☆ |

| Foxtons Group | 27.6x | 1.3x | 45.88% | ★★★☆☆☆ |

| Franchise Brands | 117.4x | 2.9x | 48.77% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

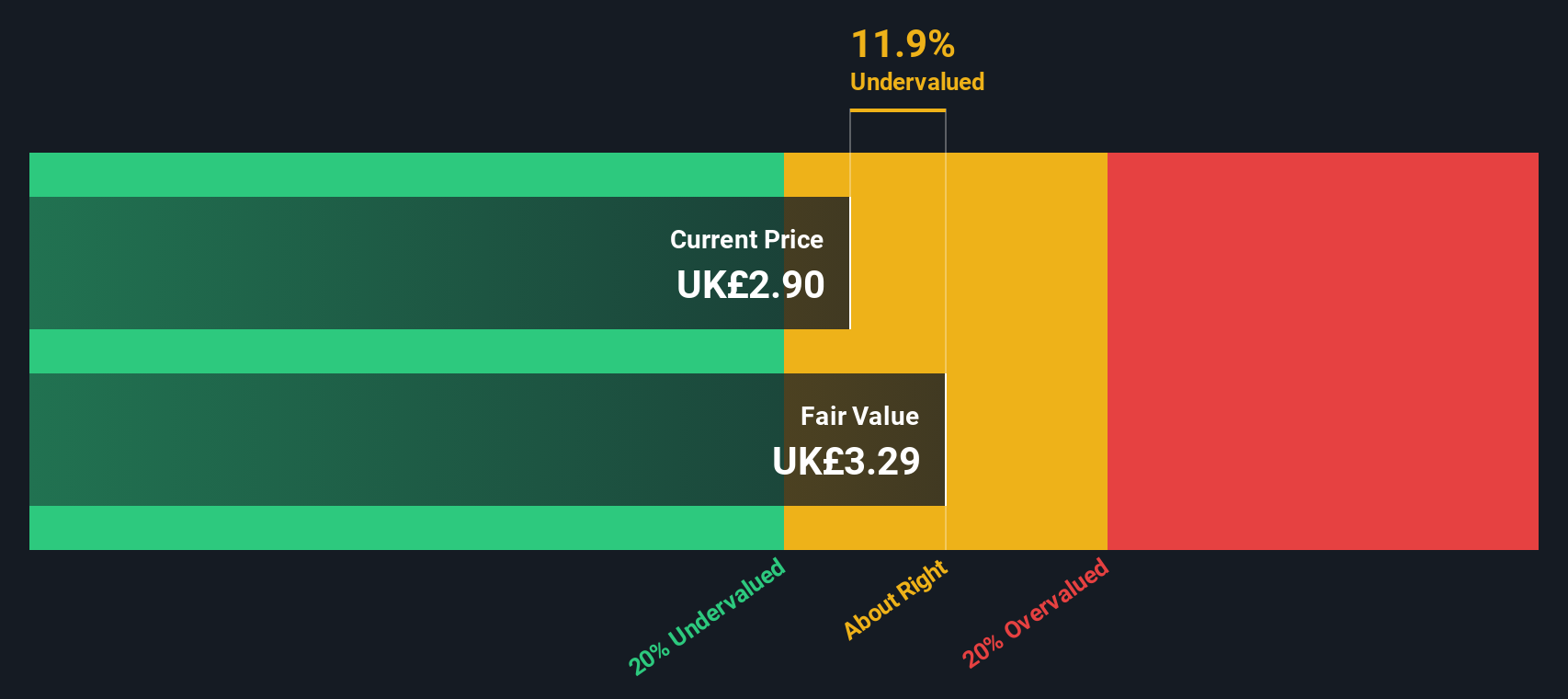

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a real estate investment company that focuses on owning, managing, and developing flagship retail destinations in the UK, France, and Ireland with a market cap of approximately £1.30 billion.

Operations: Hammerson's revenue primarily comes from its flagship destinations in the UK (£88.7 million), France (£53.2 million), and Ireland (£39.5 million). The company's gross profit margin was 81.85% as of December 2023, with operating expenses amounting to £51.1 million for the same period.

PE: -33.2x

Hammerson, a UK-based company primarily focused on retail property, has recently secured a €350 million non-recourse term loan with PIMCO Prime Real Estate to refinance existing debt maturing in September 2024. The new loan extends the average maturity of their debt from 2.2 to 2.9 years at an all-in interest cost of about 5.5%. Despite reporting a net loss of £516.7 million for H1 2024, insider confidence is evident with recent share purchases by executives over the past six months.

- Click here to discover the nuances of Hammerson with our detailed analytical valuation report.

Evaluate Hammerson's historical performance by accessing our past performance report.

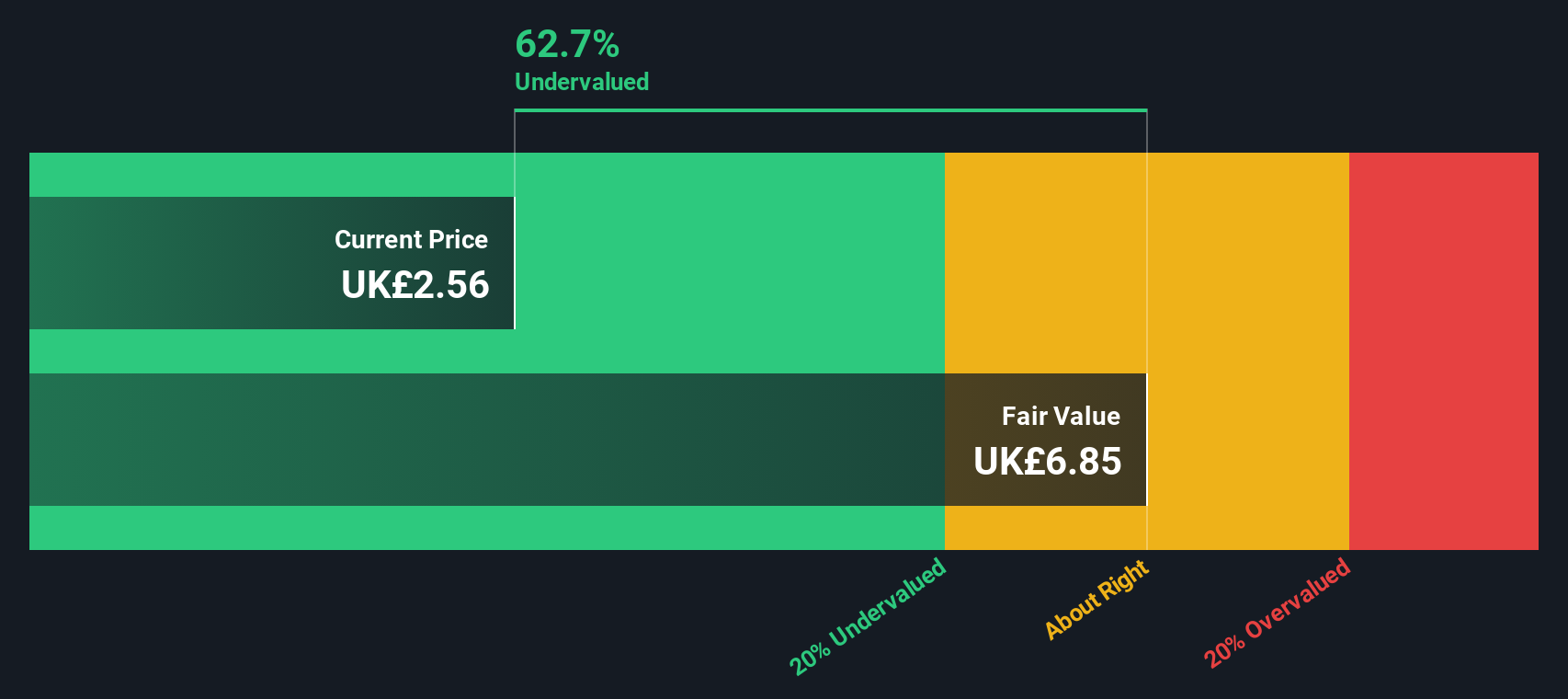

Hochschild Mining (LSE:HOC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hochschild Mining is a precious metals company focused on the exploration, mining, processing, and sale of silver and gold from its operations in Peru and Argentina with a market cap of approximately £0.55 billion.

Operations: Hochschild Mining's revenue streams are primarily derived from its Inmaculada, San Jose, and Pallancata operations, totaling $693.72 million. The company reported a gross profit margin of 26.46% for the period ending December 31, 2023. Operating expenses amounted to $100.89 million while non-operating expenses were $137.69 million for the same period.

PE: -21.7x

Hochschild Mining has shown significant insider confidence, with Eduardo Navarro purchasing 148,000 shares worth £235,320 in early July 2024. The company reiterated its production guidance for 2024, expecting to produce between 343,000-360,000 gold equivalent ounces. In Q2 2024, Hochschild reported a year-over-year increase in gold production to 66.37 koz from 54.12 koz and total silver equivalent rising to 8,097 koz from last year's 7,447 koz. Earnings are forecasted to grow by an impressive annual rate of over fifty percent.

- Unlock comprehensive insights into our analysis of Hochschild Mining stock in this valuation report.

Understand Hochschild Mining's track record by examining our Past report.

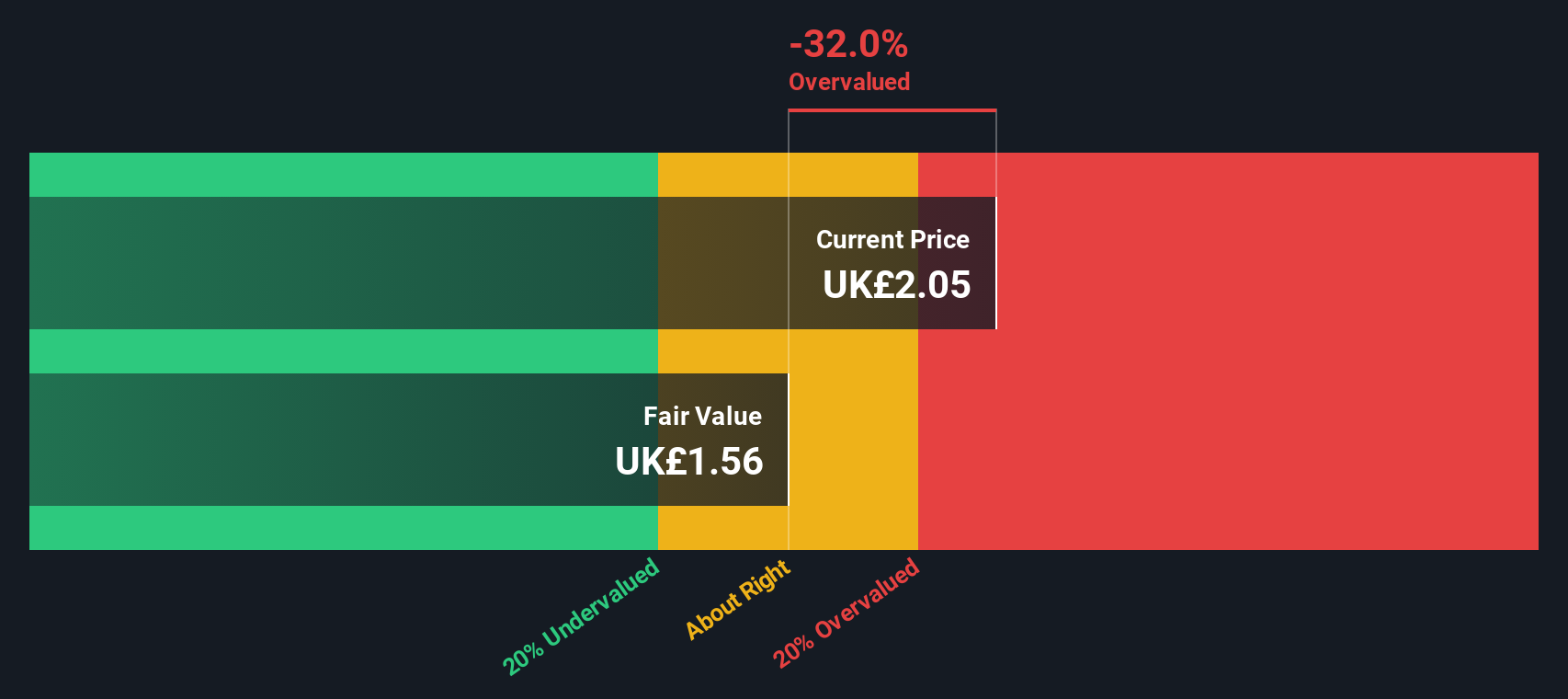

SSP Group (LSE:SSPG)

Simply Wall St Value Rating: ★★★★★☆

Overview: SSP Group operates in the food and beverage travel sector, primarily serving customers at airports and railway stations, with a market cap of approximately £2.75 billion.

Operations: The company generates revenue primarily from the Food and Beverage Travel Sector, with a significant portion of its costs attributed to COGS (£2283.10 million) and operating expenses (£717.60 million). The gross profit margin stands at 28.84%.

PE: 176.4x

SSP Group, a UK-based company in the food and beverage sector, has shown promising signs of being undervalued. Recent insider confidence is evident with share purchases from March to June 2024. Financially, SSPG reported a net loss of £10.5 million for H1 2024 but saw group sales rise by 18% year-on-year for the nine months ending June 30, 2024. Despite lower profit margins (0.2%) compared to last year (0.5%), the company announced an interim dividend of £0.012 per share in May 2024, indicating potential future growth and value realization for investors.

- Get an in-depth perspective on SSP Group's performance by reading our valuation report here.

Examine SSP Group's past performance report to understand how it has performed in the past.

Make It Happen

- Embark on your investment journey to our 26 Undervalued UK Small Caps With Insider Buying selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SSP Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SSPG

SSP Group

Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives