- United Kingdom

- /

- Residential REITs

- /

- LSE:ESP

What You Need To Know About The Empiric Student Property plc (LON:ESP) Analyst Downgrade Today

Today is shaping up negative for Empiric Student Property plc (LON:ESP) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

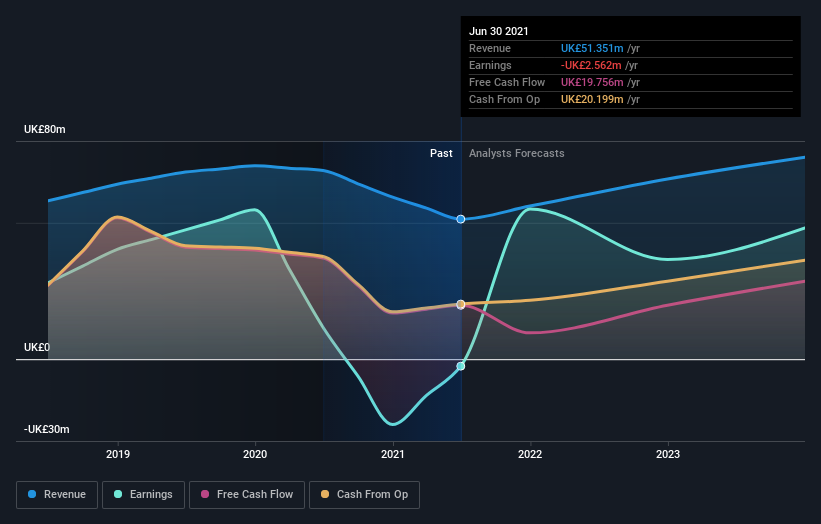

After the downgrade, the consensus from Empiric Student Property's four analysts is for revenues of UK£50m in 2021, which would reflect a discernible 2.8% decline in sales compared to the last year of performance. Losses are expected to turn into profits real soon, with the analysts forecasting UK£0.052 in per-share earnings. Before this latest update, the analysts had been forecasting revenues of UK£56m and earnings per share (EPS) of UK£0.091 in 2021. Indeed, we can see that the analysts are a lot more bearish about Empiric Student Property's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Empiric Student Property

The average price target climbed 5.8% to UK£1.09 despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Empiric Student Property analyst has a price target of UK£1.12 per share, while the most pessimistic values it at UK£1.00. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 5.5% by the end of 2021. This indicates a significant reduction from annual growth of 12% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 6.2% annually for the foreseeable future. It's pretty clear that Empiric Student Property's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Empiric Student Property. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given the stark change in sentiment, we'd understand if investors became more cautious on Empiric Student Property after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Empiric Student Property analysts - going out to 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Empiric Student Property or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Empiric Student Property might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:ESP

Empiric Student Property

Empiric Student Property plc is a leading provider and operator of modern, predominantly direct-let, premium student accommodation serving key UK universities.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026