- United Kingdom

- /

- Retail REITs

- /

- LSE:CAL

Investors in Capital & Regional (LON:CAL) from five years ago are still down 85%, even after 7.6% gain this past week

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Imagine if you held Capital & Regional Plc (LON:CAL) for half a decade as the share price tanked 89%. On the other hand the share price has bounced 7.6% over the last week. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

The recent uptick of 7.6% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

Check out our latest analysis for Capital & Regional

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Capital & Regional has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 3.1% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

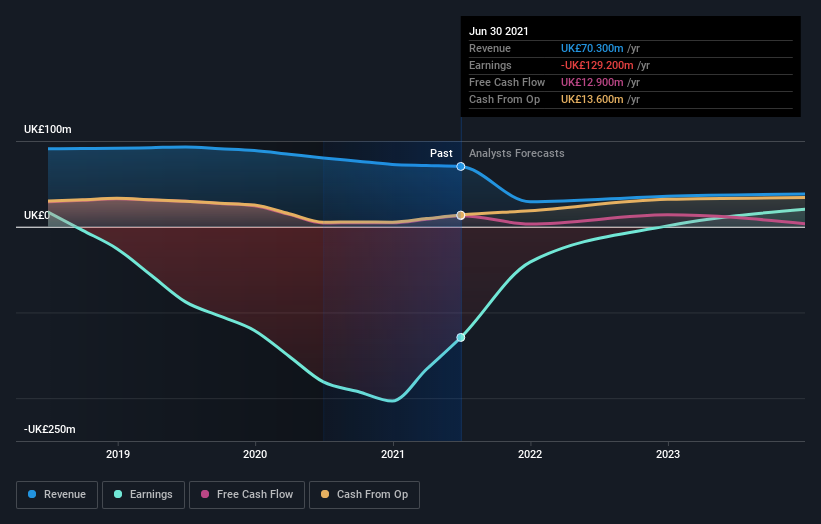

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Capital & Regional stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Capital & Regional's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Capital & Regional's TSR, which was a 85% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that Capital & Regional shareholders have received a total shareholder return of 73% over one year. That certainly beats the loss of about 13% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Capital & Regional better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Capital & Regional you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you're looking to trade Capital & Regional, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CAL

Capital & Regional

Capital & Regional is a UK focused retail property REIT specialising in shopping centres that dominate their catchment, serving the non-discretionary and value orientated needs of the local communities.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives