- United Kingdom

- /

- REITS

- /

- LSE:BLND

British Land (LON:BLND) shareholder returns have been favorable, earning 51% in 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the British Land Company PLC (LON:BLND) share price is up 42% in the last 1 year, clearly besting the market return of around 7.2% (not including dividends). So that should have shareholders smiling. In contrast, the longer term returns are negative, since the share price is 15% lower than it was three years ago.

Since the stock has added UK£193m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for British Land

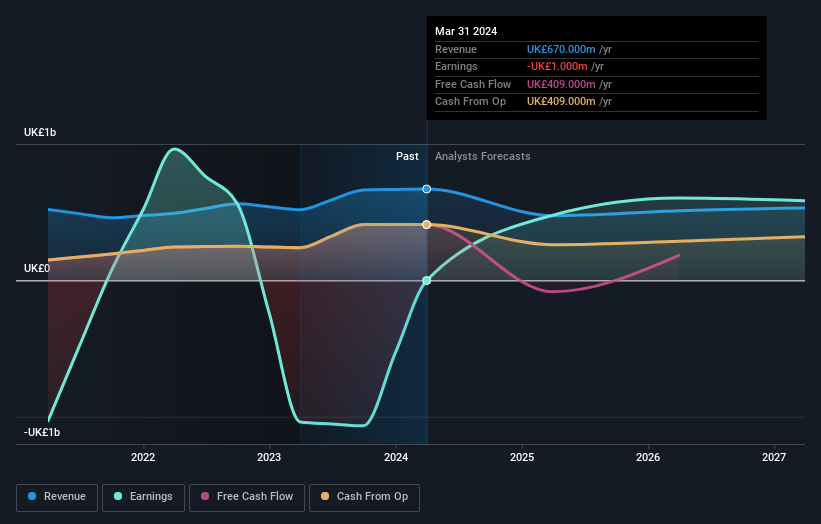

British Land wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last twelve months, British Land's revenue grew by 29%. That's a fairly respectable growth rate. While the share price performed well, gaining 42% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling British Land stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, British Land's TSR for the last 1 year was 51%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that British Land shareholders have received a total shareholder return of 51% over one year. And that does include the dividend. Notably the five-year annualised TSR loss of 0.4% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for British Land you should be aware of, and 1 of them doesn't sit too well with us.

But note: British Land may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if British Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BLND

British Land

British Land is a UK commercial property company focused on real estate sectors with the strongest operational fundamentals: London campuses, retail parks, and London urban logistics.

Very undervalued with reasonable growth potential and pays a dividend.