- United Kingdom

- /

- Health Care REITs

- /

- LSE:AGR

Exploring Three Undervalued UK Small Caps With Insider Buying Signals

In the midst of fluctuating global markets, with the FTSE 100 showing muted activity and broader economic indicators signaling mixed sentiments, investors are closely monitoring shifts that could impact investment opportunities, particularly within small-cap stocks. In such a landscape, identifying undervalued small caps with insider buying signals can offer potential avenues for those looking to diversify their portfolios in alignment with current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kenmare Resources | 3.1x | 0.9x | 48.99% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.24% | ★★★★★☆ |

| THG | NA | 0.5x | 31.01% | ★★★★★☆ |

| Ultimate Products | 10.7x | 0.8x | 8.20% | ★★★★☆☆ |

| Bodycote | 16.4x | 1.8x | 12.79% | ★★★★☆☆ |

| Morgan Advanced Materials | 19.3x | 0.8x | 46.65% | ★★★★☆☆ |

| Eurocell | 15.0x | 0.4x | 22.42% | ★★★★☆☆ |

| M&C Saatchi | NA | 0.6x | 48.16% | ★★★★☆☆ |

| Luceco | 16.7x | 1.3x | 16.93% | ★★★☆☆☆ |

| Robert Walters | 20.5x | 0.3x | 47.56% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

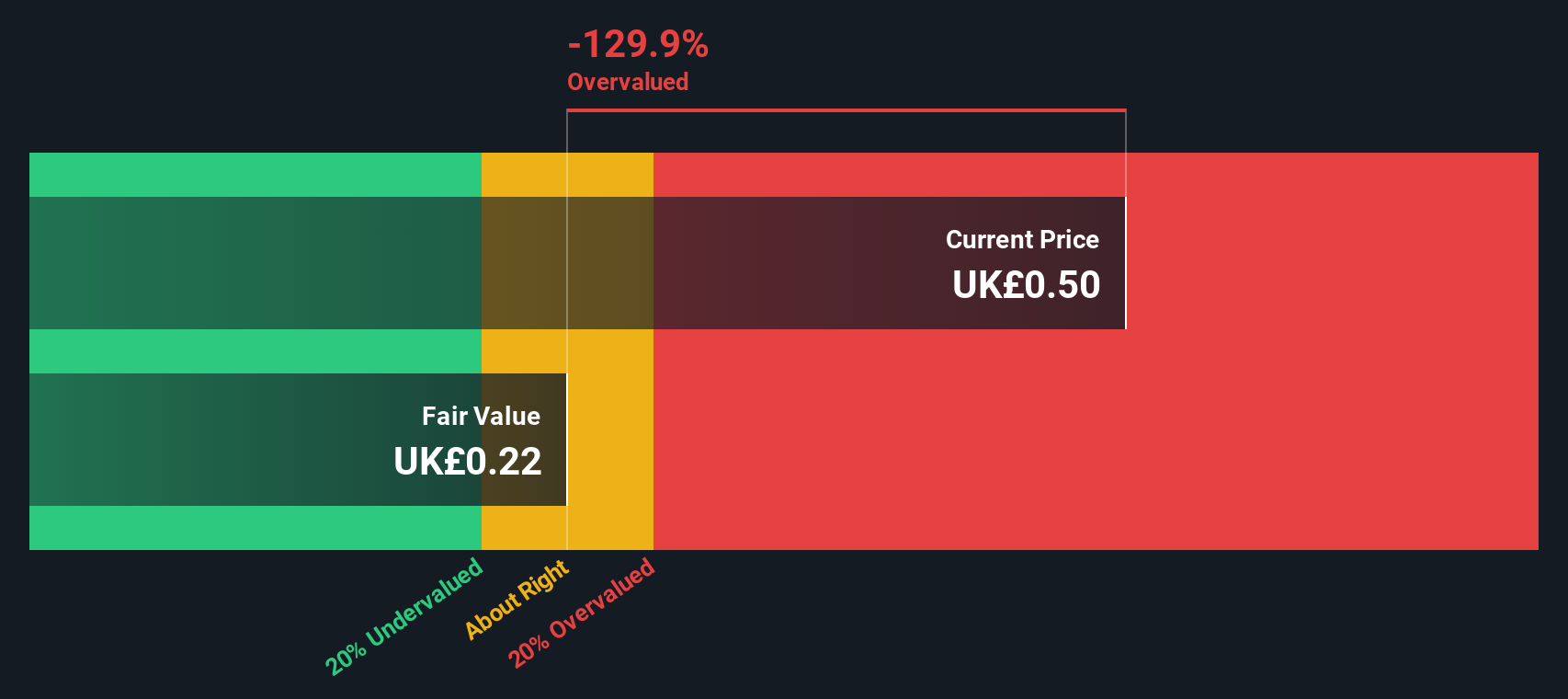

Assura (AGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Assura is a healthcare real estate investment trust (REIT) specializing in the ownership, management, and development of primary care facilities across the UK, with a market capitalization of approximately £1.76 billion.

Operations: Core segment generated £157.8 million in revenue, with a gross profit margin of 90.81% and net income margin showing a decline to -18.25%.

PE: -44.0x

Assura, a specialist in healthcare property investment, recently partnered with Universities Superannuation Scheme in a GBP 250 million venture aimed at enhancing NHS infrastructure, reflecting robust strategic growth and diversification. Despite a challenging year with a net loss of GBP 28.8 million, the company's sales rose to GBP 157.8 million from GBP 150.4 million previously. This financial resilience is underscored by their commitment to reinvesting the proceeds from this deal into further acquisitions and developments within the healthcare sector, signaling strong future prospects amidst an aging population and increasing healthcare demands.

- Click here to discover the nuances of Assura with our detailed analytical valuation report.

-

Gain insights into Assura's historical performance by reviewing our past performance report.

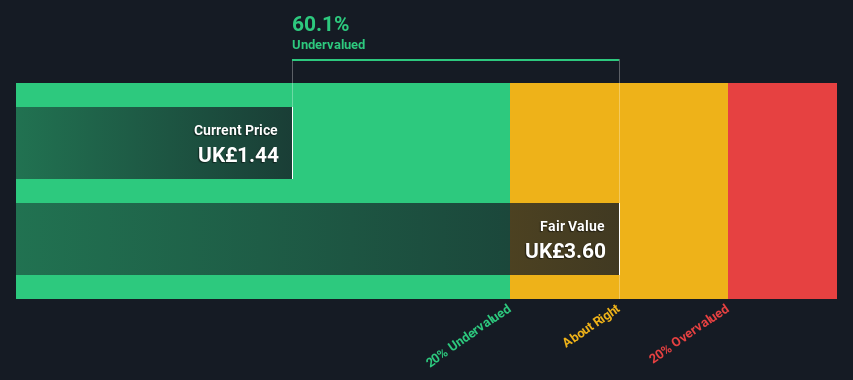

Aston Martin Lagonda Global Holdings (AML)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings is a luxury automotive manufacturer known for its high-performance vehicles, with a market capitalization of approximately £1.23 billion.

Operations: The Automotive segment generated £1.60 billion in revenue, with a gross profit margin of 39.70%.

PE: -4.2x

Amidst challenges, Aston Martin Lagonda's recent executive reshuffles and a projected 83% earnings growth per year signal a strategic pivot. Despite a dip in Q1 sales to £268 million and an increased net loss of £139 million, the company's leadership changes, including the appointment of Adrian Hallmark as CEO by October 2024, underscore a revitalization effort. This fresh direction is further affirmed by insider confidence, with significant stock purchases hinting at optimism for the restructured future.

- Navigate through the intricacies of Aston Martin Lagonda Global Holdings with our comprehensive valuation report here.

-

Understand Aston Martin Lagonda Global Holdings' track record by examining our Past report.

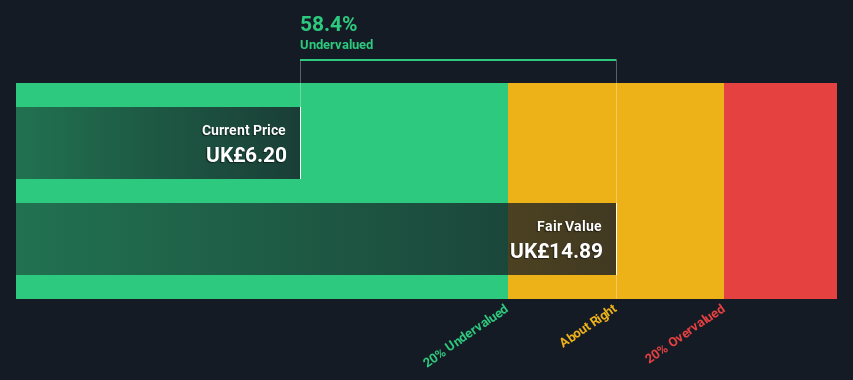

Bodycote (BOY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bodycote is a global provider of heat treatment and specialist thermal processing services, primarily serving the aerospace, defense, energy, and automotive industries with a market capitalization of approximately £1.39 billion.

Operations: The company's revenue has grown from £603 million to £802.5 million over a period, with the latest gross profit margin reported at 13.47%. Key revenue contributors include the Aerospace, Defence & Energy sectors in North America and Western Europe, and the Automotive & General Industrial sectors across various regions.

PE: 16.4x

Bodycote, a lesser-known UK entity, recently bolstered investor confidence through insider acquisitions and a robust share repurchase program, earmarking up to £60 million for buybacks. With a solid performance in 2023, posting sales of £802.5 million and net income rising to £85.6 million from the previous year's figures, they're showing promising financial health. The appointment of Jim Fairbairn as the new CEO could signal strategic shifts or continuity in growth trajectories. Their commitment to shareholder returns is further evidenced by an increased dividend payout set for June 2024.

- Get an in-depth perspective on Bodycote's performance by reading our valuation report here.

-

Assess Bodycote's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Discover the full array of 32 Undervalued Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Assura, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AGR

Assura

Assura plc is the UK's leading specialist healthcare property investor and developer.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives