Paramjit Paul Bassi became the CEO of Real Estate Investors plc (LON:RLE) in 2006, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Real Estate Investors

How Does Total Compensation For Paramjit Paul Bassi Compare With Other Companies In The Industry?

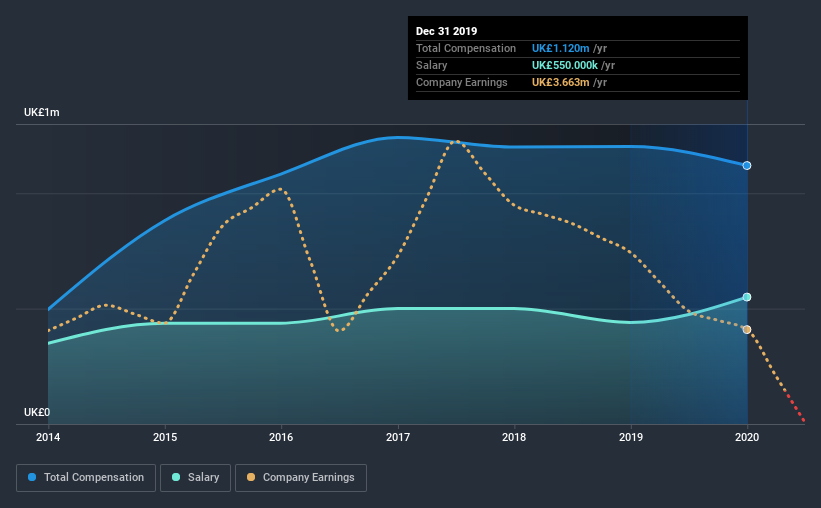

According to our data, Real Estate Investors plc has a market capitalization of UK£61m, and paid its CEO total annual compensation worth UK£1.1m over the year to December 2019. We note that's a small decrease of 6.8% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£550k.

For comparison, other companies in the industry with market capitalizations below UK£149m, reported a median total CEO compensation of UK£361k. This suggests that Paramjit Paul Bassi is paid more than the median for the industry. Furthermore, Paramjit Paul Bassi directly owns UK£4.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£550k | UK£440k | 49% |

| Other | UK£570k | UK£762k | 51% |

| Total Compensation | UK£1.1m | UK£1.2m | 100% |

Speaking on an industry level, nearly 54% of total compensation represents salary, while the remainder of 46% is other remuneration. Real Estate Investors is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Real Estate Investors plc's Growth Numbers

Over the last three years, Real Estate Investors plc has shrunk its earnings per share by 65% per year. Its revenue is up 2.8% over the last year.

The decline in EPS is a bit concerning. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Real Estate Investors plc Been A Good Investment?

With a three year total loss of 29% for the shareholders, Real Estate Investors plc would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Paramjit Paul is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. To make matters worse, EPS growth has also been negative during this period. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Real Estate Investors (of which 2 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Real Estate Investors, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Real Estate Investors, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:RLE

Real Estate Investors

A publicly quoted, internally managed property investment company and REIT with a portfolio of mixed-use commercial property, managed by a highly-experienced property team with over 100 years of combined experience of operating in the Midlands property market across all sectors.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)