- United Kingdom

- /

- Capital Markets

- /

- LSE:FSG

UK Market Insights Into 3 Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interconnections. In this environment of fluctuating market conditions, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to navigate these uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.044 | £11.52 | 47.5% |

| SigmaRoc (AIM:SRC) | £1.168 | £2.31 | 49.5% |

| Serica Energy (AIM:SQZ) | £1.794 | £3.50 | 48.8% |

| Likewise Group (AIM:LIKE) | £0.272 | £0.53 | 48.3% |

| Hollywood Bowl Group (LSE:BOWL) | £2.56 | £4.96 | 48.3% |

| Gooch & Housego (AIM:GHH) | £5.86 | £11.27 | 48% |

| Fevertree Drinks (AIM:FEVR) | £7.81 | £15.37 | 49.2% |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £2.22 | 49.3% |

| AOTI (AIM:AOTI) | £0.40 | £0.78 | 48.8% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.245 | £4.39 | 48.9% |

Underneath we present a selection of stocks filtered out by our screen.

Foresight Group Holdings (LSE:FSG)

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the UK, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £513.88 million.

Operations: The company's revenue segments are comprised of £95.89 million from infrastructure, £50.52 million from private equity, and £7.58 million from Foresight Capital Management.

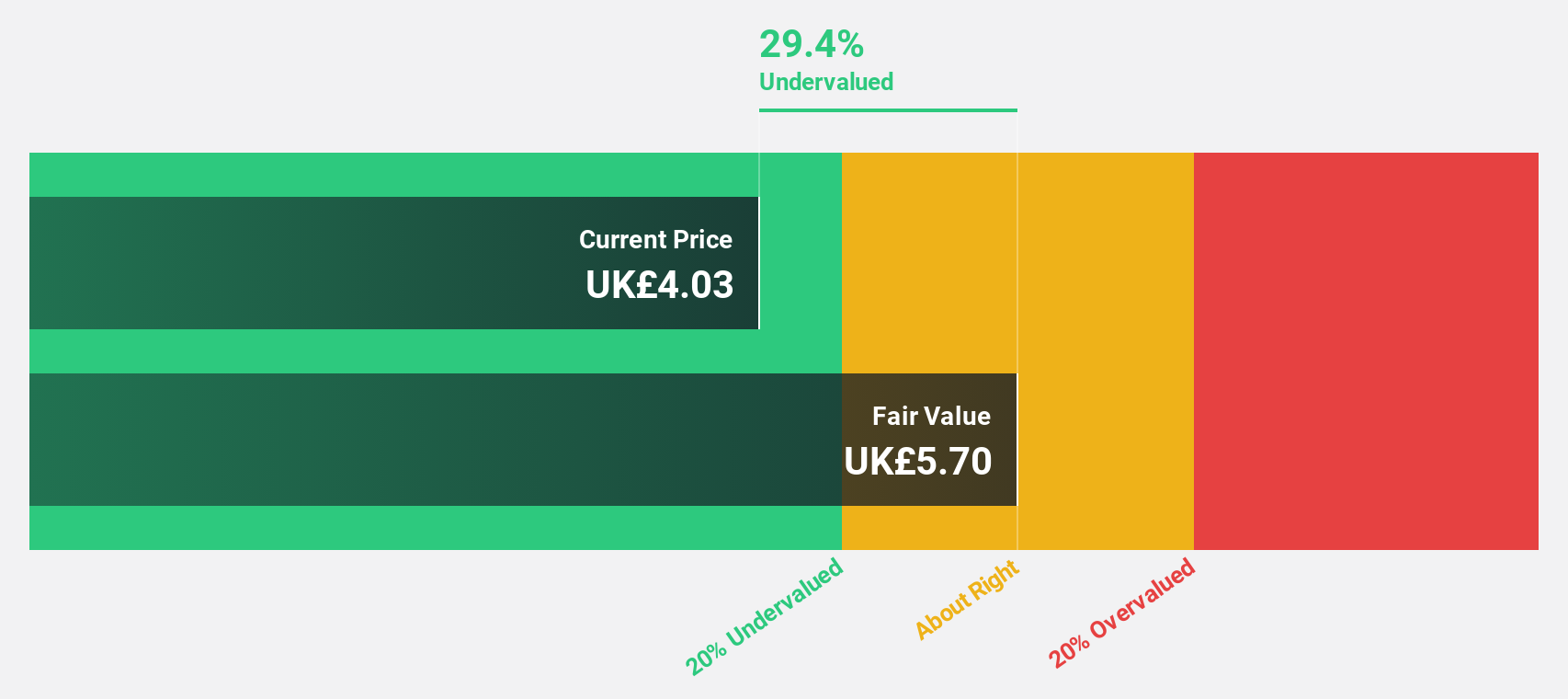

Estimated Discount To Fair Value: 13.5%

Foresight Group Holdings is trading at £4.59, below its estimated fair value of £5.3, suggesting it may be undervalued based on cash flows. The company's revenue and earnings are forecast to grow faster than the UK market, with earnings expected to increase by 19.4% annually. Analysts predict a 30.6% rise in stock price, supported by recent profit growth of 25.8%. A high return on equity is anticipated in three years at 62.2%.

- The analysis detailed in our Foresight Group Holdings growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Foresight Group Holdings.

Mitie Group (LSE:MTO)

Overview: Mitie Group plc, along with its subsidiaries, offers facilities management and professional services both in the United Kingdom and internationally, with a market cap of £1.80 billion.

Operations: Mitie Group's revenue is derived from its Communities segment (£869.80 million), Business Services (£2.24 billion), and Technical Services (£1.98 billion).

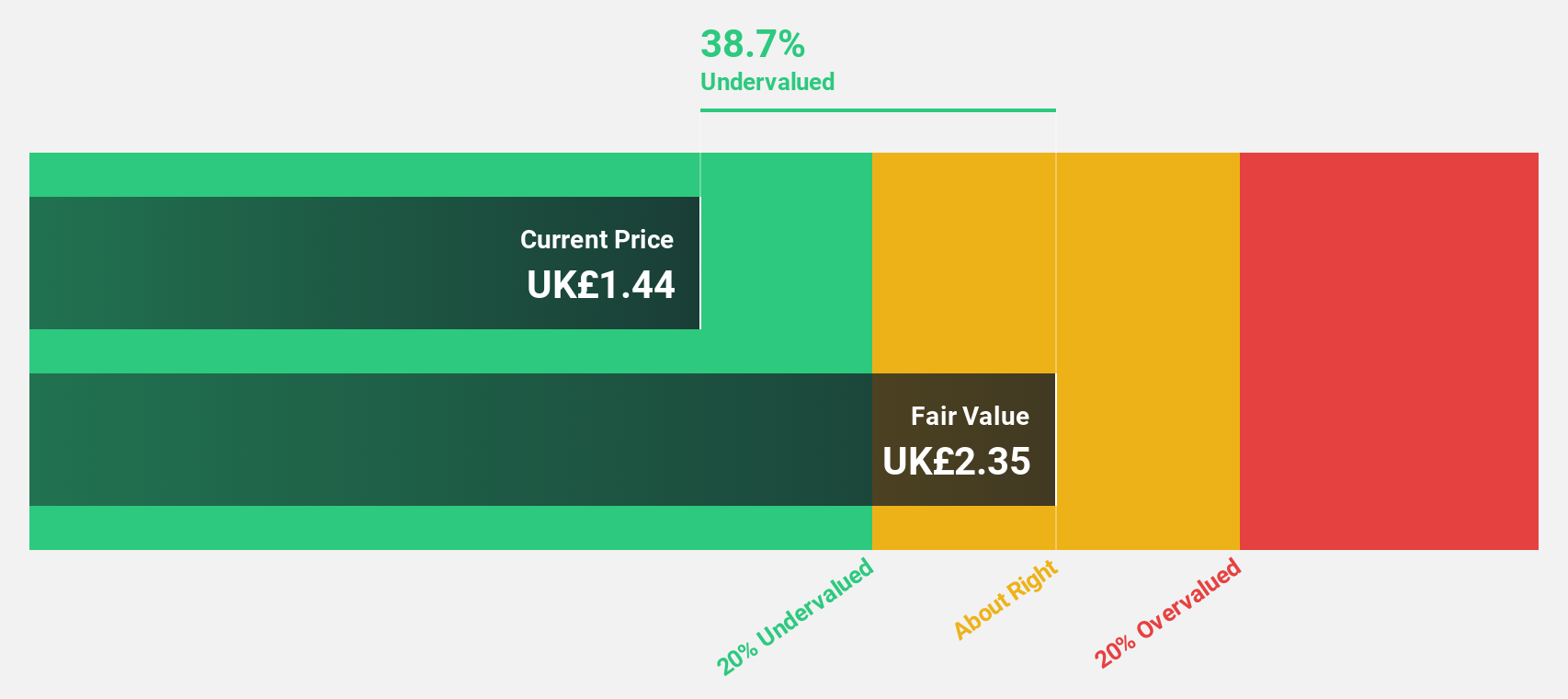

Estimated Discount To Fair Value: 46.7%

Mitie Group is trading at £1.37, significantly below its estimated fair value of £2.57, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 21.3% annually, outpacing the UK market's growth rate of 14.2%. Analysts forecast a 27.5% increase in stock price, despite recent executive changes and an unstable dividend history. Revenue growth is expected to exceed the UK market average at 6.1% annually.

- Upon reviewing our latest growth report, Mitie Group's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Mitie Group's balance sheet health report.

Savills (LSE:SVS)

Overview: Savills plc, along with its subsidiaries, provides real estate services across the United Kingdom, Continental Europe, Asia Pacific, Africa, North America, and the Middle East with a market cap of £1.32 billion.

Operations: The company's revenue segments include Consultancy (£534.90 million), Transaction Advisory (£877.30 million), Investment Management (£91.20 million), and Property and Facilities Management (£965.20 million).

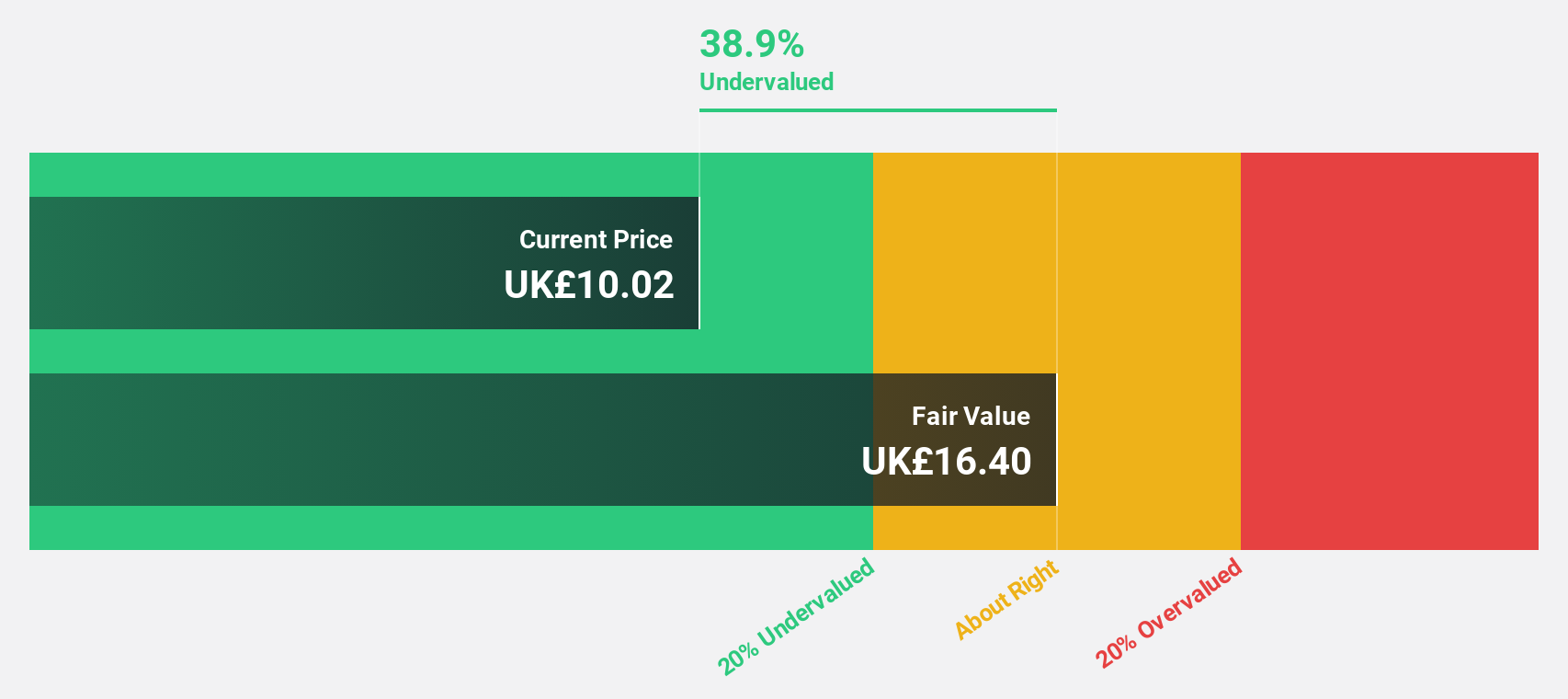

Estimated Discount To Fair Value: 30.3%

Savills is trading at £9.75, significantly below its estimated fair value of £13.98, suggesting it may be undervalued based on cash flows. Earnings grew by 23% last year and are forecast to grow 28.6% annually, outpacing the UK market's growth rate of 14.2%. While revenue growth is projected at 4.6% per year, slightly above the UK average, the company's dividend history remains unstable amidst recent executive changes enhancing its property management team.

- According our earnings growth report, there's an indication that Savills might be ready to expand.

- Get an in-depth perspective on Savills' balance sheet by reading our health report here.

Seize The Opportunity

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 49 more companies for you to explore.Click here to unveil our expertly curated list of 52 Undervalued UK Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FSG

Foresight Group Holdings

Operates as an infrastructure and private equity manager in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives