- United Kingdom

- /

- Professional Services

- /

- LSE:PAGE

Energean And 2 Other UK Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, closing 0.4 percent lower at 7,527.42, influenced by weak trade data from China that highlighted ongoing struggles in the global economy. Amid these challenging market conditions, identifying undervalued stocks like Energean and others can present potential opportunities for investors seeking to capitalize on discrepancies between current market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.396 | £0.76 | 47.9% |

| Tracsis (AIM:TRCS) | £5.50 | £10.01 | 45% |

| Informa (LSE:INF) | £8.202 | £16.20 | 49.4% |

| Ferrexpo (LSE:FXPO) | £0.4825 | £0.95 | 49% |

| Redcentric (AIM:RCN) | £1.32 | £2.44 | 45.9% |

| Videndum (LSE:VID) | £2.53 | £5.00 | 49.4% |

| SysGroup (AIM:SYS) | £0.34 | £0.65 | 47.9% |

| Hochschild Mining (LSE:HOC) | £1.836 | £3.49 | 47.4% |

| Foxtons Group (LSE:FOXT) | £0.626 | £1.18 | 47% |

| Genel Energy (LSE:GENL) | £0.692 | £1.28 | 45.9% |

Let's take a closer look at a couple of our picks from the screened companies.

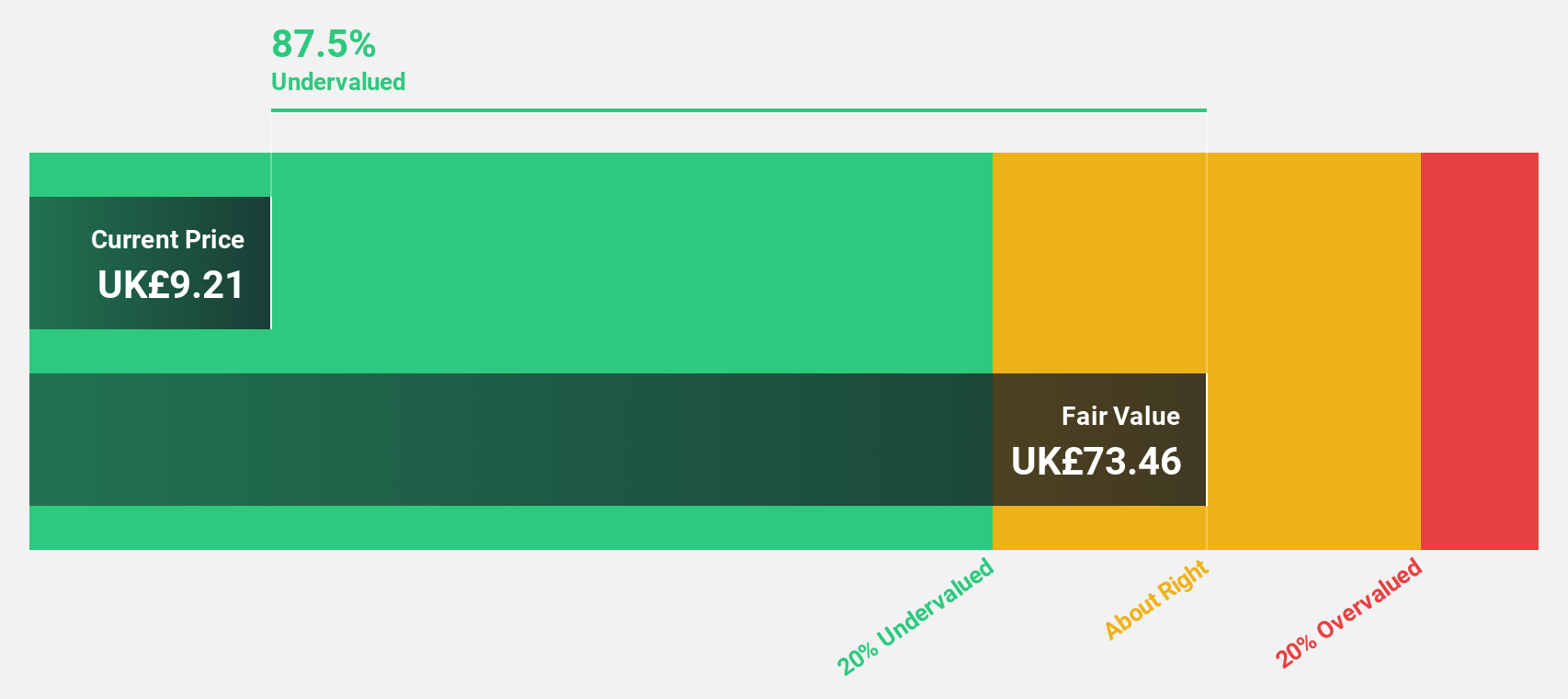

Energean (LSE:ENOG)

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.65 billion.

Operations: Energean's revenue from oil and gas exploration and production is $1.69 billion.

Estimated Discount To Fair Value: 24.2%

Energean plc's recent operational and financial performance highlights its potential as an undervalued stock based on cash flows. The company reported record production levels, with significant year-on-year increases in group production and sales reaching US$642.41 million for H1 2024. Despite a high level of debt, Energean's earnings are forecasted to grow at 30.4% annually, outpacing the UK market average. Trading at £9.02, it is notably below its estimated fair value of £11.89, indicating substantial undervaluation based on discounted cash flow analysis.

- In light of our recent growth report, it seems possible that Energean's financial performance will exceed current levels.

- Take a closer look at Energean's balance sheet health here in our report.

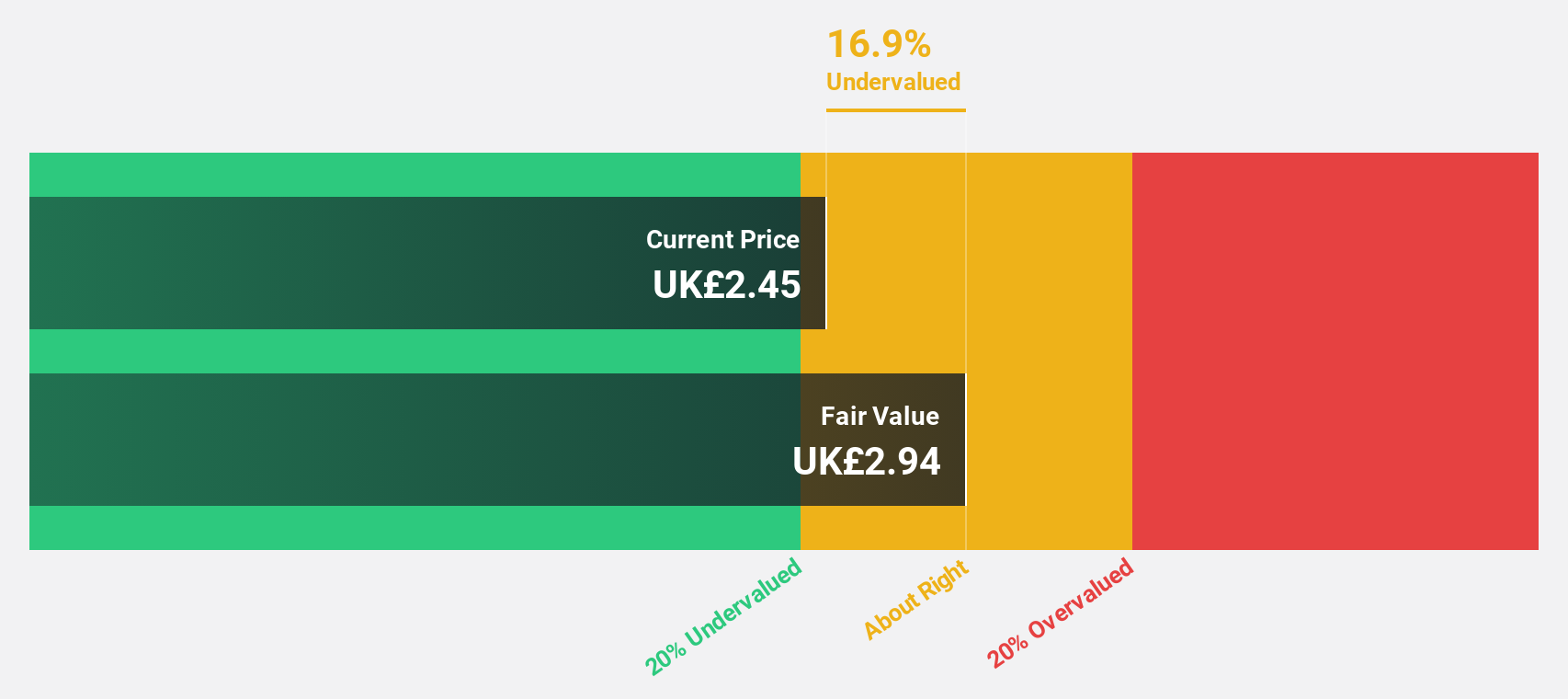

PageGroup (LSE:PAGE)

Overview: PageGroup plc, with a market cap of £1.21 billion, offers recruitment consultancy and ancillary services across the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas.

Operations: The company's revenue primarily comes from recruitment services, amounting to £1.87 billion.

Estimated Discount To Fair Value: 25.5%

PageGroup's recent earnings report shows a decline in sales to £897.96 million and net income to £16.78 million for H1 2024, compared to the previous year. Despite lower profit margins (2.7% vs. 4.9% last year), analysts expect significant annual earnings growth of 35.38%, well above the UK market average of 14.4%. Trading at £3.87, PageGroup is considered highly undervalued based on discounted cash flow analysis, with an estimated fair value of £5.19 per share.

- Our growth report here indicates PageGroup may be poised for an improving outlook.

- Dive into the specifics of PageGroup here with our thorough financial health report.

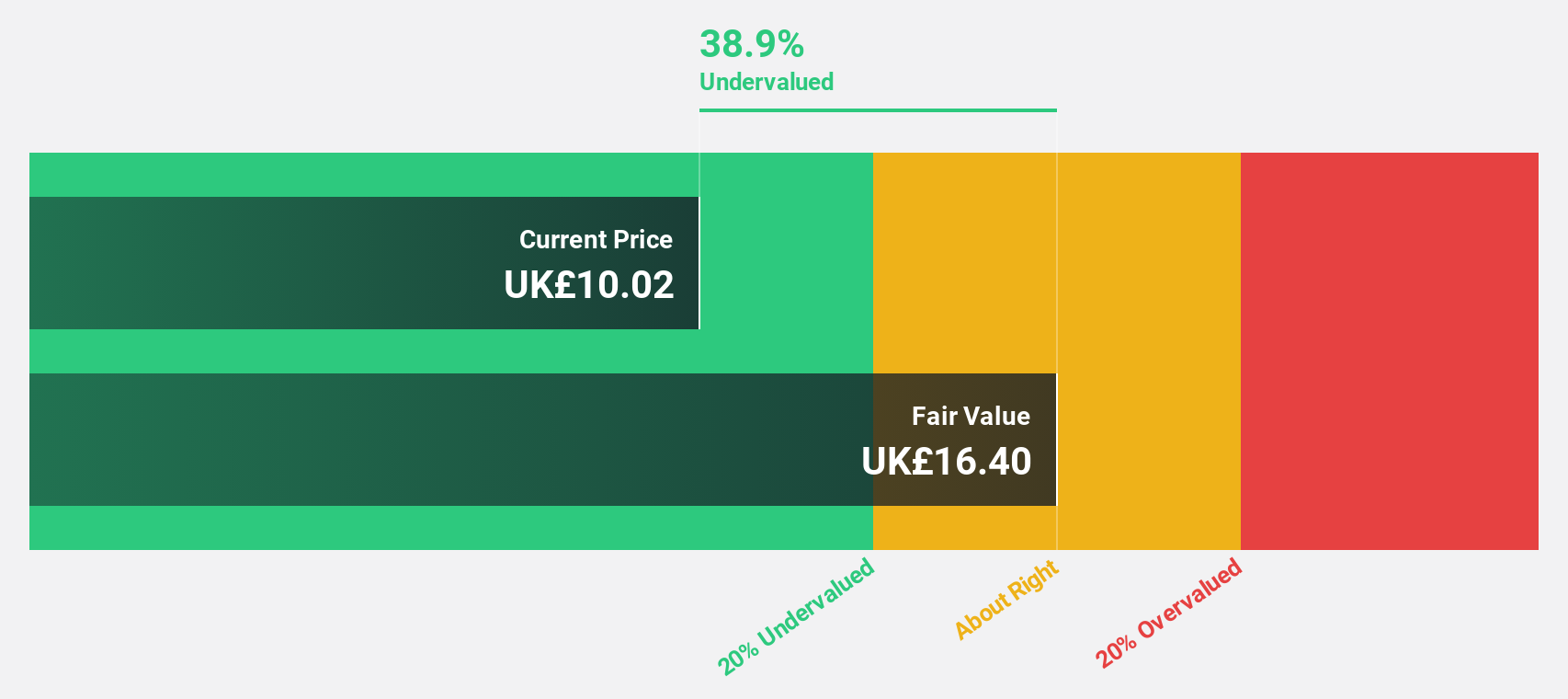

Savills (LSE:SVS)

Overview: Savills plc, with a market cap of £1.61 billion, provides real estate services across the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East.

Operations: The company's revenue segments include Consultancy (£464.80 million), Transaction Advisory (£803.60 million), Investment Management (£100.50 million), and Property and Facilities Management (£920.90 million).

Estimated Discount To Fair Value: 21.3%

Savills plc reported H1 2024 sales of £1.06 billion, up from £1.01 billion last year, with net income rising to £8.3 million from £4.8 million. Despite lower profit margins (1.9% vs 3.8% last year), the stock trades at a significant discount to its estimated fair value (£11.86 vs £15.07). Earnings are forecast to grow significantly at 33% annually, outpacing the UK market's average growth rate of 14%.

- Insights from our recent growth report point to a promising forecast for Savills' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Savills.

Where To Now?

- Click this link to deep-dive into the 60 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PageGroup, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PAGE

PageGroup

Provides recruitment consultancy and other ancillary services in the United Kingdom, rest of Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives