- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

3 UK Stocks That May Be Undervalued By Up To 48.2%

Reviewed by Simply Wall St

The recent performance of the UK's FTSE 100 and FTSE 250 indices has been influenced by weak trade data from China, highlighting concerns about global economic recovery and impacting sectors tied to commodities. In such a climate, identifying potentially undervalued stocks becomes crucial, as these opportunities may offer value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tortilla Mexican Grill (AIM:MEX) | £0.40 | £0.78 | 48.7% |

| Pinewood Technologies Group (LSE:PINE) | £3.655 | £7.09 | 48.4% |

| Nichols (AIM:NICL) | £9.66 | £18.53 | 47.9% |

| Motorpoint Group (LSE:MOTR) | £1.375 | £2.68 | 48.7% |

| Hochschild Mining (LSE:HOC) | £4.356 | £8.41 | 48.2% |

| Forterra (LSE:FORT) | £1.79 | £3.28 | 45.5% |

| Fintel (AIM:FNTL) | £2.03 | £3.82 | 46.8% |

| Fevertree Drinks (AIM:FEVR) | £7.97 | £15.82 | 49.6% |

| Airtel Africa (LSE:AAF) | £3.138 | £5.83 | 46.1% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.11 | £4.17 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

Coats Group (LSE:COA)

Overview: Coats Group plc, with a market cap of £1.51 billion, operates globally in thread manufacturing and produces structural components for apparel and footwear as well as performance materials.

Operations: The company's revenue segments include Apparel at $775.30 million, Footwear at $405.20 million, and Performance Materials at $321.80 million.

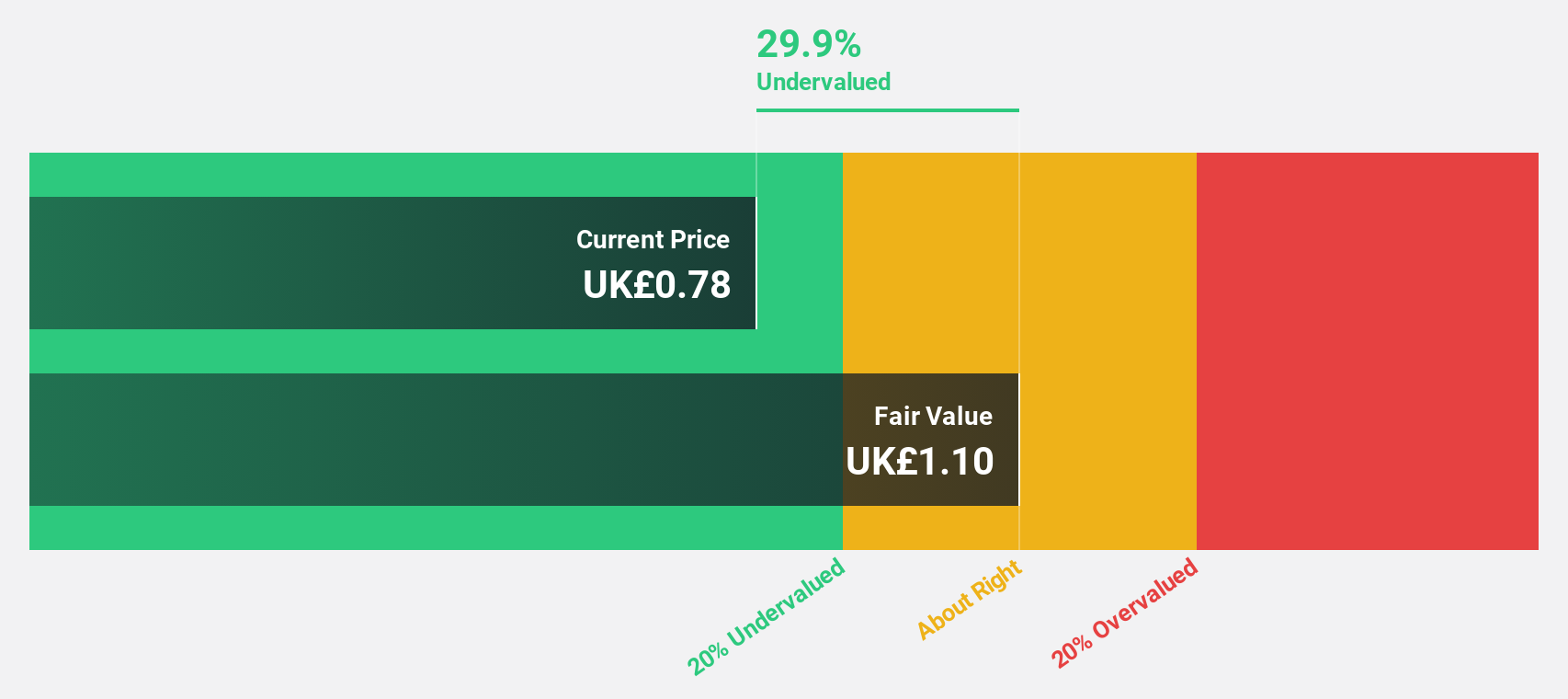

Estimated Discount To Fair Value: 36.7%

Coats Group is trading at £0.79, significantly below its estimated fair value of £1.24, presenting a potential undervaluation based on cash flow analysis. Despite recent shareholder dilution and debt not being well covered by operating cash flow, earnings are expected to grow significantly at 27.17% annually over the next three years, outpacing the UK market's growth rate. Analysts anticipate a 47.9% stock price increase, though dividend coverage remains weak against free cash flows.

- Our growth report here indicates Coats Group may be poised for an improving outlook.

- Navigate through the intricacies of Coats Group with our comprehensive financial health report here.

Hochschild Mining (LSE:HOC)

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £2.24 billion.

Operations: The company's revenue segments include $320.31 million from San Jose, $186.58 million from Mara Rosa, and $568.64 million from Inmaculada.

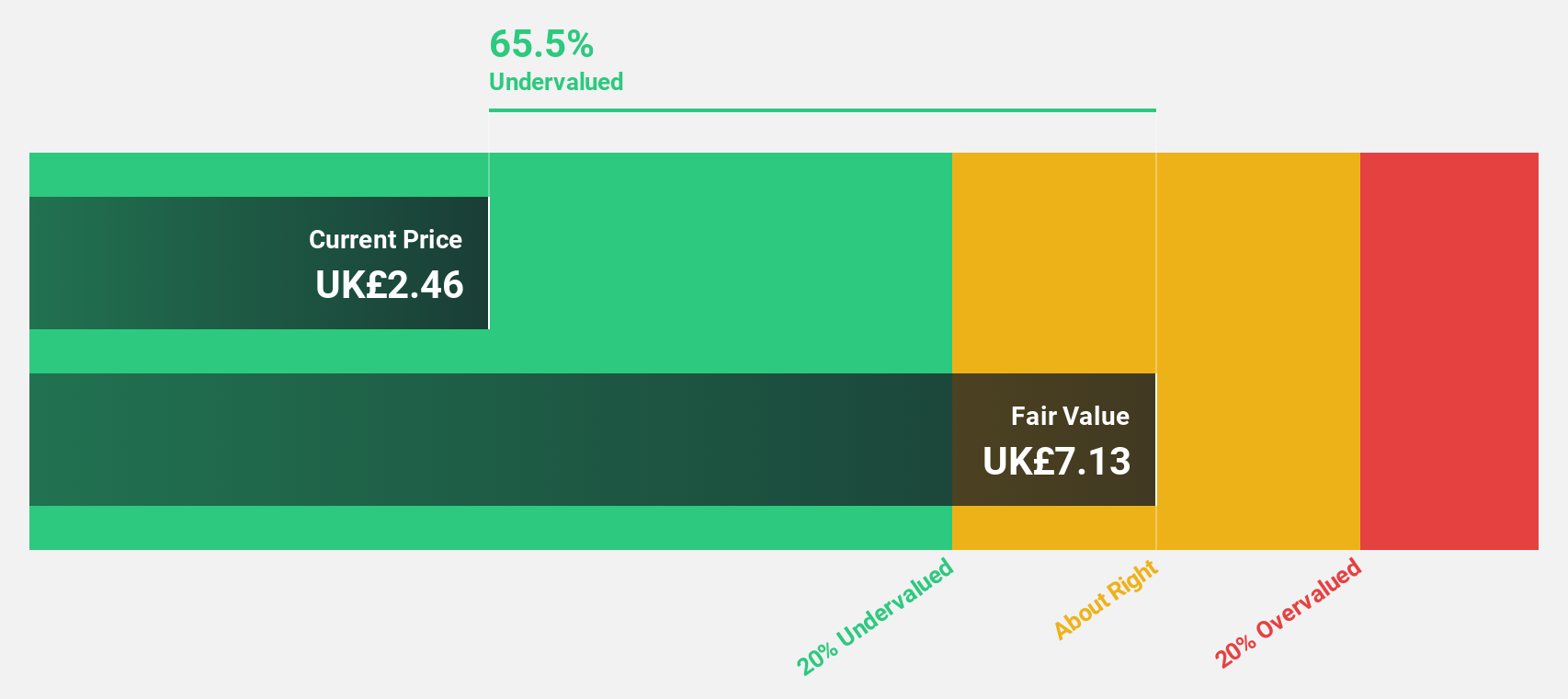

Estimated Discount To Fair Value: 48.2%

Hochschild Mining is trading at £4.36, significantly below its estimated fair value of £8.41, indicating potential undervaluation based on cash flow analysis. Despite recent declines in both silver and gold production and sales, earnings are expected to grow significantly at 24.42% annually over the next three years, surpassing the UK market's growth rate. The company has reiterated its annual production guidance amidst ongoing operational reorganisation in Brazil under new leadership appointments.

- Our comprehensive growth report raises the possibility that Hochschild Mining is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Hochschild Mining stock in this financial health report.

Savills (LSE:SVS)

Overview: Savills plc, along with its subsidiaries, provides real estate services across the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East with a market cap of approximately £1.34 billion.

Operations: Savills generates revenue through its various segments, including Consultancy (£534.90 million), Transaction Advisory (£877.30 million), Investment Management (£91.20 million), and Property and Facilities Management (£965.20 million).

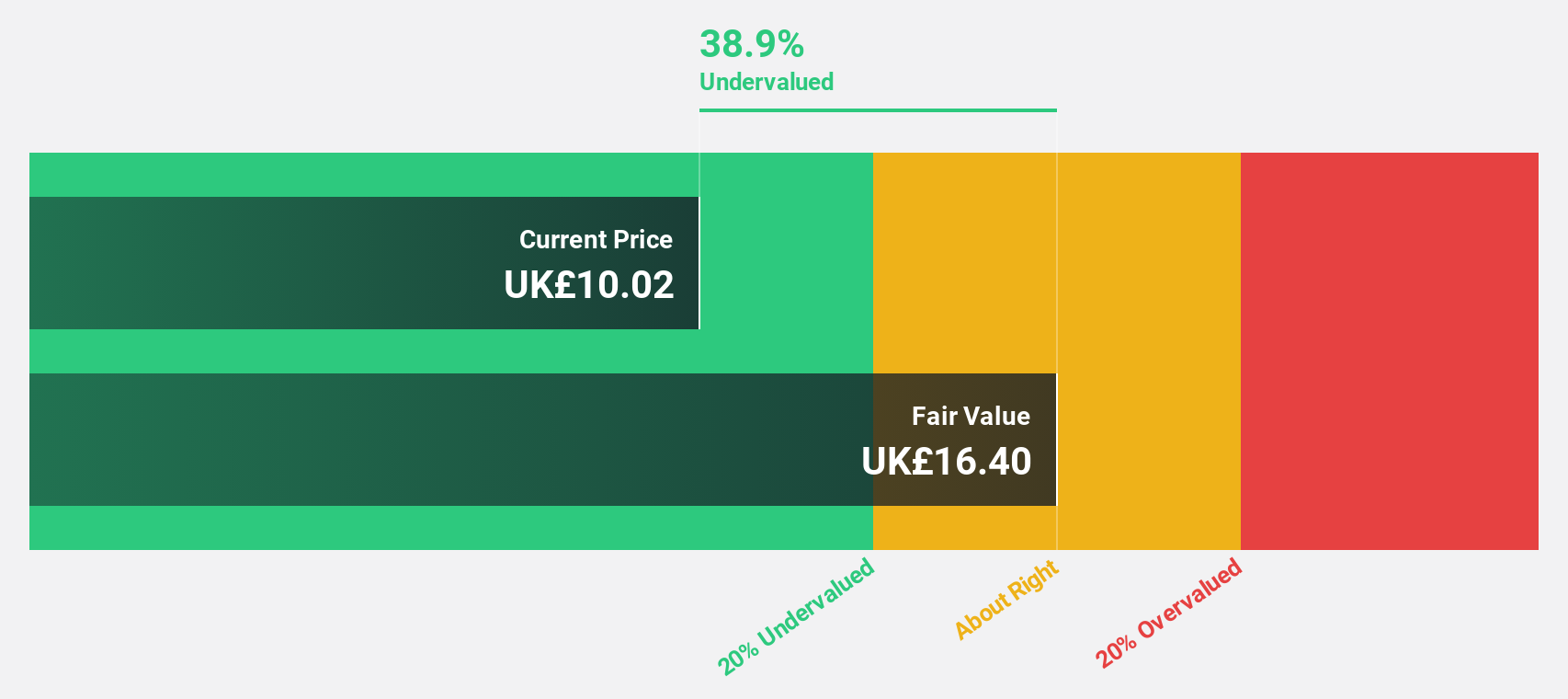

Estimated Discount To Fair Value: 27.2%

Savills is trading at £9.79, below its estimated fair value of £13.45, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 28.6% annually over the next three years, outpacing the UK market's growth rate. Recent strategic appointments in Asia-Pacific and expansion into U.S. retail markets aim to bolster global capital markets capabilities and enhance revenue streams despite a historically unstable dividend track record.

- Our earnings growth report unveils the potential for significant increases in Savills' future results.

- Take a closer look at Savills' balance sheet health here in our report.

Next Steps

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 49 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)