- United Kingdom

- /

- Luxury

- /

- LSE:COA

3 UK Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

In recent times, the UK market has faced challenges, with the FTSE 100 index experiencing fluctuations due to weak trade data from China and broader global economic concerns. As investors navigate these uncertain conditions, identifying undervalued stocks could present opportunities for those seeking value in a volatile market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £1.70 | 45.9% |

| Hercules Site Services (AIM:HERC) | £0.495 | £0.93 | 46.5% |

| Fevertree Drinks (AIM:FEVR) | £6.58 | £13.12 | 49.9% |

| Gaming Realms (AIM:GMR) | £0.376 | £0.71 | 47.3% |

| On the Beach Group (LSE:OTB) | £2.585 | £4.98 | 48.1% |

| Duke Capital (AIM:DUKE) | £0.29 | £0.58 | 49.8% |

| Deliveroo (LSE:ROO) | £1.32 | £2.61 | 49.5% |

| Informa (LSE:INF) | £8.46 | £16.35 | 48.2% |

| St. James's Place (LSE:STJ) | £9.29 | £18.50 | 49.8% |

| BATM Advanced Communications (LSE:BVC) | £0.1915 | £0.38 | 49.5% |

Let's explore several standout options from the results in the screener.

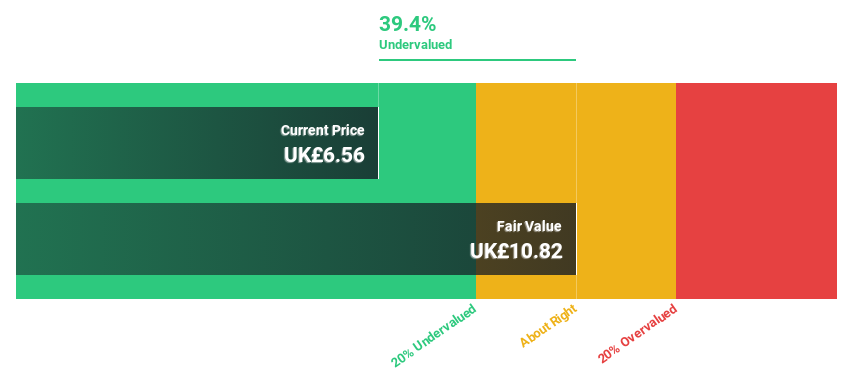

Hargreaves Services (AIM:HSP)

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and internationally with a market cap of £204.36 million.

Operations: The company's revenue segments include £206.86 million from Services and £7.04 million from Hargreaves Land.

Estimated Discount To Fair Value: 45.9%

Hargreaves Services is significantly undervalued, trading at £6.20 against an estimated fair value of £11.45, suggesting strong potential based on discounted cash flow analysis. Despite a low return on equity forecast and profit margins declining to 5.8% from last year's 13.2%, earnings are expected to grow significantly by 25% annually over the next three years, outpacing the UK market's growth rate. Recent executive changes aim to enhance value creation within its services unit.

- Our expertly prepared growth report on Hargreaves Services implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Hargreaves Services here with our thorough financial health report.

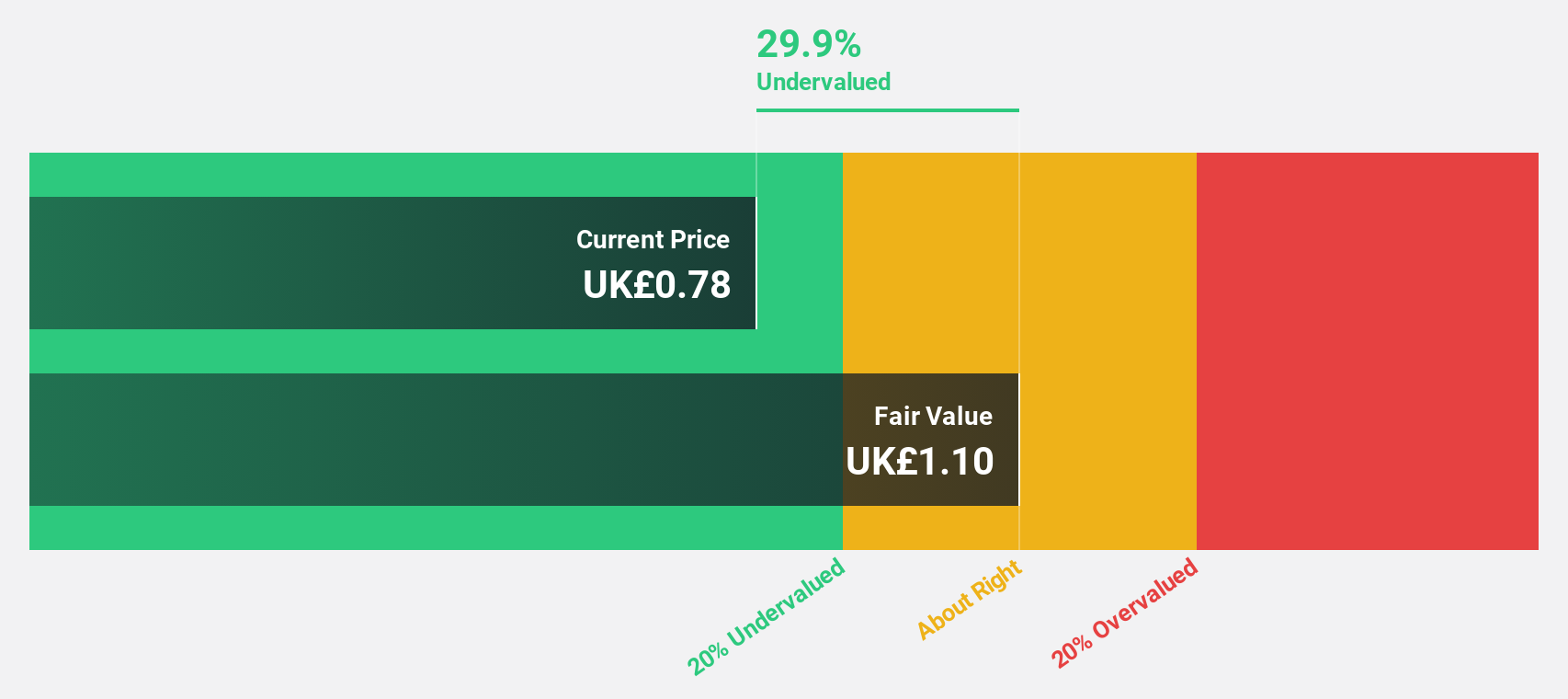

Coats Group (LSE:COA)

Overview: Coats Group plc, along with its subsidiaries, manufactures and supplies industrial sewing threads globally, with a market cap of approximately £1.50 billion.

Operations: The company's revenue segments include Apparel at $731 million, Footwear at $381.90 million, and Performance Materials at $327 million.

Estimated Discount To Fair Value: 43%

Coats Group is trading at £0.94, below its estimated fair value of £1.65, highlighting potential undervaluation based on cash flow analysis. Earnings grew by 46.8% last year and are forecast to increase by 15.4% annually, surpassing the UK market's growth rate of 14.7%. However, the company faces challenges with high debt levels and an unstable dividend track record. Recent executive changes include a new CFO appointment aimed at strengthening financial management.

- Insights from our recent growth report point to a promising forecast for Coats Group's business outlook.

- Take a closer look at Coats Group's balance sheet health here in our report.

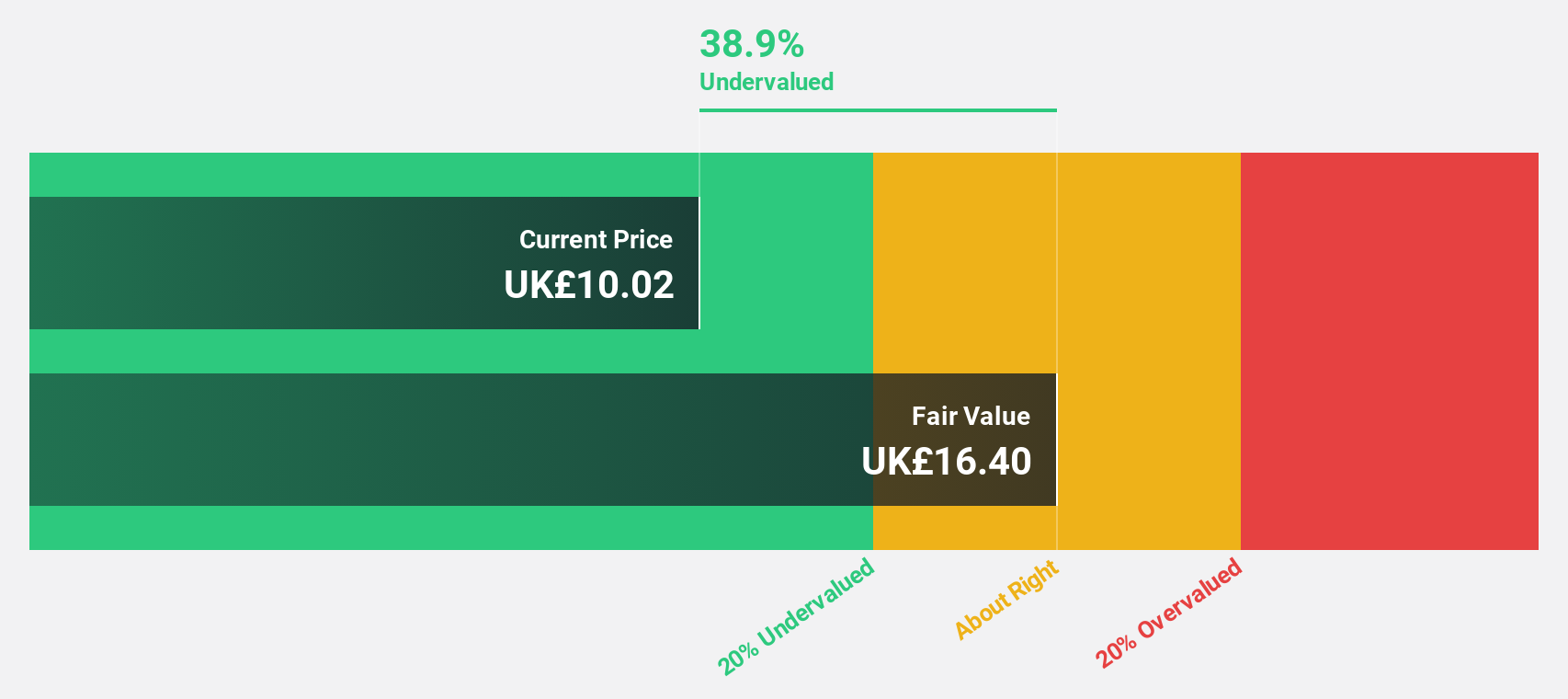

Savills (LSE:SVS)

Overview: Savills plc, along with its subsidiaries, provides real estate services across the United Kingdom, Continental Europe, Asia Pacific, Africa, North America, and the Middle East with a market cap of £1.41 billion.

Operations: The company's revenue segments include Consultancy (£464.80 million), Transaction Advisory (£803.60 million), Investment Management (£100.50 million), and Property and Facilities Management (£920.90 million).

Estimated Discount To Fair Value: 20%

Savills is trading at £10.42, below its estimated fair value of £13.02, suggesting undervaluation based on cash flows. Despite a decline in profit margins from 3.8% to 1.9%, earnings are expected to grow significantly at 32.7% annually, outpacing the UK market average of 14.7%. However, challenges include an unstable dividend track record and low forecasted return on equity (14%). Recent developments involve marketing a €60 million Dublin office asset amidst WeWork's financial restructuring.

- The analysis detailed in our Savills growth report hints at robust future financial performance.

- Click here to discover the nuances of Savills with our detailed financial health report.

Where To Now?

- Reveal the 50 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COA

Coats Group

Manufactures and supplies industrial sewing threads worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives