- United Kingdom

- /

- Banks

- /

- LSE:TBCG

UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100, influenced by weak trade data from China and global economic uncertainties, investors are increasingly seeking resilient opportunities in the UK market. In such an environment, growth companies with high insider ownership often stand out as they may indicate strong confidence from those closest to the business, potentially aligning their interests with shareholders and fostering long-term value creation.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 24.9% | 35.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 108.1% |

| Foresight Group Holdings (LSE:FSG) | 33.6% | 23.5% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23.7% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's review some notable picks from our screened stocks.

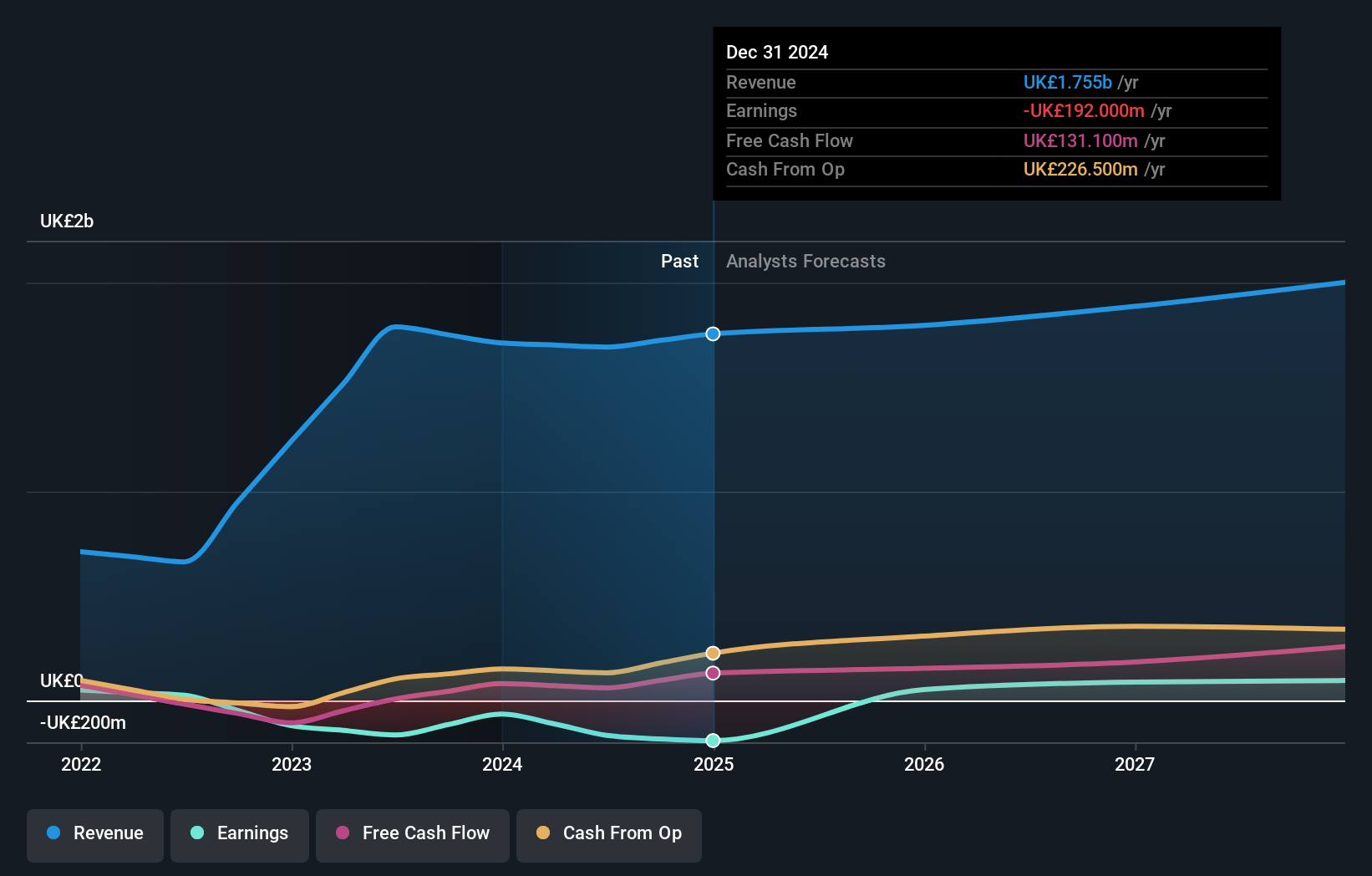

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc, along with its subsidiaries, offers online betting and gaming products and solutions across the United Kingdom, Ireland, Italy, Spain, and internationally with a market cap of £307.62 million.

Operations: The company generates revenue from three main segments: Retail (£514 million), UK&I Online (£661.20 million), and International (£516.10 million).

Insider Ownership: 20.5%

Evoke is positioned as a growth company with substantial insider ownership in the UK. It is expected to become profitable within three years, with an impressive forecasted return on equity of 131.2%. Despite its volatile share price and negative shareholders' equity, Evoke trades at a significant discount to its estimated fair value. Revenue growth is projected at 6% annually, outpacing the UK market average. Upcoming quarterly results may provide further insights into performance trends.

- Click here to discover the nuances of Evoke with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Evoke shares in the market.

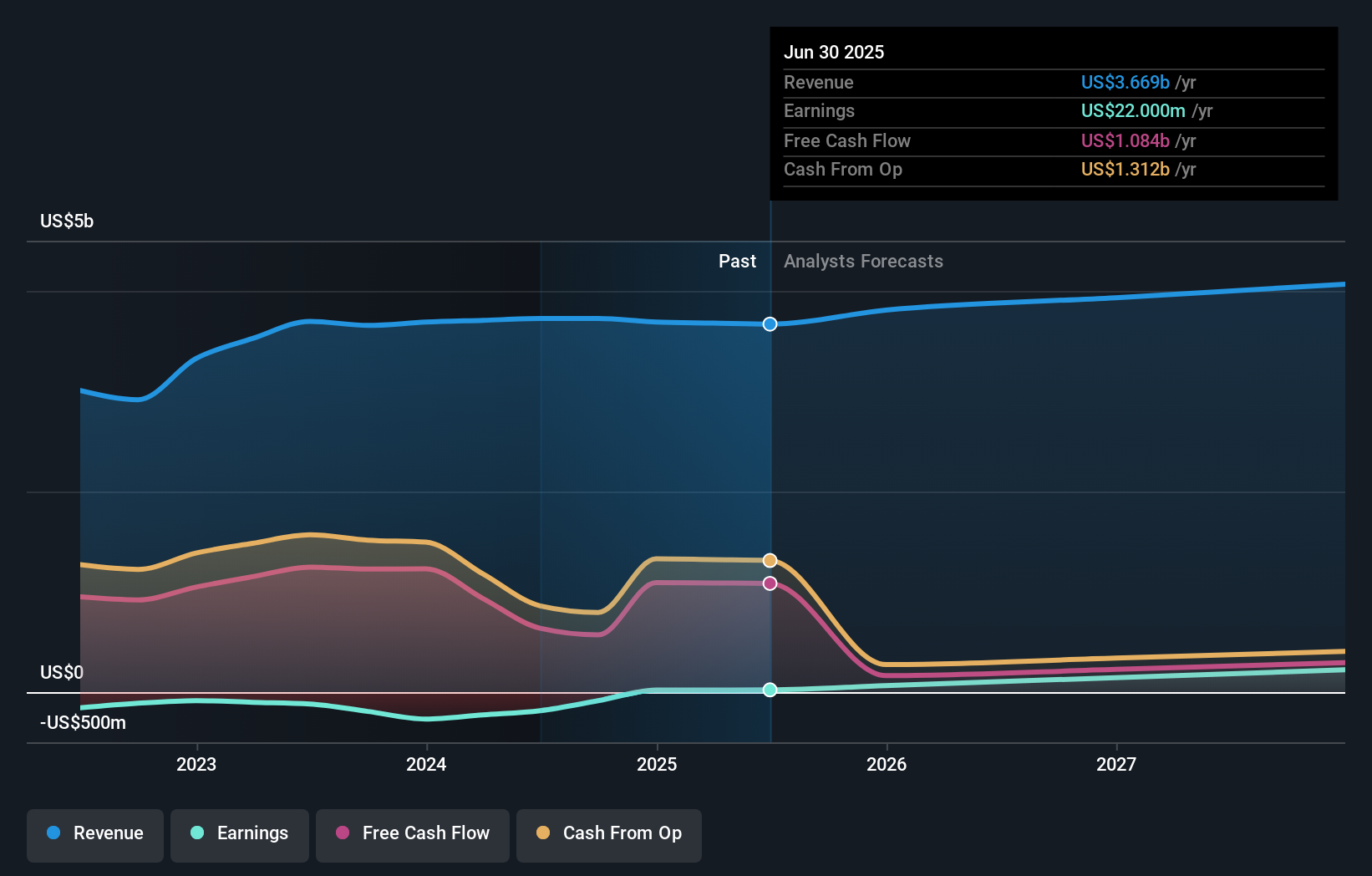

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, with a market cap of £1.66 billion, provides workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: The company's revenue segments include $402.15 million from Worka, $1.30 billion from the Americas, $343.01 million from the Asia Pacific, and $1.69 billion from Europe, the Middle East, and Africa (EMEA).

Insider Ownership: 25.2%

International Workplace Group shows promise as a growth entity with significant insider ownership. It is forecast to become profitable within three years, with earnings expected to grow at 118.78% annually. Although its revenue growth of 3.4% per year lags behind the UK market, it trades at a good value compared to peers and analysts expect a potential price increase of 36.5%. Recent board changes include François Pauly stepping down, with Tarun Lal assuming interim roles.

- Navigate through the intricacies of International Workplace Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates International Workplace Group may be undervalued.

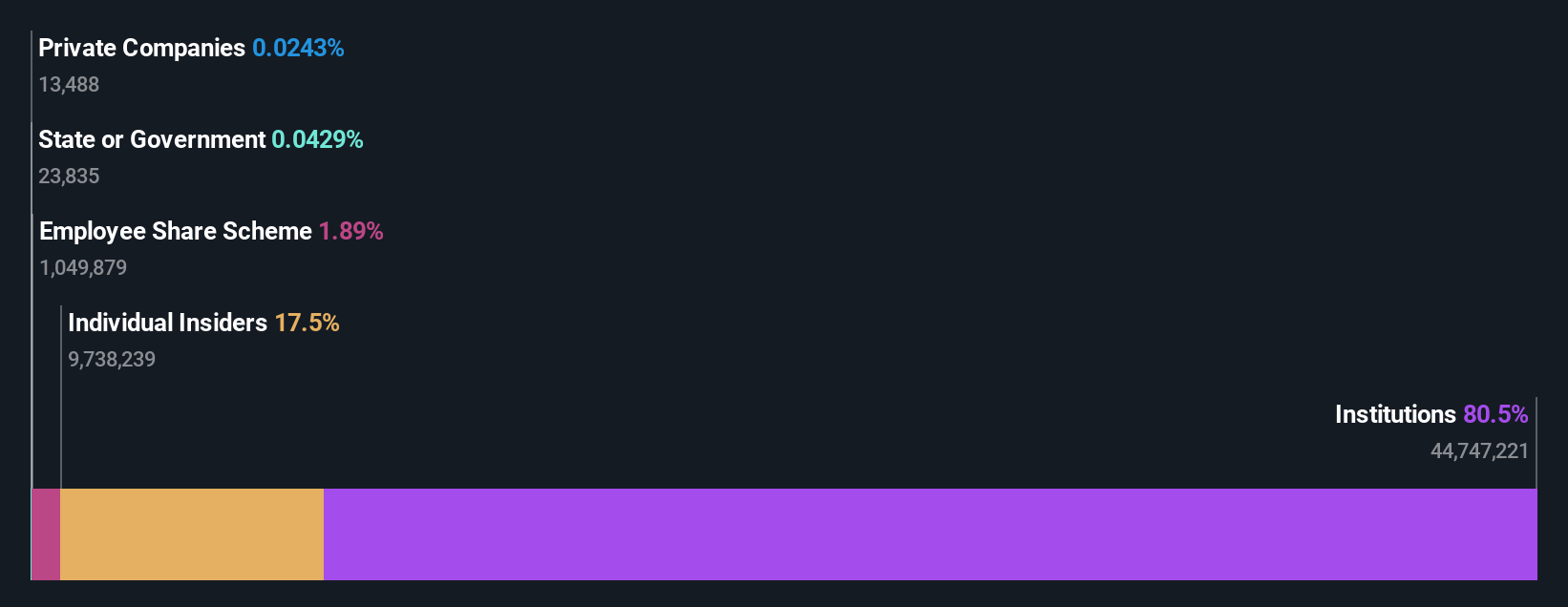

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual clients in Georgia, Azerbaijan, and Uzbekistan with a market cap of £1.76 billion.

Operations: The company's revenue segments include banking, leasing, insurance, brokerage, and card processing services provided to both corporate and individual customers across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 17.5%

TBC Bank Group demonstrates potential as a growth entity with significant insider ownership. Recent earnings showed net interest income and net income increases, reflecting positive financial health. Despite a high level of bad loans at 2.1%, its revenue is forecast to grow significantly faster than the UK market at 20.5% annually, with earnings expected to rise by 17.4% per year. Insider activity shows more buying than selling recently, although not in substantial volumes.

- Delve into the full analysis future growth report here for a deeper understanding of TBC Bank Group.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Key Takeaways

- Click this link to deep-dive into the 60 companies within our Fast Growing UK Companies With High Insider Ownership screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives