- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

3 UK Growth Companies With Up To 87% Earnings Growth

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. In such a climate, growth companies with high insider ownership can be appealing as they often indicate strong confidence from those closest to the business, potentially positioning them well for resilience and future expansion.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 22.2% | 57.8% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.6% | 62% |

| Brave Bison Group (AIM:BBSN) | 32.7% | 115.0% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 40.7% |

Here we highlight a subset of our preferred stocks from the screener.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Funding Circle Holdings plc operates online lending platforms in the UK and internationally, with a market cap of £403.65 million.

Operations: The company's revenue segments include £26.40 million from FlexiPay and £146.90 million from Term Loans in the United Kingdom.

Insider Ownership: 15%

Earnings Growth Forecast: 60.6% p.a.

Funding Circle Holdings, with significant insider ownership, is poised for robust growth as earnings are projected to rise substantially above the UK market average. Despite recent insider selling activity, the company's strategic partnerships and financial commitments underscore its strong market position. Recent agreements with TPG Angelo Gordon and Barclays, alongside Waterfall Asset Management's support, bolster Funding Circle’s lending capabilities for SMEs. Revenue forecasts suggest continued expansion at a faster pace than the broader UK market.

- Navigate through the intricacies of Funding Circle Holdings with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Funding Circle Holdings' shares may be trading at a premium.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £387.39 million.

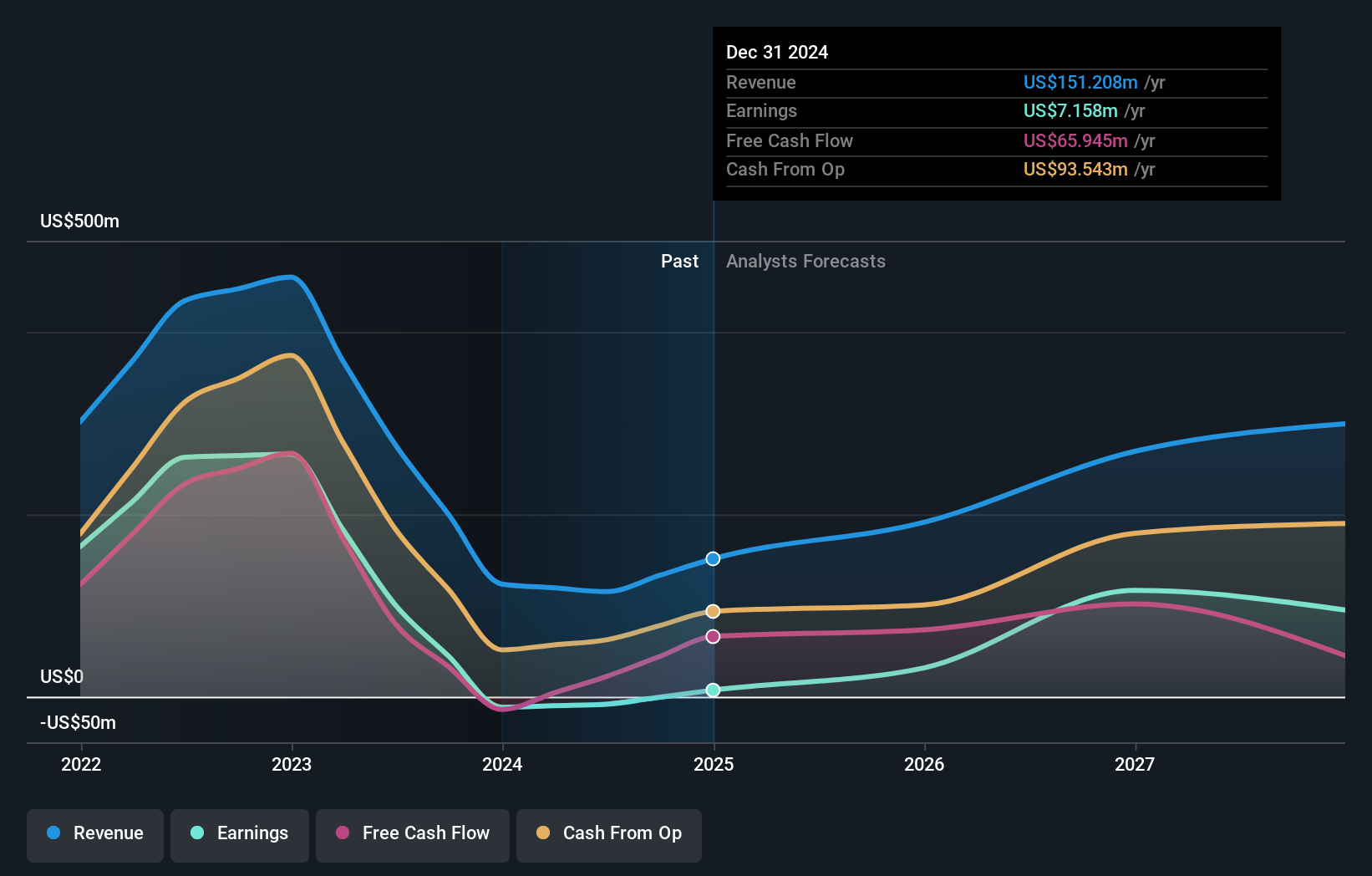

Operations: The company's revenue is primarily derived from its exploration and production activities in oil and gas, amounting to $163.17 million.

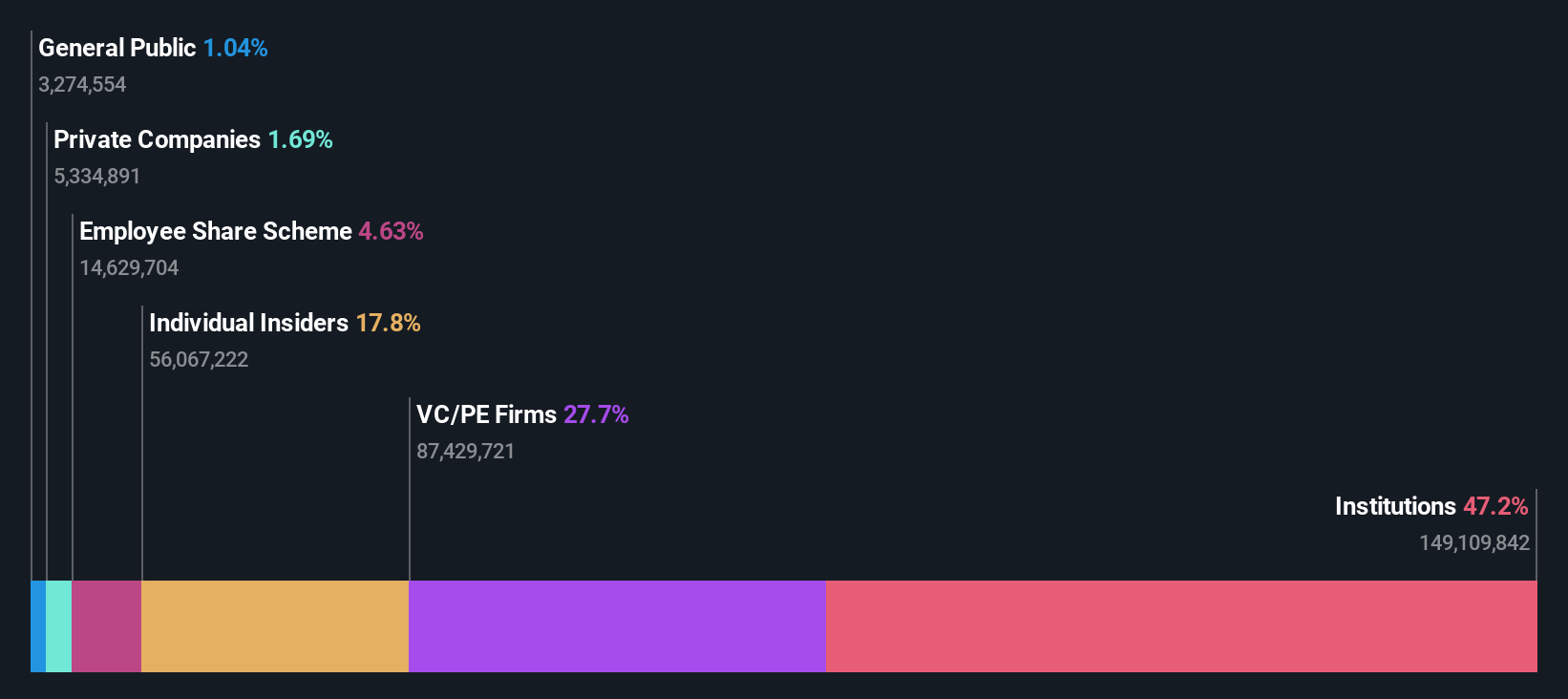

Insider Ownership: 12.2%

Earnings Growth Forecast: 87.8% p.a.

Gulf Keystone Petroleum, with substantial insider ownership, is set for significant growth as it anticipates profitability within three years. Revenue is forecast to grow at 18.8% annually, outpacing the UK market. Recent agreements with the Kurdistan Regional Government and Iraq's Federal Government will enable crude exports from Kurdistan, potentially improving pricing and revenue streams. However, a recent net loss highlights challenges in sustaining dividend payouts amid operational disruptions and financial pressures.

- Get an in-depth perspective on Gulf Keystone Petroleum's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Gulf Keystone Petroleum is priced higher than what may be justified by its financials.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £2.40 billion.

Operations: The company's revenue segments include Digital and Professional Services, generating $373 million.

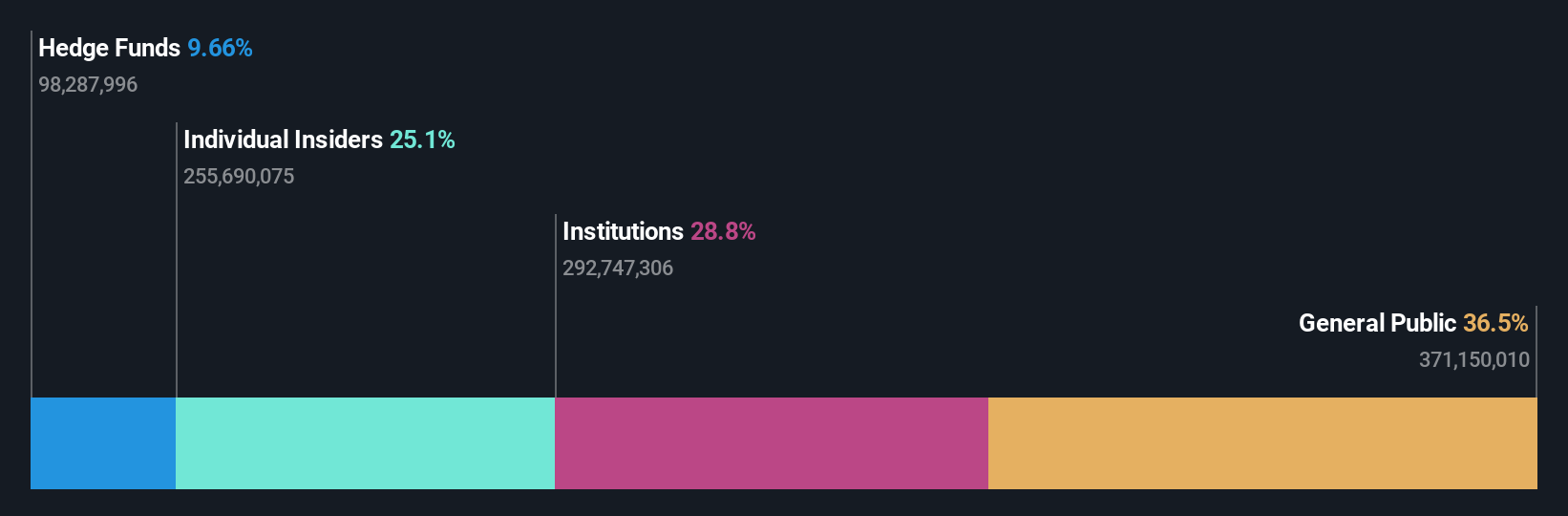

Insider Ownership: 25.6%

Earnings Growth Forecast: 70.5% p.a.

International Workplace Group, with significant insider ownership, is projected to achieve substantial earnings growth of 70.5% annually, well above the UK market average. Despite slower revenue growth at 3.6%, the company recently completed a $50 million share buyback and reported improved net income for the first half of 2025. However, challenges remain with negative equity and interest payments not fully covered by earnings, indicating potential financial vulnerabilities despite strong profit forecasts.

- Click here to discover the nuances of International Workplace Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that International Workplace Group's current price could be inflated.

Where To Now?

- Unlock more gems! Our Fast Growing UK Companies With High Insider Ownership screener has unearthed 57 more companies for you to explore.Click here to unveil our expertly curated list of 60 Fast Growing UK Companies With High Insider Ownership.

- Looking For Alternative Opportunities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives