- United Kingdom

- /

- Real Estate

- /

- LSE:GRI

Grainger (LON:GRI) Has Announced That It Will Be Increasing Its Dividend To £0.0437

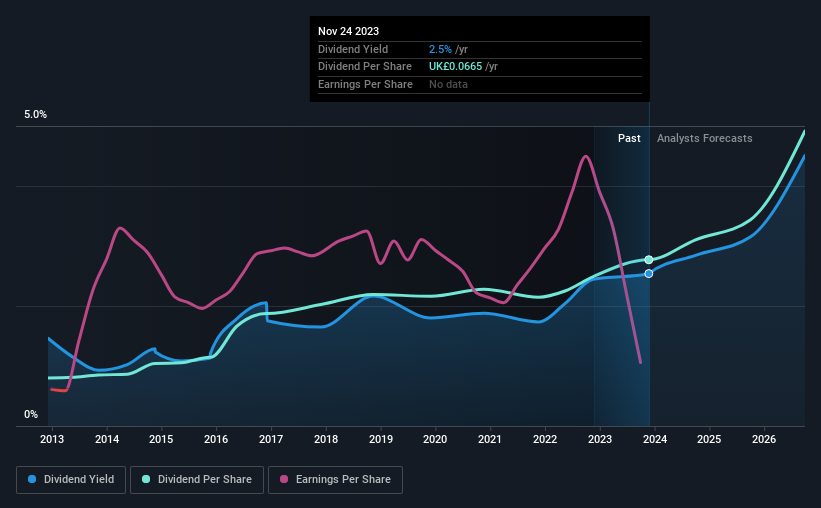

Grainger plc (LON:GRI) will increase its dividend from last year's comparable payment on the 14th of February to £0.0437. Even though the dividend went up, the yield is still quite low at only 2.5%.

View our latest analysis for Grainger

Grainger's Earnings Easily Cover The Distributions

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Before making this announcement, Grainger's dividend was higher than its profits, but the free cash flows quite comfortably covered it. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 27%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Grainger Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2013, the annual payment back then was £0.0192, compared to the most recent full-year payment of £0.0665. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Grainger's earnings per share has shrunk at 30% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Grainger will make a great income stock. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. To that end, Grainger has 4 warning signs (and 1 which is concerning) we think you should know about. Is Grainger not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GRI

Grainger

Designs, builds, develops, owns and operates rental homes in the United Kingdom.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)