- United Kingdom

- /

- Diversified Financial

- /

- LSE:WPS

3 UK Stocks Estimated To Be Undervalued For Savvy Investors

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences fluctuations due to weak trade data from China and global economic pressures, investors are keenly observing opportunities within the market. In such a climate, identifying stocks that may be undervalued can offer potential for growth, especially when these companies demonstrate resilience amidst broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| On the Beach Group (LSE:OTB) | £2.52 | £4.59 | 45.1% |

| Brickability Group (AIM:BRCK) | £0.576 | £1.04 | 44.6% |

| Gateley (Holdings) (AIM:GTLY) | £1.375 | £2.64 | 48% |

| Victrex (LSE:VCT) | £9.80 | £18.20 | 46.1% |

| Duke Capital (AIM:DUKE) | £0.3025 | £0.54 | 43.9% |

| Deliveroo (LSE:ROO) | £1.405 | £2.43 | 42.2% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| Nexxen International (AIM:NEXN) | £8.06 | £15.33 | 47.4% |

| Optima Health (AIM:OPT) | £1.75 | £3.30 | 47% |

| Melrose Industries (LSE:MRO) | £6.486 | £11.86 | 45.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories for both B2C and trade customers in the United Kingdom, with a market cap of £322.66 million.

Operations: The company's revenue primarily comes from its online retail segment, which generated £295.70 million.

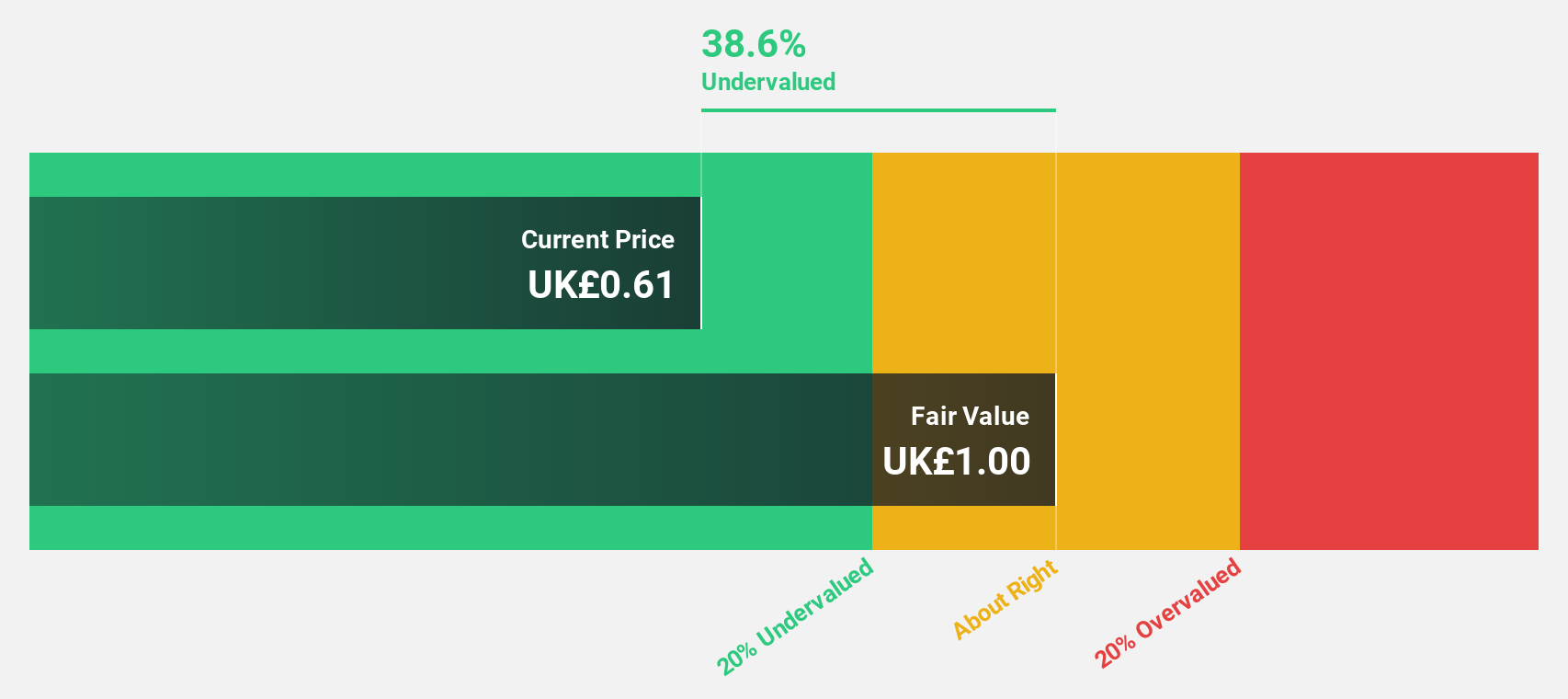

Estimated Discount To Fair Value: 21.4%

Victorian Plumbing Group is trading 21.4% below its estimated fair value of £1.26, with a current price of £0.99, suggesting it may be undervalued based on cash flows. Despite a decline in net profit margin from 4.1% to 1.9%, the company forecasts significant earnings growth at 37.6% annually over the next three years, outpacing the UK market's average growth rate of 14.9%. The board prioritizes cash preservation for warehouse transformation without incurring debt, enhancing balance sheet robustness.

- Upon reviewing our latest growth report, Victorian Plumbing Group's projected financial performance appears quite optimistic.

- Take a closer look at Victorian Plumbing Group's balance sheet health here in our report.

Foxtons Group (LSE:FOXT)

Overview: Foxtons Group plc is an estate agency offering services to the residential property market in the United Kingdom, with a market cap of £202.40 million.

Operations: The company's revenue is derived from three main segments: Sales (£41.84 million), Lettings (£103.78 million), and Financial Services (£9.10 million).

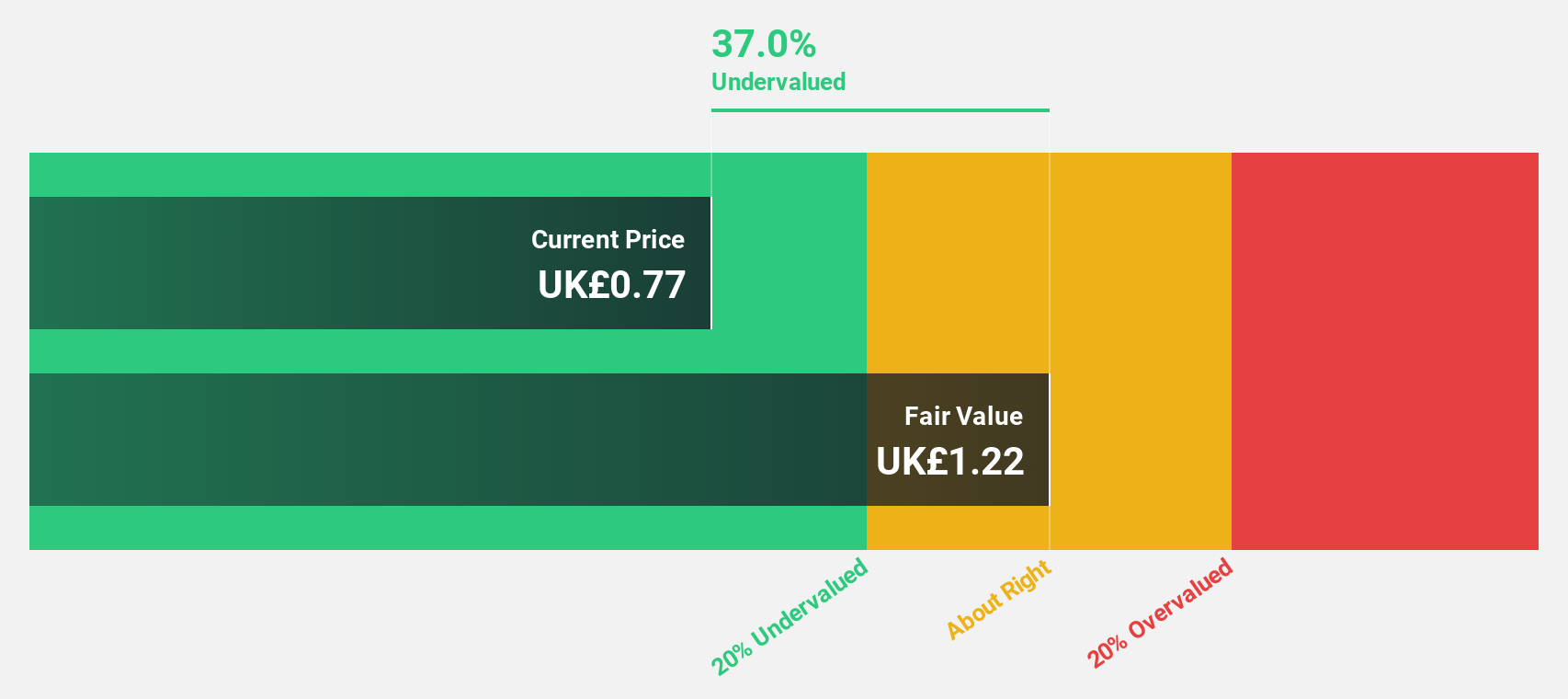

Estimated Discount To Fair Value: 21.6%

Foxtons Group is trading 21.6% below its estimated fair value of £0.85, with a current price of £0.67, reflecting potential undervaluation based on cash flows. Despite a drop in net profit margin from 7.4% to 4.7%, Foxtons forecasts earnings growth at 32% annually, surpassing the UK market's average of 14.9%. Revenue is expected to grow at 7.6% yearly, exceeding the UK's market growth rate of 3.7%.

- Our earnings growth report unveils the potential for significant increases in Foxtons Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Foxtons Group.

W.A.G payment solutions (LSE:WPS)

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform for the commercial road transportation industry primarily in Europe, with a market cap of £456.43 million.

Operations: The company's revenue is primarily derived from Payment Solutions, generating €2.10 billion, and Mobility Solutions, contributing €124.13 million.

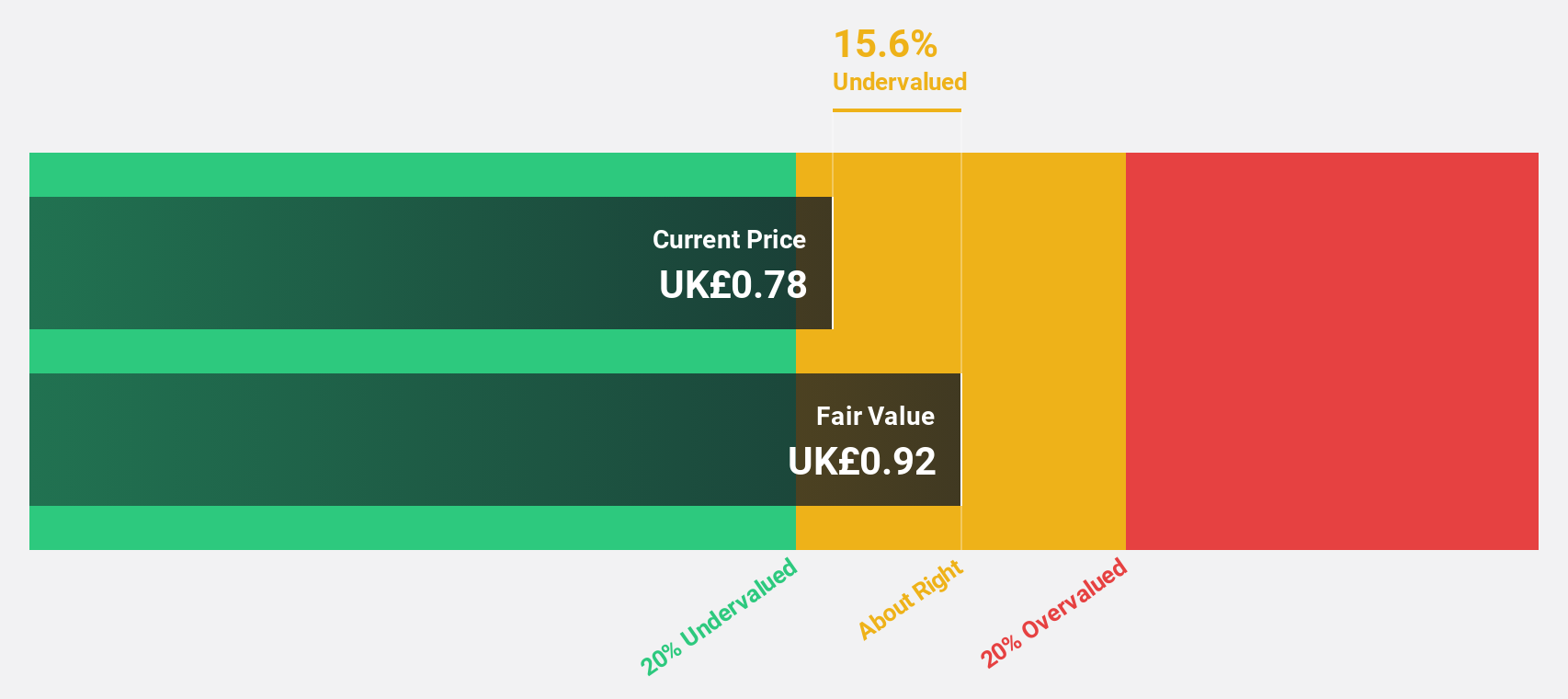

Estimated Discount To Fair Value: 12.1%

W.A.G payment solutions is trading 12.1% below its estimated fair value of £0.75, at £0.66, indicating potential undervaluation based on cash flows. The company forecasts earnings growth of 92.52% annually and expects to become profitable within three years, outperforming the UK market's average growth rate. Recent guidance anticipates net revenue for 2025 to grow in low double digits, with a full year 2024 revenue increase of 13.8%, significantly ahead of market trends despite challenges in Germany.

- Our comprehensive growth report raises the possibility that W.A.G payment solutions is poised for substantial financial growth.

- Navigate through the intricacies of W.A.G payment solutions with our comprehensive financial health report here.

Taking Advantage

- Delve into our full catalog of 55 Undervalued UK Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.A.G payment solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WPS

W.A.G payment solutions

Operates integrated payments and mobility platform that focuses on the commercial road transportation industry primary in Europe.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives