Panther Securities PLC (LON:PNS) has announced that it will pay a dividend of £0.06 per share on the 29th of October. Based on this payment, the dividend yield will be 3.9%, which is fairly typical for the industry.

See our latest analysis for Panther Securities

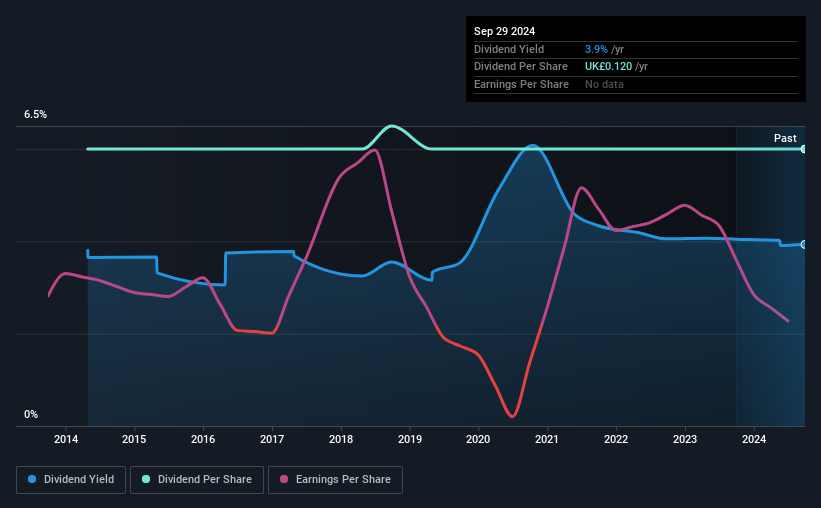

Panther Securities' Future Dividends May Potentially Be At Risk

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last payment, the dividend made up 84% of cash flows, but a higher proportion of net income. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

Earnings per share could rise by 31.2% over the next year if things go the same way as they have for the last few years. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 219% over the next year.

Panther Securities Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The payments haven't really changed that much since 10 years ago. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Panther Securities' Dividend Might Lack Growth

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that Panther Securities has grown earnings per share at 31% per year over the past five years. EPS has been growing well, but Panther Securities has been paying out a massive proportion of its earnings, which can make the dividend tough to maintain.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We don't think Panther Securities is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 5 warning signs for Panther Securities you should be aware of, and 1 of them is concerning. Is Panther Securities not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PNS

Panther Securities

Panther Securities PLC ("the Company" or "the Group") is a property investment company quoted on the AIM market (AIM) since 2013.

Proven track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.