- United Kingdom

- /

- Biotech

- /

- LSE:HEMO

Vladislav Sandler Bought 241% More Shares In Hemogenyx Pharmaceuticals

Those following along with Hemogenyx Pharmaceuticals Plc (LON:HEMO) will no doubt be intrigued by the recent purchase of shares by Vladislav Sandler, Co-Founder of the company, who spent a stonking UK£451k on stock at an average price of UK£1.80. That purchase boosted their holding by 241%, which makes us wonder if the move was inspired by quietly confident deeply-felt optimism.

We've discovered 5 warning signs about Hemogenyx Pharmaceuticals. View them for free.The Last 12 Months Of Insider Transactions At Hemogenyx Pharmaceuticals

Notably, that recent purchase by Vladislav Sandler is the biggest insider purchase of Hemogenyx Pharmaceuticals shares that we've seen in the last year. That means that an insider was happy to buy shares at above the current price of UK£1.78. It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. The only individual insider to buy over the last year was Vladislav Sandler.

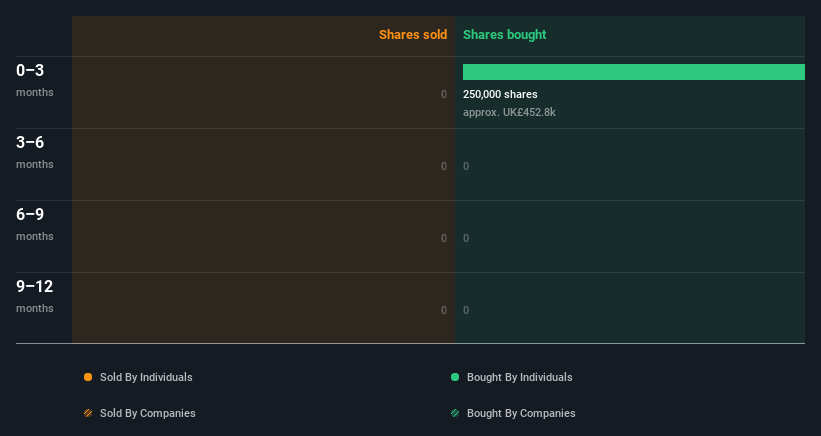

The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Check out our latest analysis for Hemogenyx Pharmaceuticals

Hemogenyx Pharmaceuticals is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insider Ownership Of Hemogenyx Pharmaceuticals

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Insiders own 7.0% of Hemogenyx Pharmaceuticals shares, worth about UK£541k, according to our data. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Do The Hemogenyx Pharmaceuticals Insider Transactions Indicate?

It is good to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. But we don't feel the same about the fact the company is making losses. On this analysis the only slight negative we see is the fairly low (overall) insider ownership; their transactions suggest that they are quite positive on Hemogenyx Pharmaceuticals stock. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. When we did our research, we found 5 warning signs for Hemogenyx Pharmaceuticals (3 are significant!) that we believe deserve your full attention.

But note: Hemogenyx Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

If you're looking to trade Hemogenyx Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hemogenyx Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HEMO

Hemogenyx Pharmaceuticals

A clinical-stage biotechnology company, focuses on the discovery, development, and commercialization of therapies and treatments for blood cancer.

Moderate with adequate balance sheet.

Market Insights

Community Narratives