- United Kingdom

- /

- Pharma

- /

- LSE:GSK

GSK (LSE:GSK) Secures FDA Approval For COPD Treatment, Eyes European Nod For Blenrep

Reviewed by Simply Wall St

GSK (LSE:GSK) recently received FDA approval for Nucala for COPD treatment, potentially enhancing its market presence. Meanwhile, the Committee for Medicinal Products for Human Use recommended Blenrep for multiple myeloma, adding momentum to the company's oncology portfolio. Despite broader market volatility driven by renewed trade tensions sparked by President Trump, GSK's shares rose 4.9% over the last month. This increase, amid a market experiencing a 2.5% weekly drop, suggests that the company's positive product news may have overshadowed broader market concerns, highlighting investor confidence in GSK's future earnings potential.

You should learn about the 4 risks we've spotted with GSK.

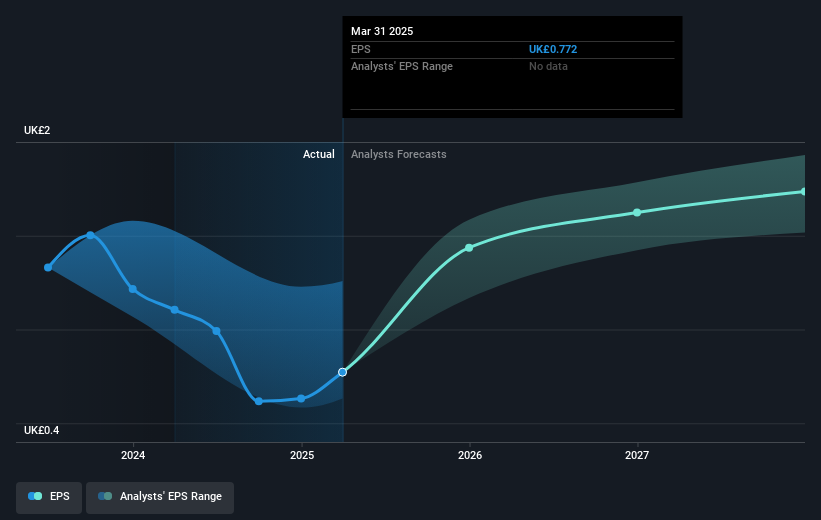

The recent FDA approval for GSK's Nucala in COPD treatment and the positive recommendation for Blenrep could significantly enhance the company's revenue and earnings forecasts by expanding its product offerings in high-demand therapeutic areas. The approval is projected to strengthen its Specialty Medicines segment, which already experienced a 17% sales increase. The company’s ongoing innovation and pipeline launches are central to analysts' expectations of 4.6% annual revenue growth over the next three years. These developments might improve investor sentiment, as reflected in the company's fair value estimation of £16.72 per share, indicating an 18.6% potential upside from the current share price of £13.6.

Over a five-year period, GSK experienced a total shareholder return of 5.42%, highlighting steady albeit modest growth in a volatile market environment. In the past year, however, GSK's stock underperformed compared to the UK Pharmaceuticals industry, which recorded a 13% decline, and the broader UK market with a 2.2% increase. Despite short-term challenges, the company's long-term performance and the potential impact of recent product approvals could further consolidate its market position. The fair valuation underscores the need for investors to assess how GSK's operational enhancements will influence its growth trajectory amid competitive pressures and sector-specific risks.

Upon reviewing our latest valuation report, GSK's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GSK

GSK

Engages in the research, development, and manufacture of vaccines, specialty medicines, and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives