- United Kingdom

- /

- Pharma

- /

- LSE:GSK

GSK (LSE:GSK) Poised for Growth with Strong Sales, Strategic Alliances, and New Vaccine Launches

Reviewed by Simply Wall St

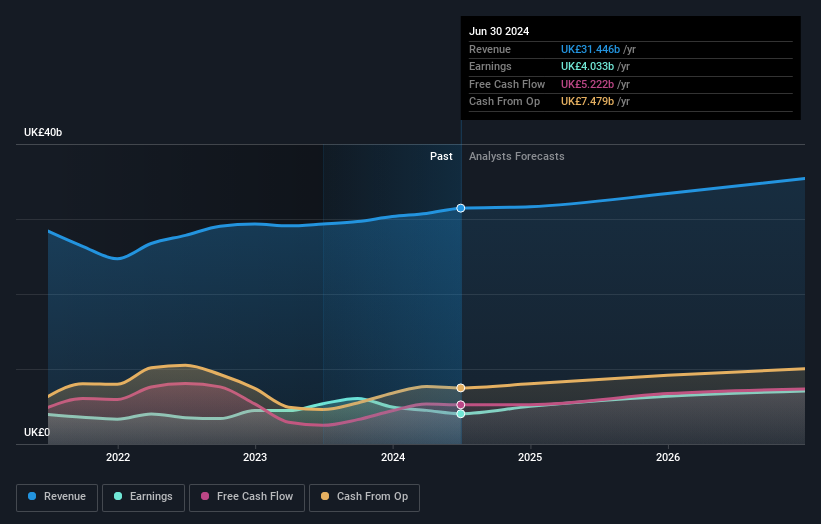

GSK(LSE:GSK) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a robust 13% sales growth and strategic innovations in R&D, contrasted with a significant decline in U.S. vaccine sales and ongoing legal issues. In the discussion that follows, we will delve into GSK's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Delve into the full analysis report here for a deeper understanding of GSK.

Strengths: Core Advantages Driving Sustained Success For GSK

GSK has demonstrated robust sales growth, with a 13% increase to GBP 7.9 billion and a core operating profit up by 21% to GBP 2.5 billion, as noted by CEO Emma Walmsley in the latest earnings call. This growth is underpinned by effective cost control, driving operating leverage and further margin improvements. The company's strategic focus on innovation, particularly in R&D, is evident from its investments in new vaccines and medicines, combining scientific focus on the immune system with advanced technologies, as highlighted by Tony Wood, R&D Head. GSK's specialty medicines segment showed strong performance, growing over 20% due to successful new launches. Additionally, GSK is currently undervalued, trading at £16.1, significantly below the estimated fair value of £56.49, while showing good value relative to peers and industry averages based on its Price-To-Earnings Ratio.

Weaknesses: Critical Issues Affecting GSK's Performance and Areas For Growth

Despite its strengths, GSK faces several challenges. The company has experienced a decline in vaccine sales in the U.S., with a 36% decrease in the quarter, as pointed out by Chief Commercial Officer Luke Miels. Regulatory changes have also impacted performance, although these effects are not expected to persist in the second half of the year. Additionally, GSK's earnings have declined by 2.4% per year over the past five years, and the company has faced significant one-off losses, including a £3.3 billion impact on its financial results to June 30, 2024. The ongoing Zantac litigation remains a critical issue, with CEO Emma Walmsley emphasizing that the Daubert ruling in Delaware does not determine liability.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

GSK has several strategic opportunities to enhance its market position. The company is preparing for vaccine launches in Europe and internationally for 2025 and beyond, leveraging best-in-class data profiles, as mentioned by Chief Commercial Officer Luke Miels. Investments in innovative treatments continue to progress, with anticipated Phase III data for Nucala in COPD and camlipixant in refractory chronic cough. GSK's commitment to long-term growth is evident from its revised sales growth forecast of 79% and core operating profit growth of 11% to 13%. Additionally, strategic alliances, such as the collaboration with Flagship Pioneering, aim to develop transformational medicines and vaccines, further strengthening GSK's competitive edge. Learn more about how these opportunities could impact GSK's future growth by reviewing our analysis of GSK's Future Performance.

Threats: Key Risks and Challenges That Could Impact GSK's Success

Several external factors pose risks to GSK's growth and market share. Competitive pressures are significant, with local CDC budgets potentially tightening, as noted by Chief Commercial Officer Luke Miels. Economic factors and ongoing legal issues, such as the Zantac litigation, continue to be a concern, with CEO Emma Walmsley affirming the company's commitment to defending against these claims. Regulatory risks also loom large, particularly with new vaccines entering the market. Market risks, including changes in rules and retroactive adjustments, could further impact GSK's operations. These threats highlight the need for GSK to navigate its external environment carefully to maintain its market position.

Conclusion

GSK's strong sales growth and improved core operating profit, driven by strategic cost control and innovation in R&D, position the company favorably for future success. However, challenges such as declining vaccine sales in the U.S. and ongoing legal issues like the Zantac litigation must be carefully managed. The company's forward-looking strategies, including new vaccine launches and strategic alliances, offer significant growth potential. Importantly, GSK's current trading price of £16.1, well below its estimated fair value of £56.49, indicates a substantial upside, making it an attractive investment relative to its peers and industry averages. This potential undervaluation, combined with strategic initiatives, suggests a promising outlook for GSK's long-term performance.

Next Steps

- Hold shares in GSK? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

If you're looking to trade GSK, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:GSK

GSK

Engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

Good value slight.

Similar Companies

Market Insights

Community Narratives