- United Kingdom

- /

- Capital Markets

- /

- OFEX:LFT

UK Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China and declining commodity prices. Despite these broader market pressures, there are still opportunities for investors willing to explore beyond the well-known names. Penny stocks, often representing smaller or newer companies, can offer potential growth at lower price points when backed by strong fundamentals and sound financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.805 | £463.19M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £155.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.898 | £715.19M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.61 | £413.58M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.16 | £178.91M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.44 | £183.39M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.35 | £333.18M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.07 | £91.42M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.185 | £199.59M | ★★★★★★ |

Click here to see the full list of 463 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

essensys (AIM:ESYS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: essensys plc provides software and technology solutions for critical SaaS platforms to the flexible workspace segment of the real estate industry across North America, the United Kingdom, Europe, and the Asia-Pacific region, with a market cap of £20.69 million.

Operations: The company's revenue of £24.13 million is generated from its software and technology platform services tailored for the flexible workspace sector within the real estate industry.

Market Cap: £20.69M

essensys plc, with a market cap of £20.69 million, provides software solutions for the flexible workspace sector. Despite generating £24.13 million in revenue last year, the company remains unprofitable with a net loss of £3.31 million, though this is an improvement from previous years. The board and management team are experienced, and essensys holds no debt while its short-term assets exceed liabilities significantly. However, its cash runway is less than one year based on current free cash flow levels, posing potential financial challenges if profitability isn't achieved soon despite stable weekly volatility at 4%.

- Unlock comprehensive insights into our analysis of essensys stock in this financial health report.

- Gain insights into essensys' future direction by reviewing our growth report.

Synairgen (AIM:SNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Synairgen plc focuses on discovering and developing drugs for respiratory diseases, with a market cap of £4.23 million.

Operations: Synairgen plc does not report any revenue segments.

Market Cap: £4.23M

Synairgen plc, with a market cap of £4.23 million, operates in the biotech sector focusing on respiratory disease treatments. The company is pre-revenue and currently unprofitable, with no significant lines of revenue reported. Despite this, Synairgen has a solid cash position to cover short-term liabilities (£10.5M in assets against £1.1M liabilities) and remains debt-free. Recent capital raising through a follow-on equity offering of £24 million suggests efforts to extend its cash runway beyond 12 months amid high share price volatility and an inexperienced board averaging 2.3 years tenure, contrasting with an experienced management team (3.7 years).

- Jump into the full analysis health report here for a deeper understanding of Synairgen.

- Gain insights into Synairgen's outlook and expected performance with our report on the company's earnings estimates.

Lift Global Ventures (OFEX:LFT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lift Global Ventures Plc is a UK-based financial public relations and investor relations consulting company with a market cap of £334,985.

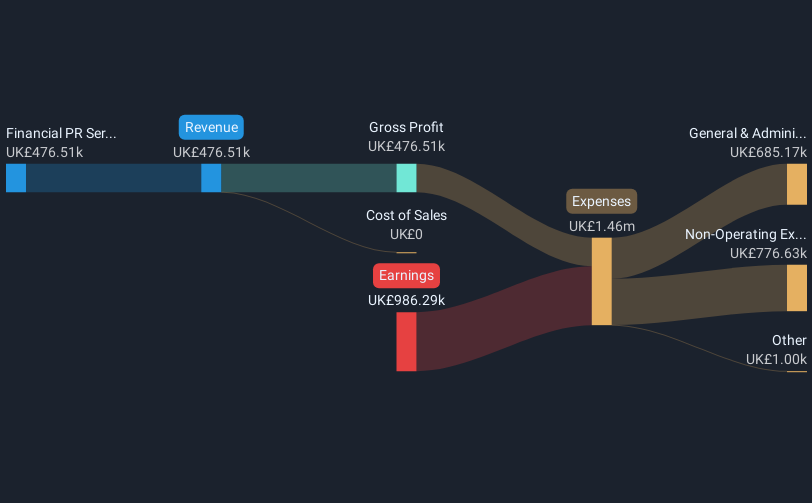

Operations: The company generates revenue primarily from its Financial PR Services segment, totaling £0.48 million.

Market Cap: £334.99k

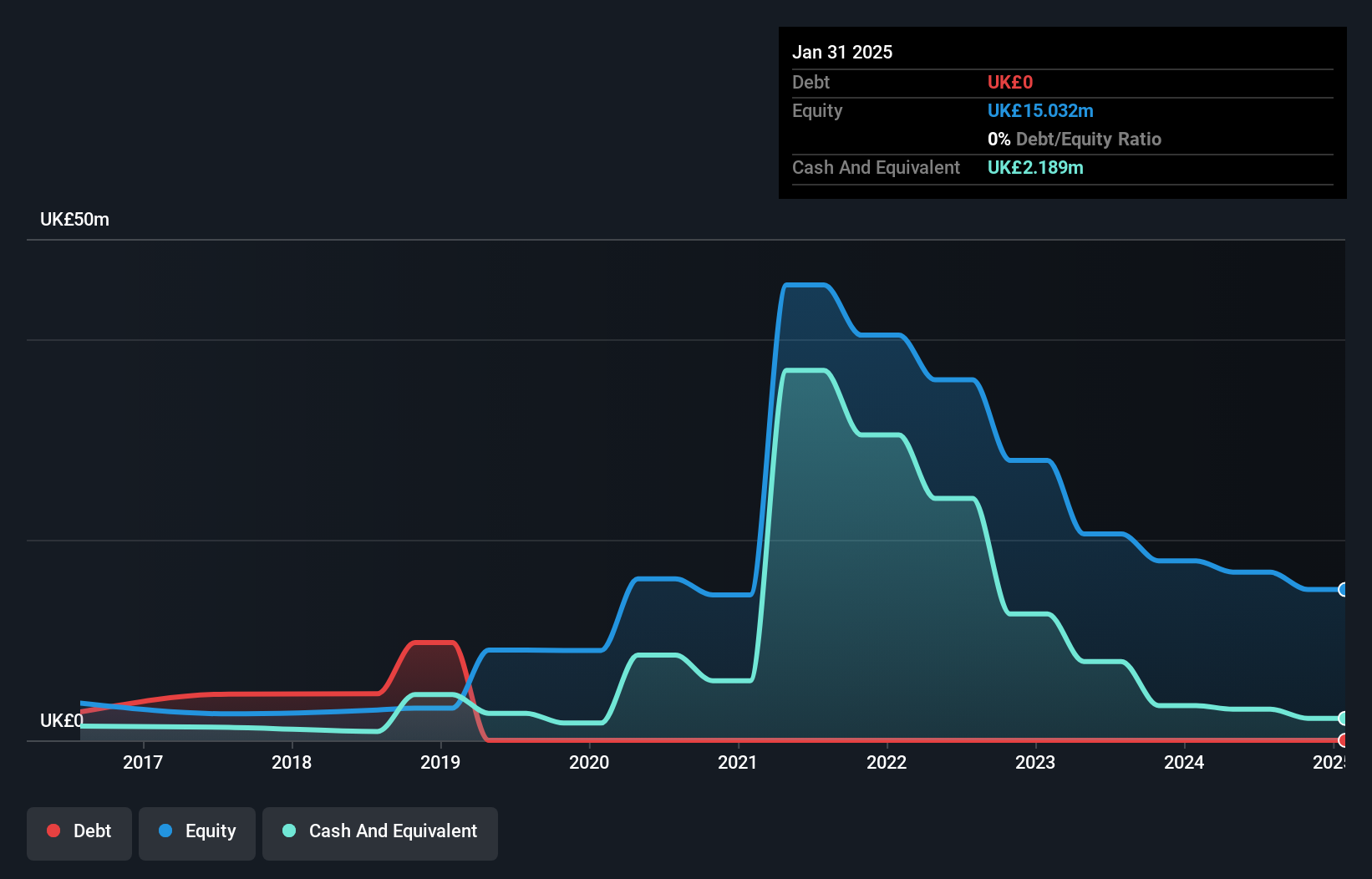

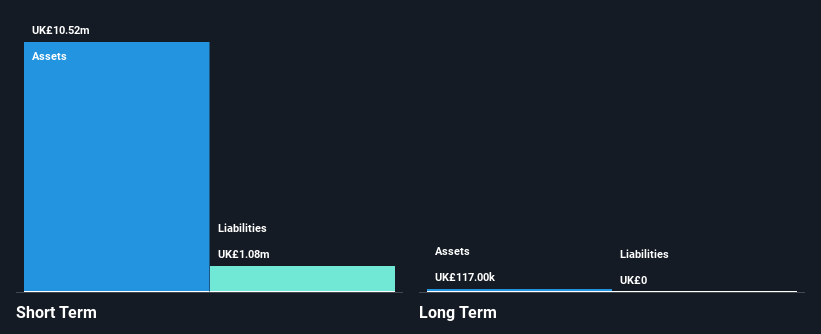

Lift Global Ventures Plc, with a market cap of £334,985, is pre-revenue and unprofitable, generating £477K in revenue from its Financial PR Services segment. The company maintains a solid cash runway exceeding three years without debt or long-term liabilities. Despite declining revenue by 1.6% over the past year and increased net loss to £986K for the year ended June 2024, Lift's short-term assets (£261.3K) comfortably cover its short-term liabilities (£120.3K). The board's average tenure of 2.1 years indicates inexperience while volatility has decreased significantly from 17% to 4%.

- Take a closer look at Lift Global Ventures' potential here in our financial health report.

- Understand Lift Global Ventures' track record by examining our performance history report.

Make It Happen

- Embark on your investment journey to our 463 UK Penny Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:LFT

Lift Global Ventures

Operates as a financial public relations and IR consulting company in the United Kingdom.

Flawless balance sheet low.