- United Kingdom

- /

- Media

- /

- LSE:WPP

WPP (LSE:WPP) Partners With Ubie And CMI To Transform DTC Healthcare Advertising

Reviewed by Simply Wall St

Last month, WPP (LSE:WPP) experienced a 15% increase in its share price, possibly influenced by two significant developments: the announcement of a partnership with Ubie and CMI Media Group, aiming to transform direct-to-consumer advertising, and stable financial performance reported in its Q1 sales results. This rise coincided with broader market trends, where the S&P 500 and Nasdaq saw gains driven by tech sector advancements and easing U.S.-China tariff tensions. While the market's rally provided a positive backdrop, WPP's specific initiatives likely contributed additional confidence to investors amidst these favorable conditions.

We've identified 1 weakness for WPP that you should be aware of.

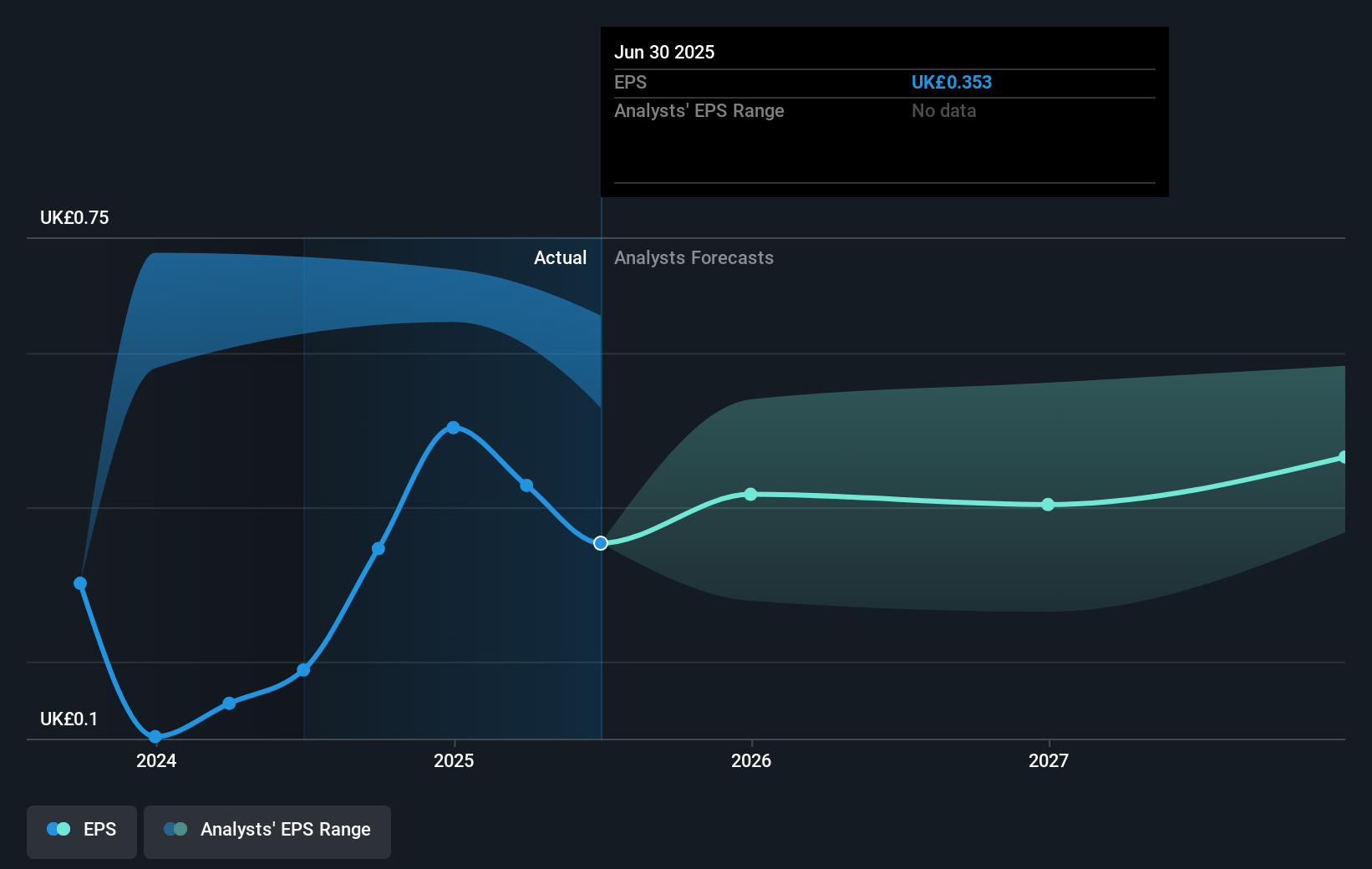

The news of WPP's recent initiatives, including the partnerships and stable Q1 sales results, potentially serves as a catalyst for enhancing investor confidence and could positively impact the company’s future revenue and earnings forecasts. Such strategic alliances may drive innovation and efficiency, potentially leading to improved margins and a more robust financial outlook amid challenging market conditions.

Examining a longer-term perspective, WPP's total shareholder return, including share price and dividends, was 25.49% over the past five years. This long-term performance provides context to recent movements, as the company underperformed over the last year against the UK Market return of 0.1%, but showed resilience over a broader time frame. In contrast, compared to the UK Media industry which had a return of 19.6% for the past year, WPP’s performance indicates room for improvement in shorter-term investor confidence.

WPP’s current share price maintains a discount to the consensus analyst price target of £6.80, suggesting potential upside. Analysts expect continued focus on AI and operational efficiencies to potentially aid revenue and margin improvement. The impact of client wins such as Amazon is anticipated to contribute positively in the latter half of 2025, counteracting some of the headwinds anticipated in the first half. These enhancements can bolster earnings, aligning with projected growth figures and potentially closing the gap to the target price. As the market makes its corrections, investor attention remains on validating these initiatives' impact on revenue and earnings improvements.

Assess WPP's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WPP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WPP

WPP

A creative transformation company, provides communications, experience, commerce, and technology services in North America, the United Kingdom, Western Continental Europe, the Asia Pacific, Latin America, Africa, the Middle East, and Central and Eastern Europe.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Hemisphere Energy Looks Forward to a Remarkable 38% Profit Margin Surge

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion