- United Kingdom

- /

- Media

- /

- LSE:WPP

WPP (LSE:WPP) Adjusts 2025 Revenue Estimates Following Decline in Client Spending

Reviewed by Simply Wall St

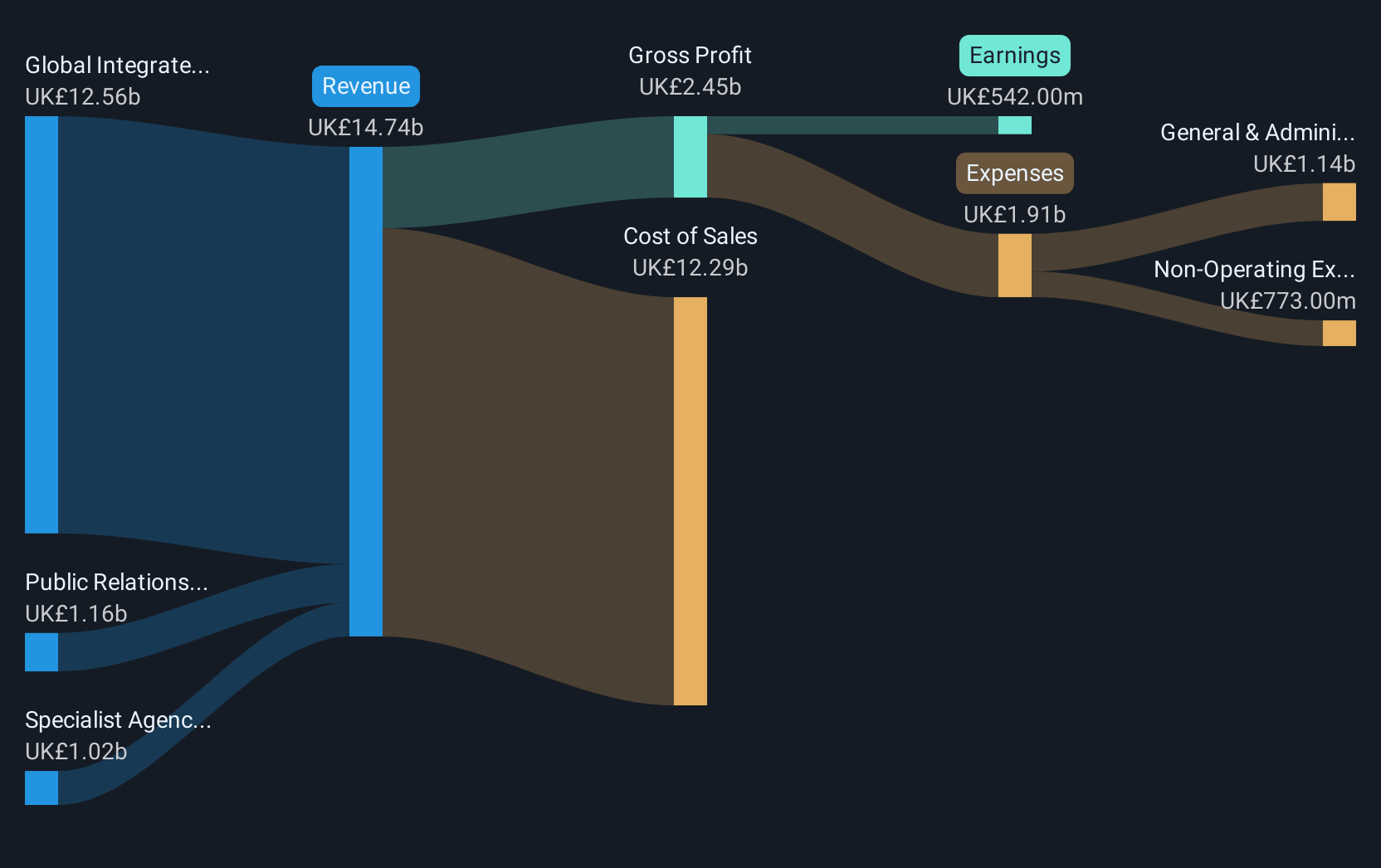

WPP (LSE:WPP) recently updated its earnings guidance, indicating a potential revenue decline in the first half of 2025 due to challenges like reduced client spending and macroeconomic uncertainties. The company's projections of a 4% to 5% decline in like-for-like revenue could have influenced its share price movement, which reflected a 6% increase over the last quarter. Amid a generally stable market, WPP’s news, including guidance updates and executive changes, added context to this performance, contrasting with the broader flat market behavior. Despite these challenges, the company expects margin improvements in the year's second half.

WPP's recent guidance update, which anticipates a 4% to 5% revenue decline in the first half of 2025, casts a shadow over its potential near-term performance, impacting the anticipated revenue and earnings trajectory. Although WPP has seen a 6% rise in its share price over the last quarter, the company’s financial estimates project a less optimistic scenario with a potential drop in revenue, challenging its growth and impacting forecasts.

Over the last five years, WPP’s total shareholder return, which combines share price appreciation and dividends, has been 9.40%. This return provides a broader context for its performance amidst the current market conditions. Notably, WPP has underperformed the UK market over the past year, while the UK market grew by 6%. In contrast, WPP’s performance in this period has been less robust, reflecting challenges within the industry and the company itself.

The current share price of £5.76, juxtaposed against a consensus analyst price target of £6.80, suggests a potential for upside, although differences among analysts’ forecasts underline the uncertainty in the market outlook. As WPP forecasts revenue and margin improvements in the second half of the year, the tension between the expected decline and strategic client wins like Amazon, J&J, and Unilever remains a focal point. These wins are expected to mitigate early-year challenges, supported by AI investments and operational efficiencies aimed at enhancing performance. Despite the short-term challenges, the anticipated ramp-up of new client engagements could bolster the company's financial resilience and shape its longer-term trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WPP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WPP

WPP

A creative transformation company, provides communications, experience, commerce, and technology services in North America, the United Kingdom, Western Continental Europe, the Asia Pacific, Latin America, Africa, the Middle East, and Central and Eastern Europe.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives