- United Kingdom

- /

- Media

- /

- LSE:SFOR

Slammed 25% S4 Capital plc (LON:SFOR) Screens Well Here But There Might Be A Catch

S4 Capital plc (LON:SFOR) shares have had a horrible month, losing 25% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

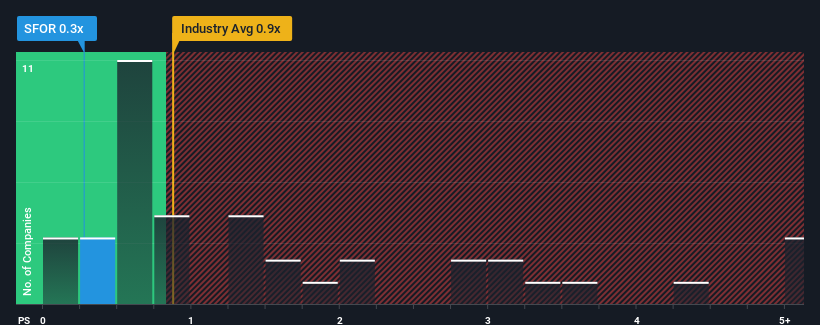

After such a large drop in price, considering around half the companies operating in the United Kingdom's Media industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider S4 Capital as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for S4 Capital

How S4 Capital Has Been Performing

S4 Capital could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on S4 Capital.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like S4 Capital's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.4%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 195% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should demonstrate some strength in company's business, generating growth of 0.7% per year as estimated by the six analysts watching the company. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 3.0% per annum.

With this information, we find it very odd that S4 Capital is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

S4 Capital's recently weak share price has pulled its P/S back below other Media companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that S4 Capital currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with S4 Capital, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on S4 Capital, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SFOR

S4 Capital

Provides digital advertising and marketing services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives