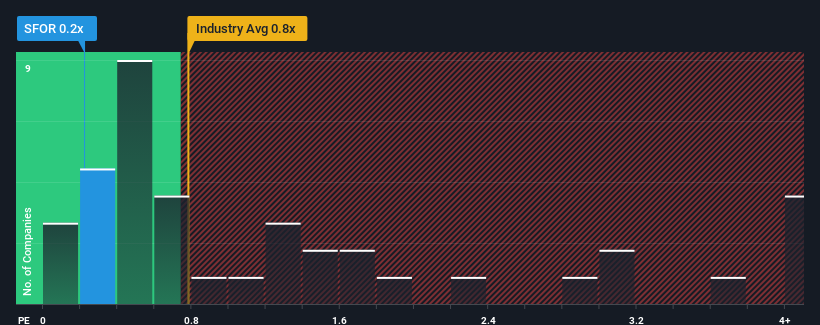

When you see that almost half of the companies in the Media industry in the United Kingdom have price-to-sales ratios (or "P/S") above 0.8x, S4 Capital plc (LON:SFOR) looks to be giving off some buy signals with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for S4 Capital

How Has S4 Capital Performed Recently?

S4 Capital could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on S4 Capital.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like S4 Capital's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. Even so, admirably revenue has lifted 91% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the seven analysts covering the company are not good at all, suggesting revenue should decline by 11% over the next year. The industry is also set to see revenue decline 3.5% but the stock is shaping up to perform materially worse.

With this in consideration, it's clear to us why S4 Capital's P/S isn't quite up to scratch with its industry peers. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does S4 Capital's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that S4 Capital's P/S is about what we expect, seeing as the P/S and revenue growth forecasts are lower than that of an already struggling industry. With such a gloomy outlook, investors feel the potential for an improvement in revenue isn't great enough to justify paying a premium resulting in a higher P/S ratio. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. Given the current circumstances, it's difficult to envision any significant increase in the share price in the near term.

You should always think about risks. Case in point, we've spotted 3 warning signs for S4 Capital you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SFOR

S4 Capital

Provides digital advertising and marketing services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives