- United Kingdom

- /

- Media

- /

- LSE:RCH

Discovering Goodwin And 2 Other Promising Small Caps In The UK Market

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat, but it has shown a 10% rise over the past 12 months with earnings projected to grow by 14% annually. In such a climate, identifying promising small-cap stocks like Goodwin and others can offer unique opportunities for growth and diversification.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Goodwin PLC, with a market cap of £510.65 million, offers mechanical and refractory engineering solutions across the UK, Europe, the United States, the Pacific Basin, and other international markets.

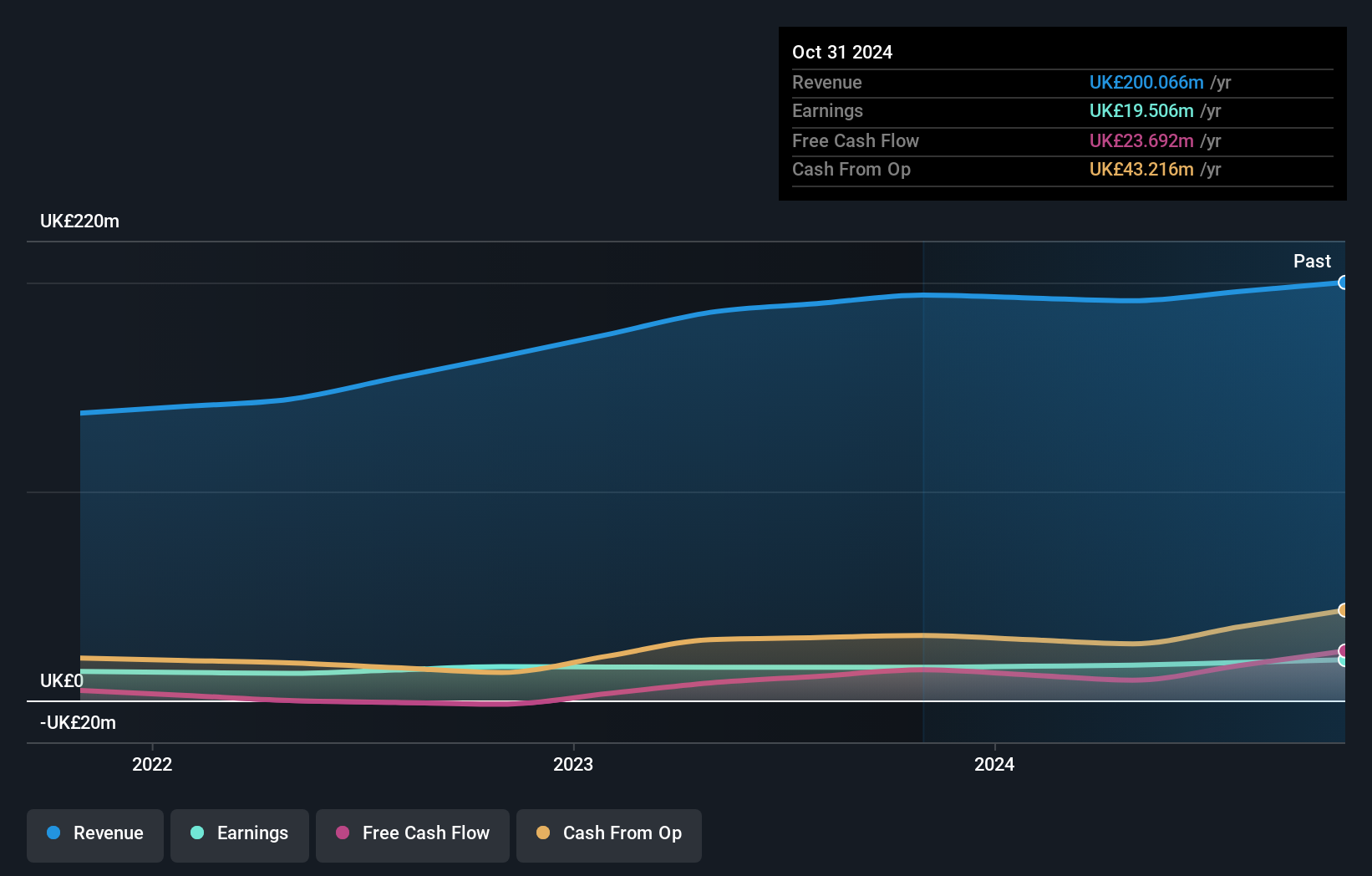

Operations: Goodwin PLC generates revenue from two primary segments: Mechanical Engineering (£156.94 million) and Refractory Engineering (£75.86 million).

Goodwin, a notable name in the UK market, has shown resilience with earnings growth of 6.3% over the past year, outpacing the Machinery industry's -4.7%. Despite an increase in debt to equity from 26.2% to 52.2% over five years, its interest payments are comfortably covered by EBIT at a ratio of 9.8 times. The net debt to equity ratio stands at a satisfactory 25.9%, indicating sound financial management amidst expansion efforts reflected by recent board changes like Christine McNamara's appointment as Non-Executive Director, bringing extensive energy sector experience to bolster strategic growth initiatives.

- Click here and access our complete health analysis report to understand the dynamics of Goodwin.

Gain insights into Goodwin's past trends and performance with our Past report.

VH Global Sustainable Energy Opportunities (LSE:GSEO)

Simply Wall St Value Rating: ★★★★★★

Overview: VH Global Sustainable Energy Opportunities plc is a closed-ended investment company that invests in sustainable energy infrastructure assets across EU, OECD, OECD key partner, or OECD Accession countries and has a market cap of £287.93 million.

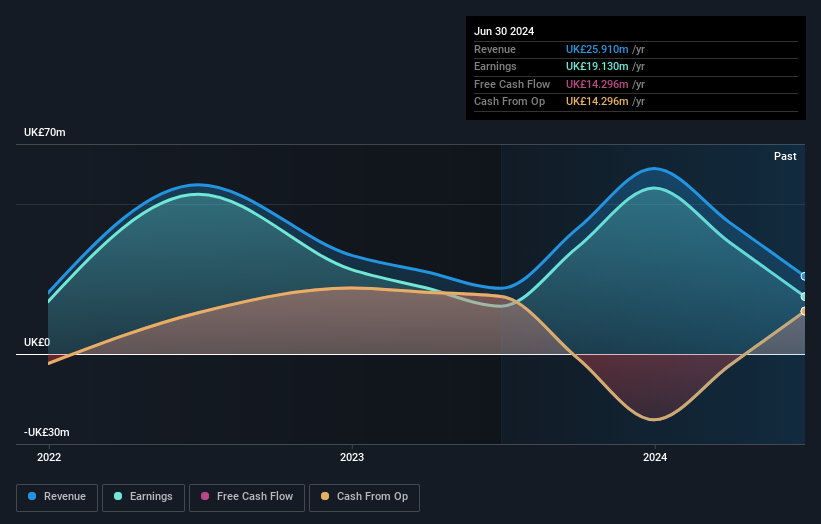

Operations: VH Global Sustainable Energy Opportunities generates revenue primarily through its investments in global sustainable energy opportunities, amounting to £25.91 million.

VH Global Sustainable Energy Opportunities, a promising player in the sustainable energy sector, has recently experienced some financial turbulence. Over the past year, earnings grew by 20%, outpacing the Capital Markets industry average of 11.9%. However, for the half-year ending June 2024, they reported a net loss of £16.09 million compared to last year's net income of £20.12 million. Despite this setback, their debt-free status and share repurchase program—buying back 5.64% of shares for £17.44 million—highlight strategic financial management aimed at enhancing shareholder value amidst challenging times.

Reach (LSE:RCH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reach plc operates as a national and regional commercial news publisher in the United Kingdom and Ireland with a market cap of £294.69 million.

Operations: Reach plc generates revenue primarily from its publishing segment, specifically newspapers, which contributed £554.20 million.

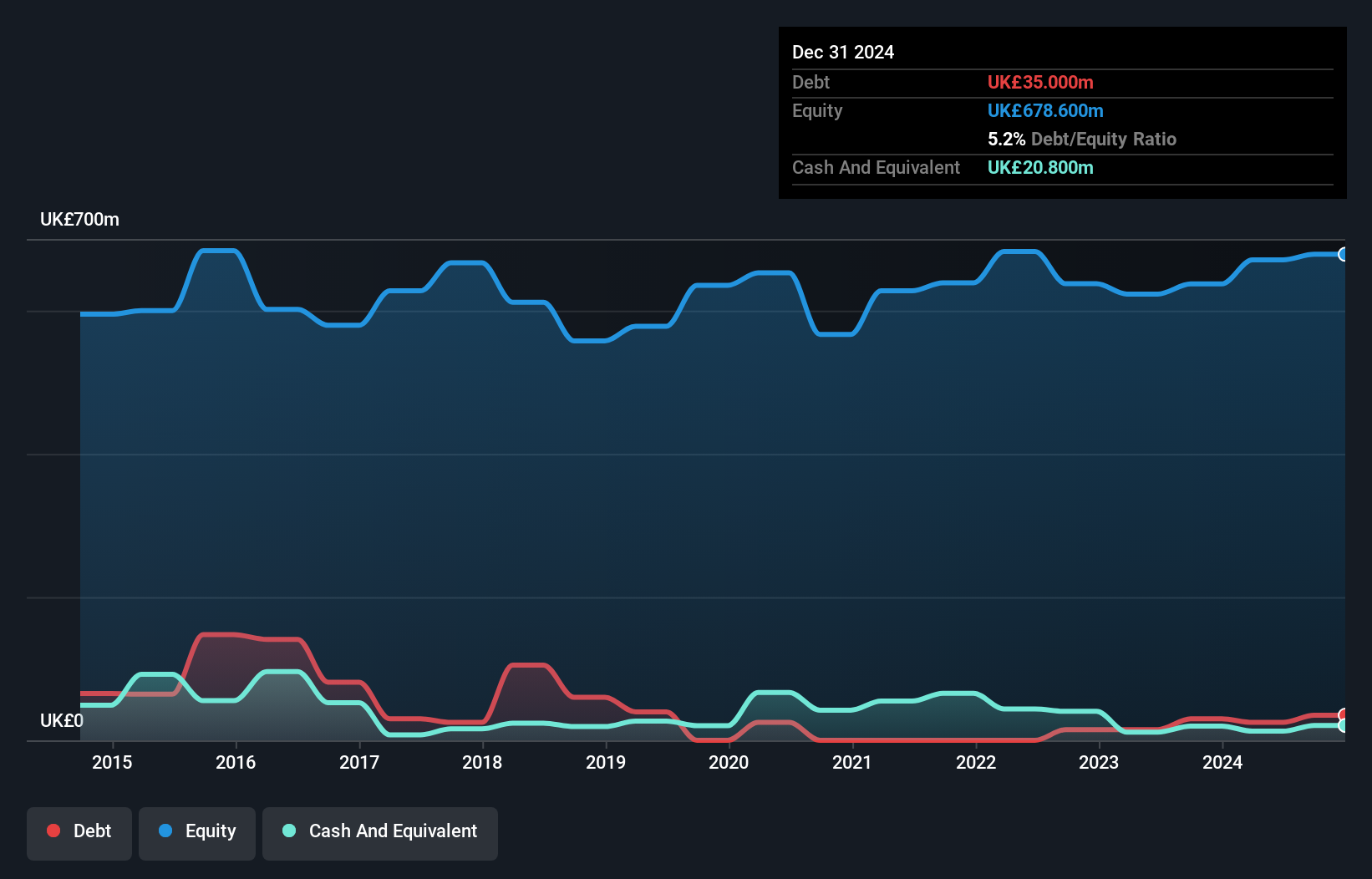

Reach plc, a notable player in the UK media landscape, has shown resilience despite challenges. The company reported a net income of £24.6 million for the first half of 2024, significantly up from £4.6 million last year, reflecting improved profitability with basic earnings per share rising to £0.078 from £0.015. Despite a dip in group revenue by 2.5% for the recent quarter and 4.3% year-to-date compared to last year, Reach's debt management is commendable with a net debt to equity ratio at just 1.8%. Trading at a price-to-earnings ratio of 7.1x suggests undervaluation relative to peers and industry averages.

- Click to explore a detailed breakdown of our findings in Reach's health report.

Review our historical performance report to gain insights into Reach's's past performance.

Key Takeaways

- Gain an insight into the universe of 81 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RCH

Reach

Operates as commercial news publisher in the United Kingdom, rest of Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives