- United Kingdom

- /

- Capital Markets

- /

- LSE:FSG

Kore Potash And 2 Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The United Kingdom market has shown resilience, remaining flat over the past week but achieving a 7.8% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In such a landscape, identifying stocks with strong financials and growth potential is key, particularly when considering penny stocks—an older term that still signifies smaller or emerging companies offering value opportunities. By focusing on those with solid fundamentals and clear growth trajectories, investors can uncover promising prospects within this often overlooked segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £813.81M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.235 | £70.45M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.015 | £76.87M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.125 | £96.01M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £197.41M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.46 | £443.57M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.416 | $241.83M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kore Potash (AIM:KP2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kore Potash plc, along with its subsidiaries, focuses on the exploration and development of potash minerals in the Republic of Congo and has a market capitalization of £118.20 million.

Operations: Kore Potash plc does not report any revenue segments.

Market Cap: £118.2M

Kore Potash is a pre-revenue company focused on developing potash resources, with recent developments including the signing of a USD 1.929 billion fixed-price EPC contract for its Kola Project. This contract minimizes cost overrun risks and positions Kore Potash to potentially become one of the lowest-cost producers in key markets like Brazil and Africa. Despite its strategic advancements, Kore Potash faces challenges such as high share price volatility and short cash runway, although it recently raised additional capital through equity offerings. The company remains debt-free but has experienced shareholder dilution over the past year.

- Navigate through the intricacies of Kore Potash with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Kore Potash's track record.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £474.78 million.

Operations: The company's revenue is derived from its Infrastructure segment (£87.79 million), Private Equity operations (£50.78 million), and Foresight Capital Management (£8.10 million).

Market Cap: £474.78M

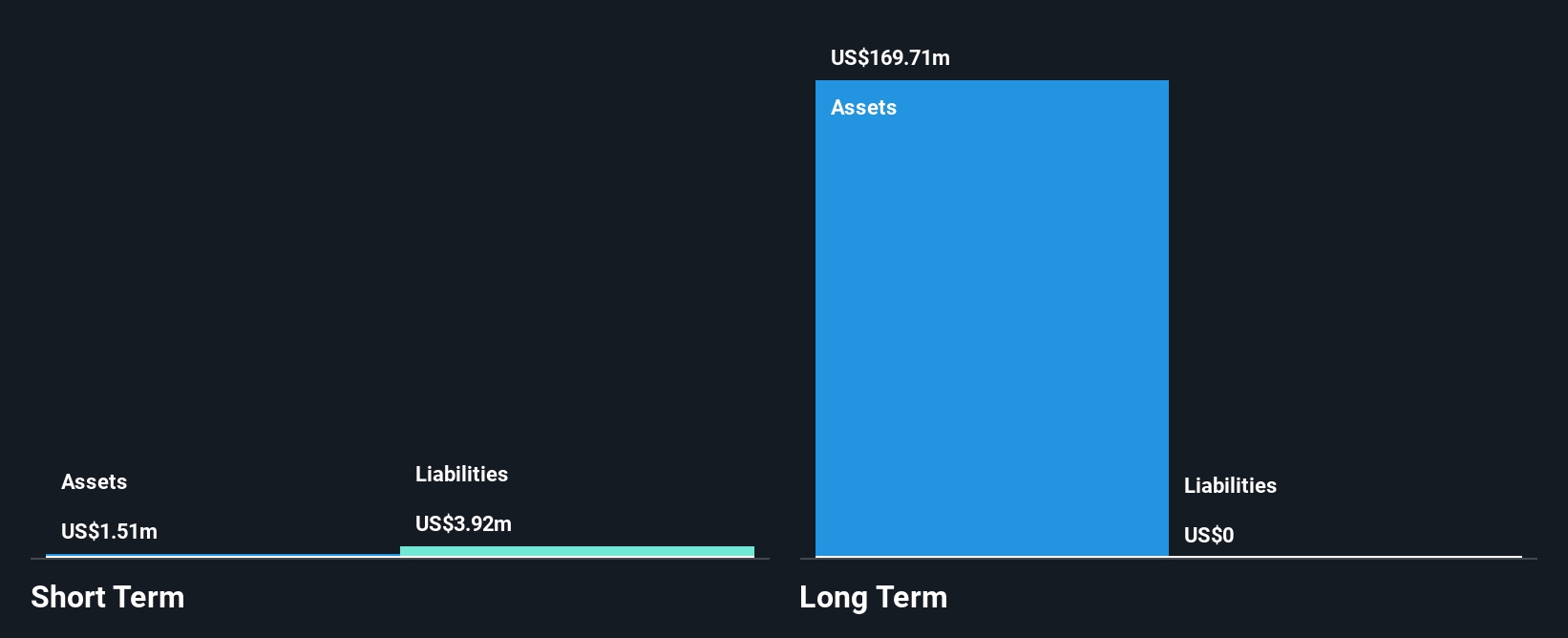

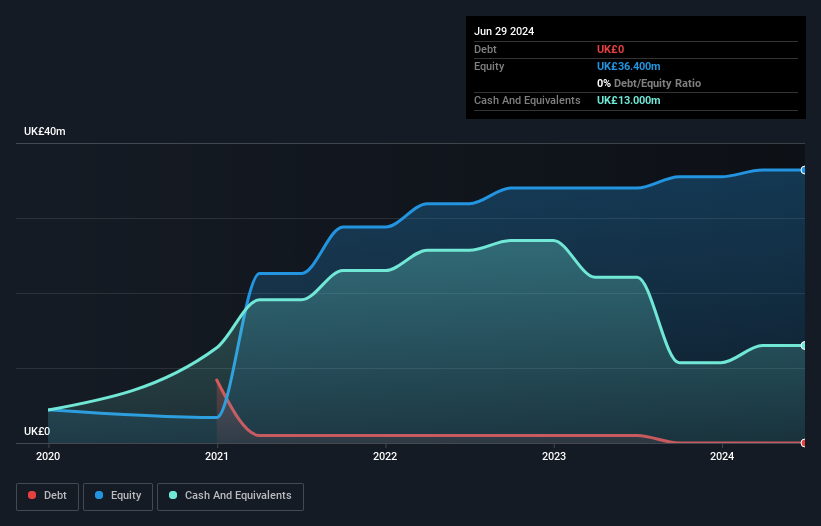

Foresight Group Holdings demonstrates financial robustness with short-term assets (£81.9M) surpassing both short and long-term liabilities, while maintaining more cash than total debt. The company's earnings have shown strong growth, increasing by 45.9% over the past year and outpacing industry averages. Recent half-year results revealed a rise in net income to £12.65 million from £8.49 million previously, alongside improved profit margins (20.9%). Despite a significant one-off loss of £11.7M impacting results, Foresight's price-to-earnings ratio remains attractive compared to the UK market average, suggesting potential value for investors mindful of volatility risks.

- Jump into the full analysis health report here for a deeper understanding of Foresight Group Holdings.

- Understand Foresight Group Holdings' earnings outlook by examining our growth report.

National World (LSE:NWOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: National World Plc, with a market cap of £55.14 million, operates in the United Kingdom offering news and information services through various multimedia publications and websites.

Operations: The company generates revenue of £95.6 million from identifying and acquiring investment projects.

Market Cap: £55.14M

National World Plc, with a market cap of £55.14 million, has seen its earnings grow significantly by 27.9% annually over the past five years, though recent performance shows negative growth and declining profit margins from 4.2% to 2.5%. The company is debt-free and maintains stable short-term assets exceeding liabilities (£29.2M vs £22.9M). A recent acquisition proposal from Media Concierge offers shareholders a substantial cash premium at 23 pence per share, contingent on board recommendations and shareholder agreements. Despite high volatility in share price recently, the company's valuation appears attractive at 54% below estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of National World.

- Examine National World's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Click here to access our complete index of 470 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FSG

Foresight Group Holdings

Operates as an infrastructure and private equity manager in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives