- United Kingdom

- /

- Media

- /

- LSE:INF

UK Value Stock Picks: Begbies Traynor Group And 2 More Trading At An Estimated Discount

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces pressure from weak trade data out of China, investors are increasingly looking for opportunities in undervalued stocks that can offer potential resilience amid global economic uncertainties. In this environment, identifying companies trading at an estimated discount becomes crucial, as these stocks may present a compelling value proposition despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victrex (LSE:VCT) | £7.20 | £13.72 | 47.5% |

| TBC Bank Group (LSE:TBCG) | £48.05 | £93.25 | 48.5% |

| Moonpig Group (LSE:MOON) | £2.135 | £3.99 | 46.5% |

| Marlowe (AIM:MRL) | £4.40 | £8.35 | 47.3% |

| LSL Property Services (LSE:LSL) | £3.21 | £5.96 | 46.2% |

| Informa (LSE:INF) | £8.204 | £15.15 | 45.9% |

| Gooch & Housego (AIM:GHH) | £6.20 | £11.25 | 44.9% |

| Burberry Group (LSE:BRBY) | £12.34 | £23.78 | 48.1% |

| Benchmark Holdings (AIM:BMK) | £0.246 | £0.45 | 44.9% |

| AstraZeneca (LSE:AZN) | £103.40 | £188.98 | 45.3% |

Here's a peek at a few of the choices from the screener.

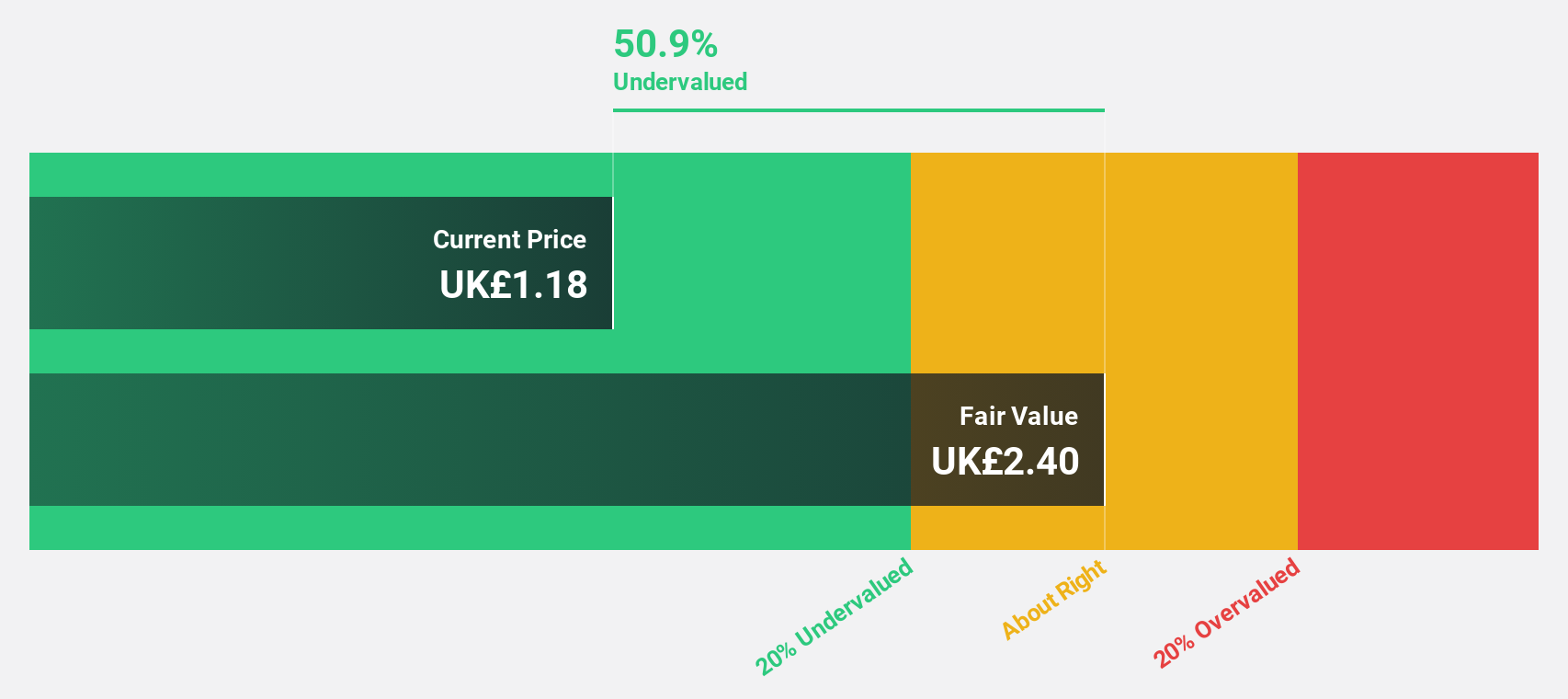

Begbies Traynor Group (AIM:BEG)

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, corporations, and financial institutions in the UK with a market cap of £193.83 million.

Operations: Begbies Traynor Group plc generates revenue through its professional services provided to a range of clients, including businesses, advisors, corporations, and financial institutions across the United Kingdom.

Estimated Discount To Fair Value: 39.8%

Begbies Traynor Group is trading at £1.22, significantly below its estimated fair value of £2.02, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow 34.6% annually, outpacing the UK market's growth rate of 14.4%. Recent results show a substantial increase in net income to £6.3 million from £1.5 million last year, with revenue guidance for FY26 expected at the upper end of market expectations (£158.9m-£162.8m).

- Upon reviewing our latest growth report, Begbies Traynor Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Begbies Traynor Group stock in this financial health report.

Entain (LSE:ENT)

Overview: Entain Plc is a sports-betting and gaming company with operations in the UK, Ireland, Italy, Europe, Australia, New Zealand, and other international markets; it has a market cap of approximately £5.96 billion.

Operations: The company's revenue is derived from segments including CEE (£488 million), UK&I (£2.05 billion), and International (£2.57 billion).

Estimated Discount To Fair Value: 36.9%

Entain is trading at £9.32, significantly below its estimated fair value of £14.66, suggesting potential undervaluation based on cash flows. The company forecasts revenue growth of 4.4% annually, surpassing the UK market average of 3.6%. With earnings expected to grow by over 100% per year and profitability anticipated within three years, Entain's financial outlook is promising. Recent corporate developments include Stella David's appointment as CEO and the reaffirmation of mid-single-digit online NGR growth for 2025.

- According our earnings growth report, there's an indication that Entain might be ready to expand.

- Click to explore a detailed breakdown of our findings in Entain's balance sheet health report.

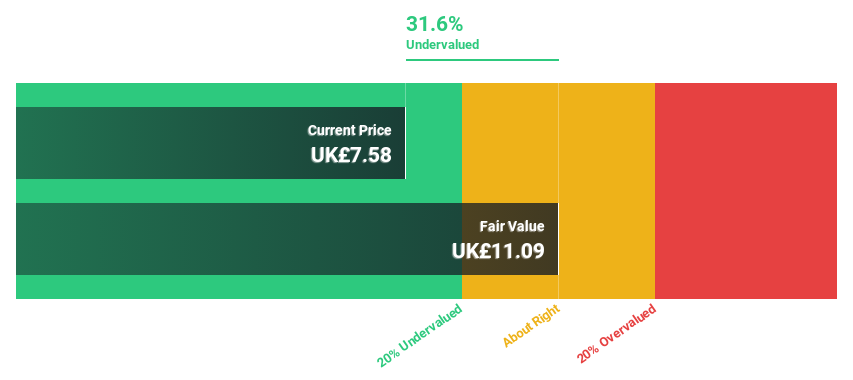

Informa (LSE:INF)

Overview: Informa plc is an international company that provides events, digital services, and academic research across the United Kingdom, Continental Europe, North America, China, and other regions with a market cap of £10.66 billion.

Operations: Informa's revenue segments include Informa Tech (£423.90 million), Informa Connect (£631 million), Informa Markets (£1.72 billion), and Taylor & Francis (£698.20 million).

Estimated Discount To Fair Value: 45.9%

Informa is trading at £8.20, considerably below its estimated fair value of £15.15, indicating potential undervaluation based on cash flows. Despite a recent decline in profit margins from 13.1% to 8.4%, earnings are projected to grow significantly at over 20% annually, outpacing the UK market's average growth rate of 14.4%. The recent addition of Art Monte-Carlo enhances its Luxury and Lifestyle portfolio, potentially boosting future revenue streams despite an unstable dividend history and low return on equity forecast (13.1%).

- Our growth report here indicates Informa may be poised for an improving outlook.

- Get an in-depth perspective on Informa's balance sheet by reading our health report here.

Key Takeaways

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 62 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, North America, China, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives