- United Kingdom

- /

- Media

- /

- LSE:FUTR

Future plc's (LON:FUTR) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Future plc (LON:FUTR) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

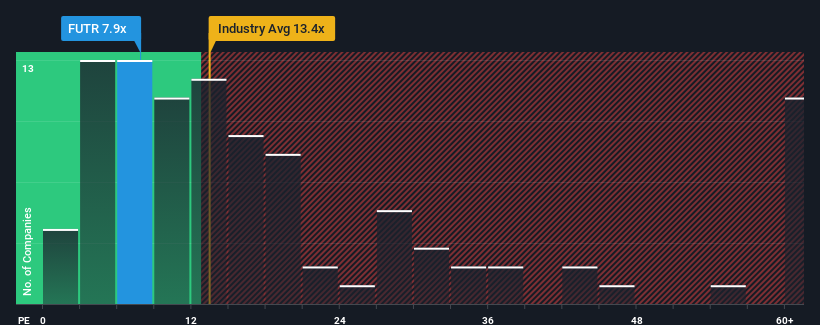

Although its price has surged higher, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may still consider Future as an attractive investment with its 7.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Future has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Future

What Are Growth Metrics Telling Us About The Low P/E?

Future's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 6.6%. Even so, admirably EPS has lifted 114% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 0.8% per annum over the next three years. With the market predicted to deliver 12% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Future's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Future's P/E?

Despite Future's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Future maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Future that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FUTR

Future

Future plc, together with its subsidiaries, publishes and distributes content for technology, gaming, sports, fashion, beauty, homes, wealth, and knowledge sectors in the United States and the United Kingdom.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)