- United Kingdom

- /

- Capital Markets

- /

- LSE:IHP

3 UK Penny Stocks With Market Caps Under £2B To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the global interconnectedness of economies. In such fluctuating market conditions, identifying promising investment opportunities requires a focus on companies with strong financials and growth potential. While the term "penny stocks" may seem outdated, these typically smaller or newer companies can offer significant upside when backed by robust balance sheets and sound fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.695 | £525.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.74 | £11.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £256.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.51 | £72.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.46 billion.

Operations: The company's revenue is generated from its segments in Auto (€31.39 million), Real Estate (€22.25 million), Jobs & Services (€15.96 million), and Generalist categories (€13.22 million).

Market Cap: £1.46B

Baltic Classifieds Group exhibits a robust financial profile, with its interest payments well-covered by EBIT and operating cash flow effectively managing debt. The company's short-term assets surpass both short and long-term liabilities, indicating strong liquidity. However, recent corporate guidance suggests a slight reduction in anticipated revenue and profit growth for 2025. Despite this, the company continues to deliver high-quality earnings with significant historical profit growth. A stable management team and an experienced board further bolster its operational stability. The recent dividend increase underscores confidence in future cash flows despite lowered earnings expectations.

- Dive into the specifics of Baltic Classifieds Group here with our thorough balance sheet health report.

- Learn about Baltic Classifieds Group's future growth trajectory here.

IntegraFin Holdings (LSE:IHP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IntegraFin Holdings plc, along with its subsidiaries, offers software and services to clients and financial advisers in the UK and Isle of Man, with a market cap of £1.23 billion.

Operations: The company's revenue is primarily derived from three segments: Investment Administration Services (£74.7 million), Insurance and Life Assurance Business (£72 million), and Adviser Back-Office Technology (£5 million).

Market Cap: £1.23B

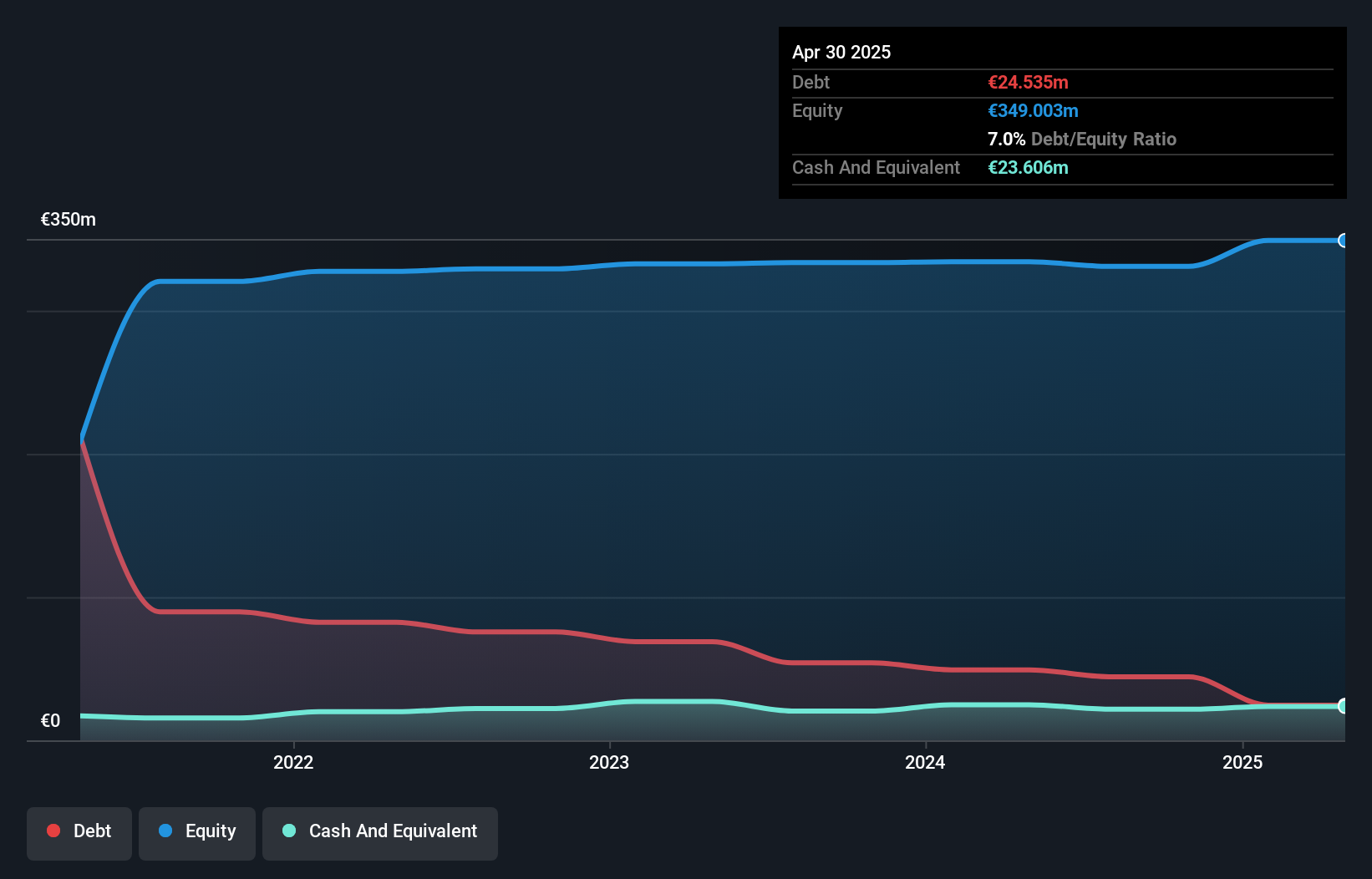

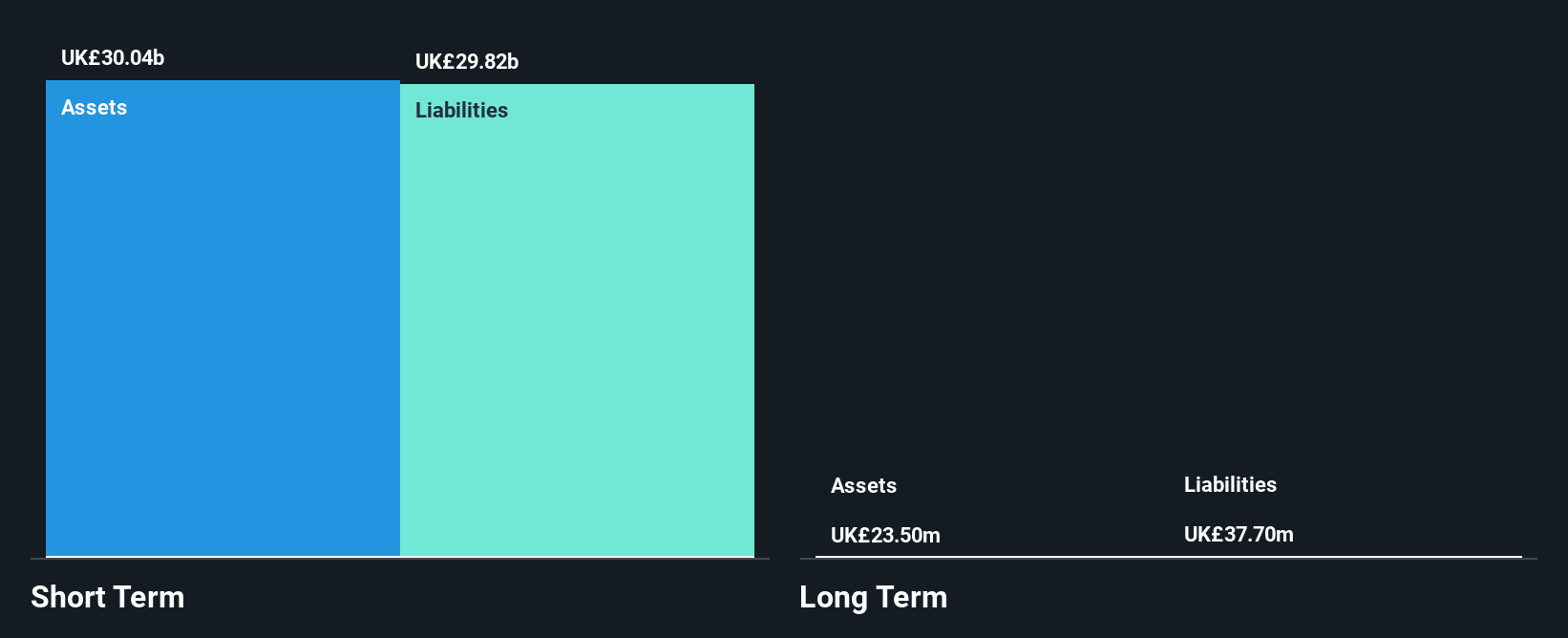

IntegraFin Holdings plc demonstrates financial stability with no debt and short-term assets of £30 billion exceeding both short and long-term liabilities. The company has provided revenue guidance for fiscal year 2025, expecting an increase to £156.8 million. Despite a decline in net profit margins from 37.7% to 32.2% over the past year, IntegraFin maintains high-quality earnings and a strong return on equity at 23.8%. However, recent negative earnings growth contrasts with its forecasted annual growth of 17.22%, suggesting potential volatility in future performance despite stable weekly returns volatility at 3%.

- Unlock comprehensive insights into our analysis of IntegraFin Holdings stock in this financial health report.

- Evaluate IntegraFin Holdings' prospects by accessing our earnings growth report.

ME Group International (LSE:MEGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a variety of instant-service equipment in the United Kingdom and has a market cap of £717.67 million.

Operations: The company generates revenue of £311.32 million from its Personal Services - Others segment.

Market Cap: £717.67M

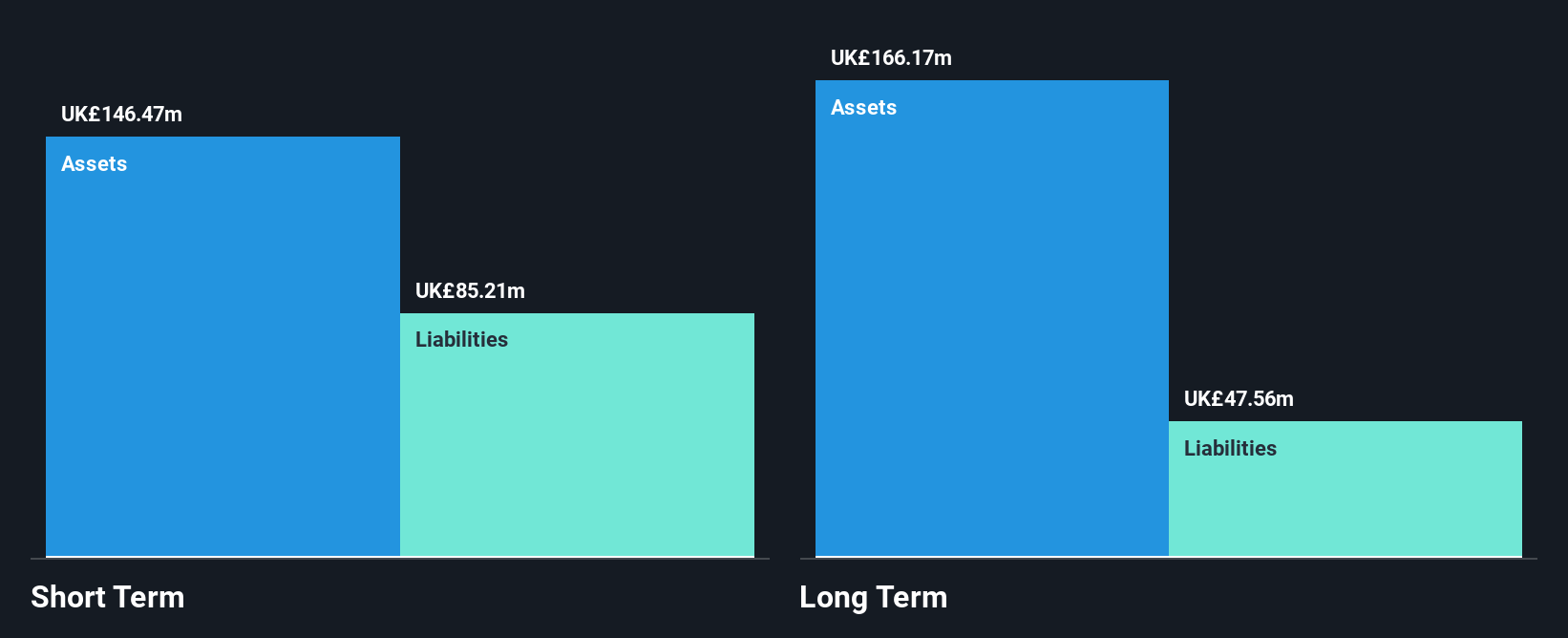

ME Group International plc shows financial resilience with short-term assets (£143.9M) surpassing both short and long-term liabilities, while maintaining a reduced debt-to-equity ratio of 19.8%. The company's earnings growth has slowed to 7.9% over the past year, underperforming the Consumer Services industry but still reflecting high-quality earnings and a strong return on equity at 29.2%. Despite trading at a significant discount to its estimated fair value, MEGP's dividends remain unstable. With experienced management and board members, MEGP continues to cover interest payments comfortably and benefits from well-covered debt by operating cash flow (239.9%).

- Click here and access our complete financial health analysis report to understand the dynamics of ME Group International.

- Gain insights into ME Group International's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Get an in-depth perspective on all 295 UK Penny Stocks by using our screener here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IHP

IntegraFin Holdings

Provides software and services for clients and UK financial advisers in the United Kingdom and Isle of Man.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives