- United Kingdom

- /

- Media

- /

- AIM:YOU

YouGov plc's (LON:YOU) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

YouGov plc (LON:YOU) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

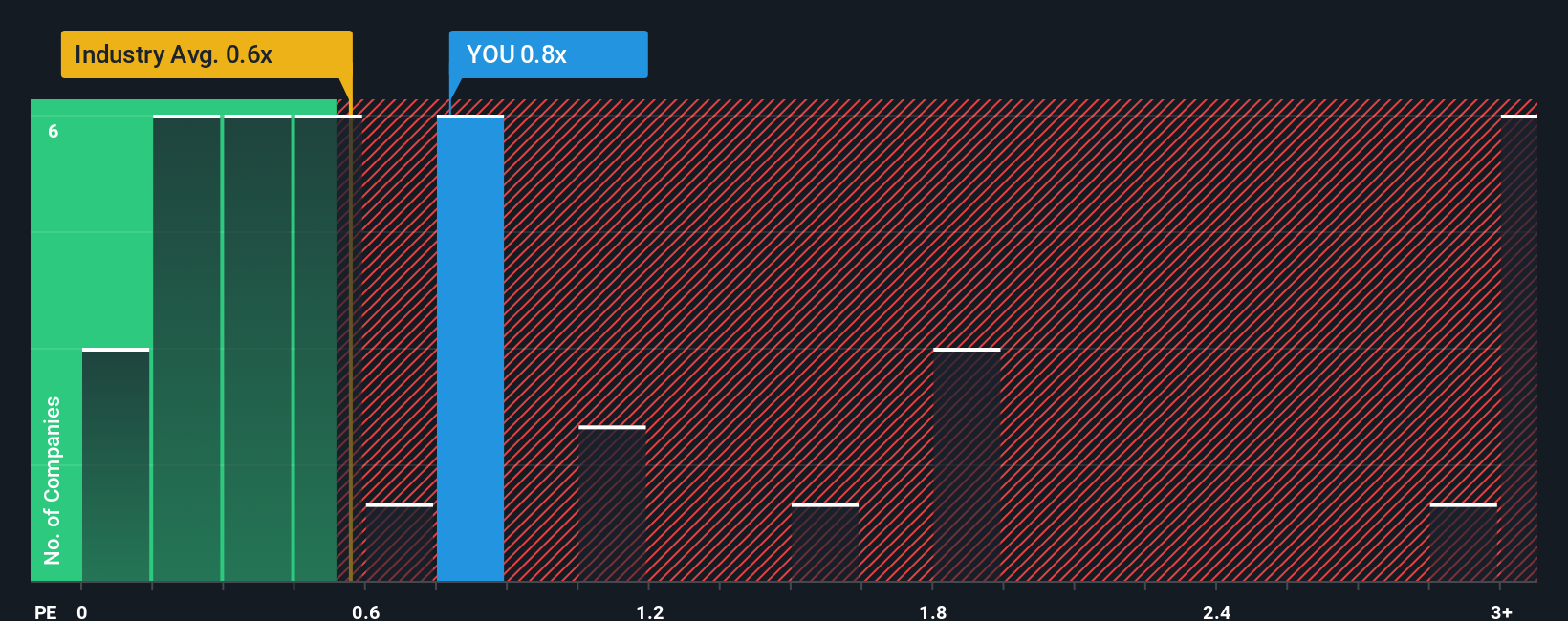

Even after such a large drop in price, you could still be forgiven for feeling indifferent about YouGov's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Media industry in the United Kingdom is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for YouGov

What Does YouGov's P/S Mean For Shareholders?

YouGov certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on YouGov will help you uncover what's on the horizon.How Is YouGov's Revenue Growth Trending?

In order to justify its P/S ratio, YouGov would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Pleasingly, revenue has also lifted 76% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 3.0% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 2.5% each year, which is not materially different.

With this information, we can see why YouGov is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Following YouGov's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A YouGov's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Media industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with YouGov (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on YouGov, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:YOU

YouGov

Provides online market research services in the United Kingdom, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives