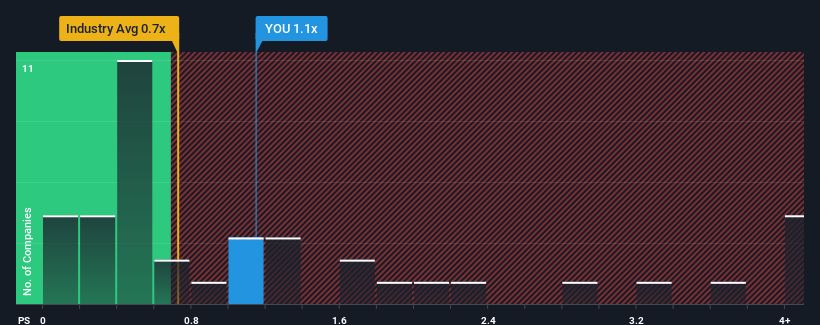

There wouldn't be many who think YouGov plc's (LON:YOU) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Media industry in the United Kingdom is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for YouGov

What Does YouGov's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, YouGov has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think YouGov's future stacks up against the industry? In that case, our free report is a great place to start.How Is YouGov's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like YouGov's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. The latest three year period has also seen an excellent 98% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 8.4% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.8% each year, which is noticeably less attractive.

In light of this, it's curious that YouGov's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that YouGov currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 2 warning signs we've spotted with YouGov (including 1 which is potentially serious).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:YOU

YouGov

Provides online market research services in the United Kingdom, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives