- United Kingdom

- /

- Auto Components

- /

- AIM:CTA

3 UK Penny Stocks With Market Caps Under £30M To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic interdependencies. In such a climate, identifying stocks with strong financials becomes crucial for investors seeking resilience and growth potential. Penny stocks, though an outdated term, still represent a compelling investment area when they are backed by robust fundamentals and offer opportunities for discovering under-the-radar companies with promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £791.31M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £146.94M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.76 | £428.23M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.42 | £84.3M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.425 | £340.64M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.06 | £90.27M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.09 | £149.11M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.425 | £181.48M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

CT Automotive Group (AIM:CTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CT Automotive Group plc designs, develops, manufactures, and supplies automotive interior components and kinematic assemblies for automotive brands globally, with a market cap of £24.29 million.

Operations: The company generates revenue from two main segments: Tooling, which accounts for $13.12 million, and Production, contributing $122.20 million.

Market Cap: £24.29M

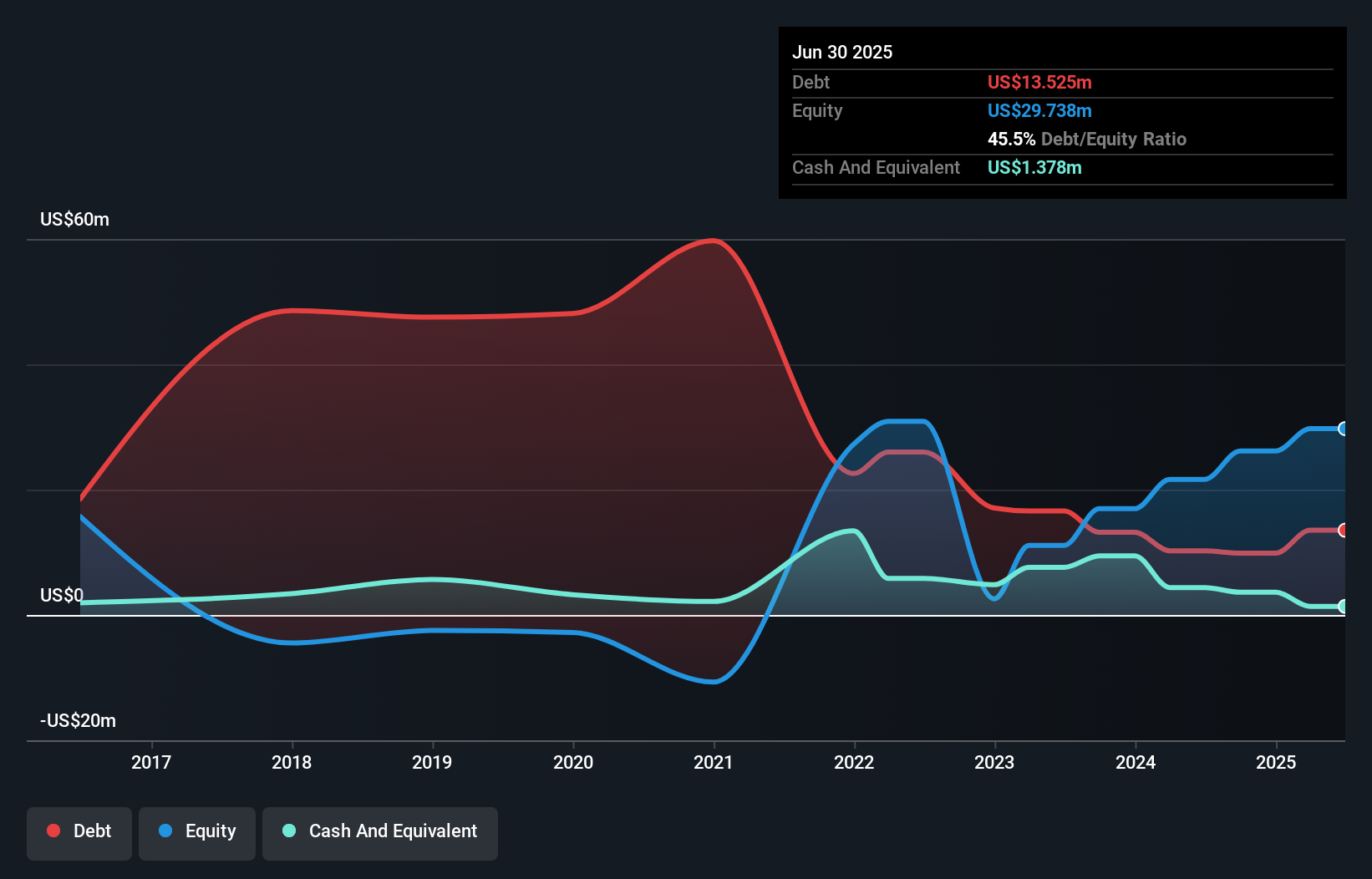

CT Automotive Group, with a market cap of £24.29 million, has recently become profitable and boasts high-quality earnings. The company's short-term assets exceed both its short- and long-term liabilities, indicating strong financial health. Despite a relatively inexperienced management team and board, CT Automotive's Return on Equity is outstanding at 41.9%, and its debt levels are well-managed with operating cash flow covering debt effectively. Recent developments include a service agreement with iAqua Watercraft Limited, expected to generate modest annual revenue but deemed profitable for the company. The share price remains volatile despite these positive indicators.

- Navigate through the intricacies of CT Automotive Group with our comprehensive balance sheet health report here.

- Examine CT Automotive Group's earnings growth report to understand how analysts expect it to perform.

OPG Power Ventures (AIM:OPG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OPG Power Ventures Plc, with a market cap of £20.64 million, develops, owns, operates, and maintains private sector power projects in India through its subsidiaries.

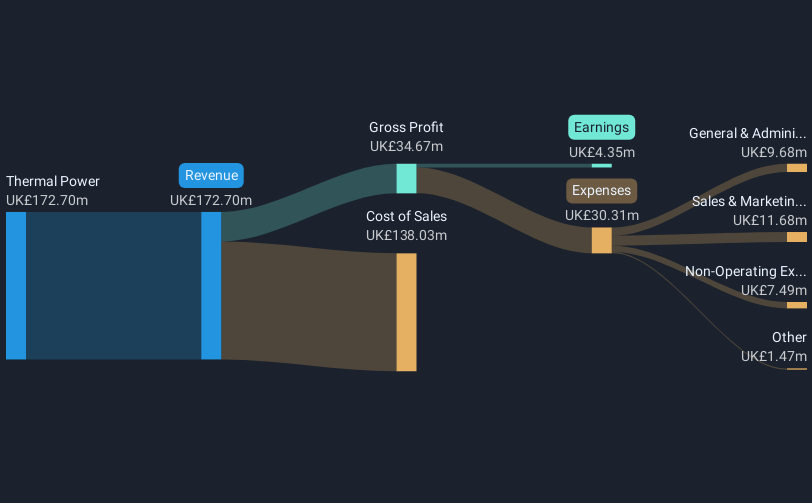

Operations: The company's revenue primarily comes from its thermal power segment, generating £172.70 million.

Market Cap: £20.64M

OPG Power Ventures, with a market cap of £20.64 million, demonstrates financial stability as its short-term assets exceed both short- and long-term liabilities. The company reported half-year sales of £86.88 million, an increase from the previous year, although profit margins have decreased to 2.5%. Despite negative earnings growth over the past five years and increased share price volatility recently, OPG's debt management is robust; it has more cash than total debt and interest payments are well covered by EBIT. The board and management team possess seasoned experience, contributing to high-quality earnings despite challenges in profitability growth.

- Get an in-depth perspective on OPG Power Ventures' performance by reading our balance sheet health report here.

- Examine OPG Power Ventures' past performance report to understand how it has performed in prior years.

XLMedia (AIM:XLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XLMedia PLC is a digital media company that produces content for audiences and links them to relevant advertisers in North America and Europe, with a market cap of £27.61 million.

Operations: The company's revenue from its Publishing segment is $43.76 million.

Market Cap: £27.61M

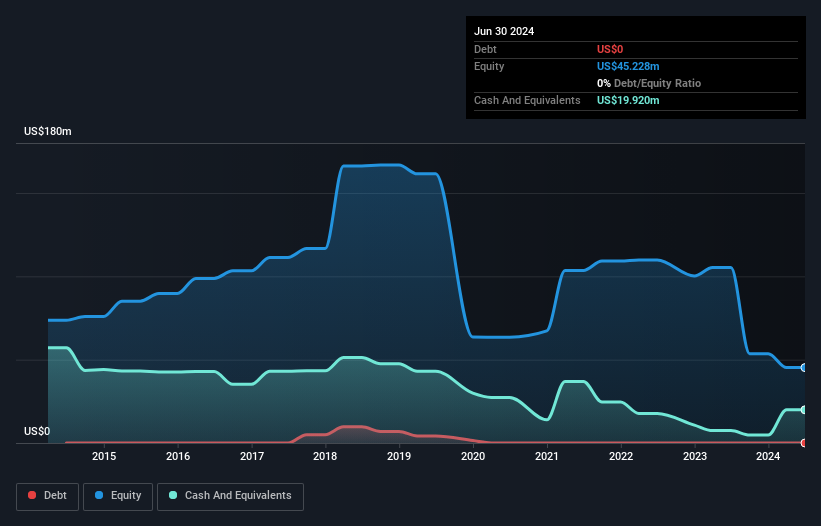

XLMedia, with a market cap of £27.61 million, is navigating significant transitions as it prepares for asset disposal and potential liquidation. Despite being debt-free, the company remains unprofitable with increasing losses over five years and a negative return on equity. Its short-term assets of $40.5M comfortably cover both short- and long-term liabilities, indicating solid liquidity management. Recent executive changes signal strategic shifts as the company aims to return capital to shareholders by mid-2025. Although share price volatility has decreased recently, it remains higher than most UK stocks, reflecting ongoing uncertainty in its business outlook.

- Jump into the full analysis health report here for a deeper understanding of XLMedia.

- Evaluate XLMedia's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 446 companies within our UK Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CTA

CT Automotive Group

Designs, develops, manufactures, and supplies automotive interior components and kinematic assemblies for automotive brands in the United Kingdom and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives