- United Kingdom

- /

- Media

- /

- AIM:NFG

Top UK Dividend Stocks For May 2025

Reviewed by Simply Wall St

As the FTSE 100 index experiences turbulence due to weak trade data from China, investors in the UK are navigating a challenging market environment. In such times, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to weather market volatility while still seeking returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.66% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.45% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.17% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.16% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.67% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.00% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.97% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.31% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.97% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.71% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

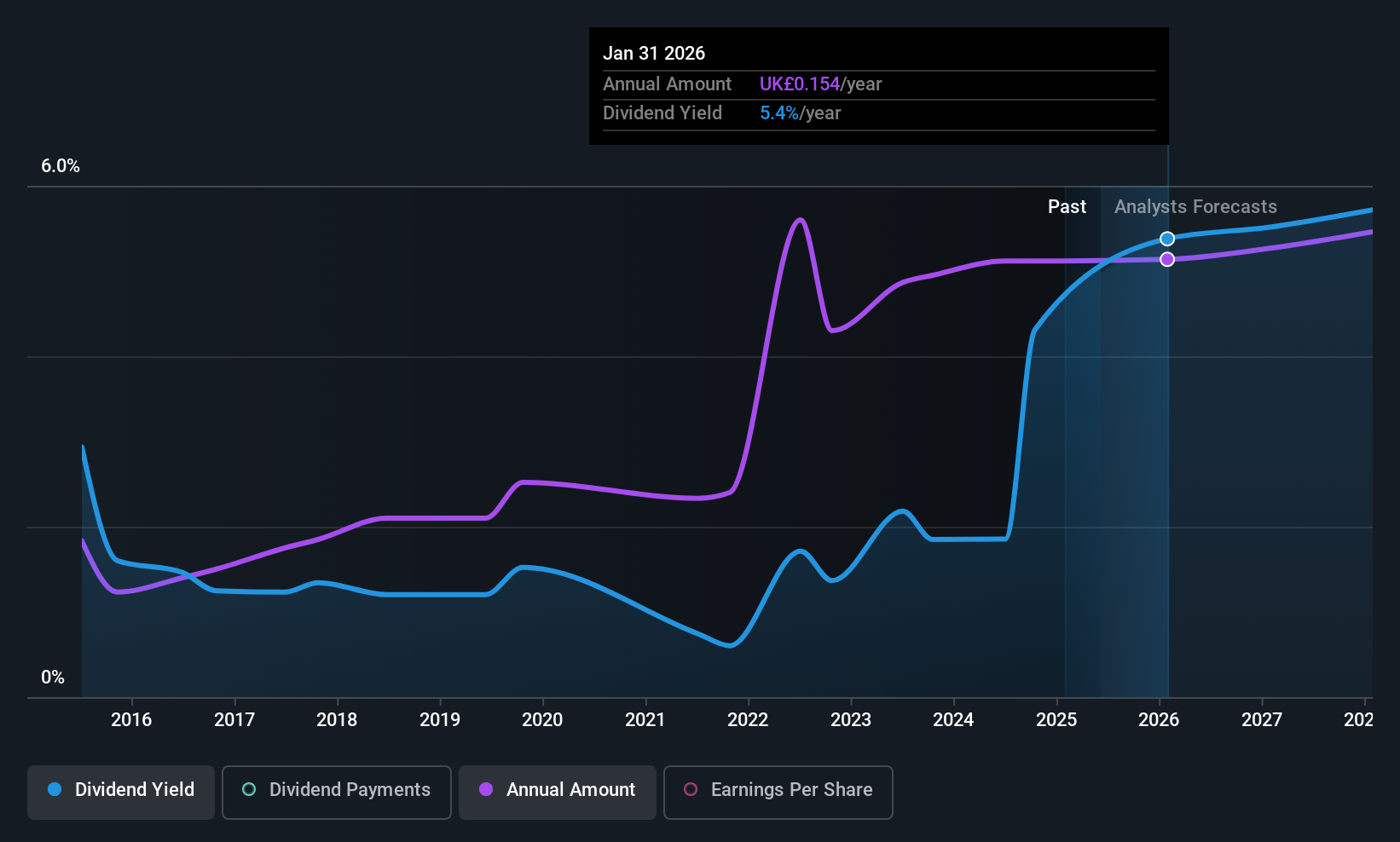

Next 15 Group (AIM:NFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £269.97 million.

Operations: Next 15 Group plc generates its revenue through four main segments: Customer Engage (£340.56 million), Customer Insight (£73.87 million), Customer Delivery (£171.19 million), and Business Transformation (£144.19 million).

Dividend Yield: 5.7%

Next 15 Group's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 39% and a cash payout ratio of 22.7%. However, its dividend track record is unstable due to volatility over the past decade. Despite this, the company trades at good value compared to its peers and industry. Recent earnings showed slight revenue growth but declining net income, with new board appointments potentially influencing future strategies.

- Dive into the specifics of Next 15 Group here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Next 15 Group is trading behind its estimated value.

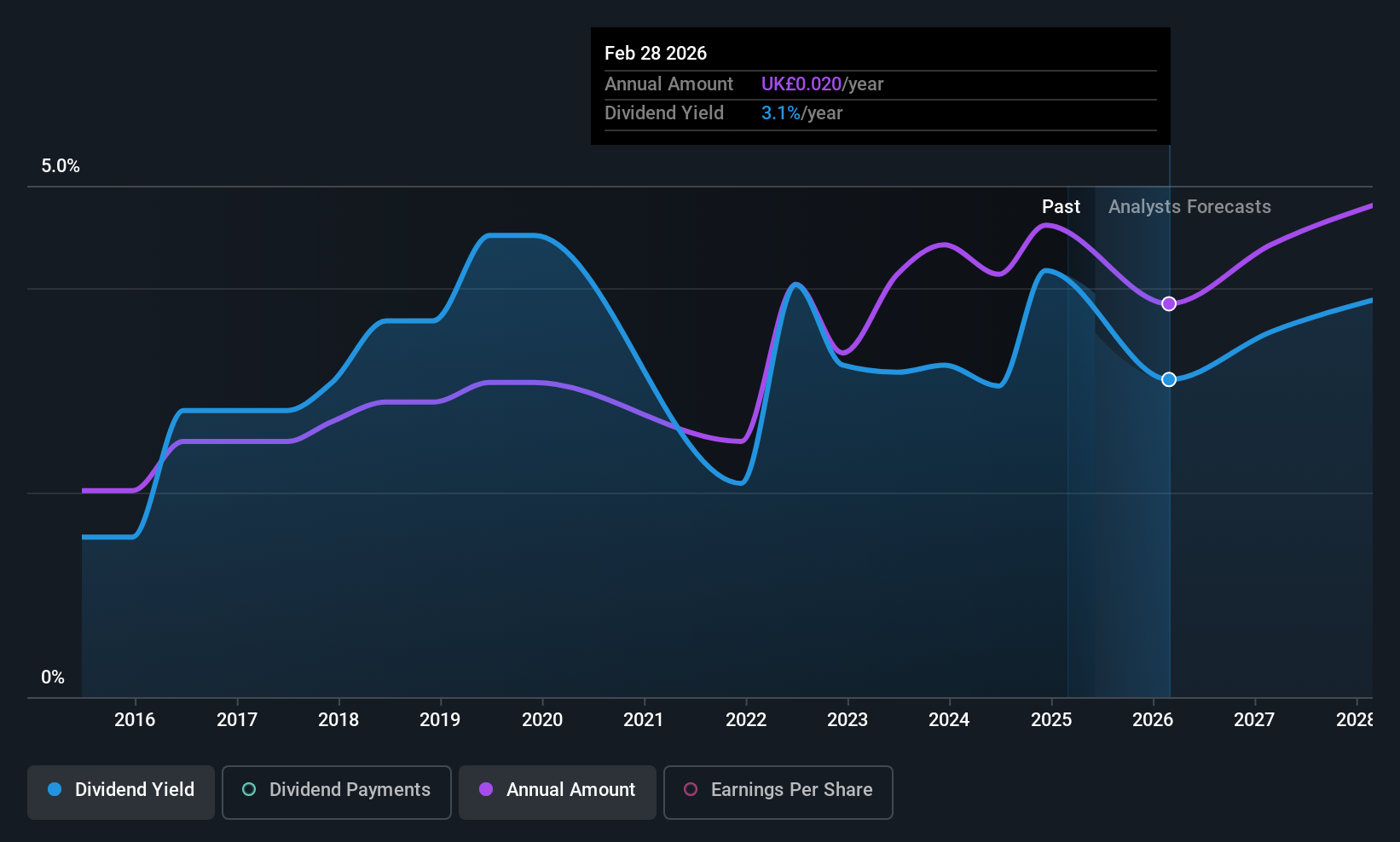

Vertu Motors (AIM:VTU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vertu Motors plc is an automotive retailer based in the United Kingdom with a market cap of £201.07 million.

Operations: Vertu Motors plc generates revenue of £4.76 billion from its operations as a gasoline and auto dealer in the United Kingdom.

Dividend Yield: 3.2%

Vertu Motors' dividend payments are well-covered by earnings (payout ratio: 37.4%) and cash flows (cash payout ratio: 16.4%), yet they have been volatile over the past decade, with a recent decrease to 2.05 pence per share for FY25 from FY24's 2.35 pence. The company trades below fair value and is seeking acquisitions despite sector uncertainties, aiming for profitability improvements through cost control and strategic capital allocation amidst declining net income of £18.1 million from £25.71 million last year.

- Get an in-depth perspective on Vertu Motors' performance by reading our dividend report here.

- Our valuation report here indicates Vertu Motors may be undervalued.

City of London Investment Group (LSE:CLIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £181.85 million.

Operations: City of London Investment Group PLC generates revenue primarily from its asset management segment, amounting to $72.64 million.

Dividend Yield: 8.3%

City of London Investment Group offers an attractive dividend yield at 8.29%, ranking in the top 25% of UK dividend payers, but its sustainability is questionable given a high payout ratio (111.6%) not covered by earnings, though cash flows do cover dividends (cash payout ratio: 87.1%). Dividends have grown over the past decade but remain volatile and unreliable. Recent board addition of Ben Stocks may enhance governance with his extensive leadership experience.

- Take a closer look at City of London Investment Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that City of London Investment Group is trading beyond its estimated value.

Summing It All Up

- Embark on your investment journey to our 59 Top UK Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next 15 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NFG

Next 15 Group

Provides communications services in the United Kingdom, Europe, Africa, the United States, and the Asia Pacific.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives