- United Kingdom

- /

- Media

- /

- AIM:NAH

NAHL Group And 2 Other UK Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such fluctuating markets, investors often look for opportunities in less conventional areas like penny stocks. Although the term "penny stocks" may seem outdated, these smaller or emerging companies can offer potential value and growth when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.055 | £774.25M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.52M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.445 | £312.41M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.43 | $249.97M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

NAHL Group (AIM:NAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NAHL Group Plc operates in the United Kingdom, offering products and services in consumer legal services and catastrophic injury markets, with a market capitalization of £33.74 million.

Operations: The company generates revenue from two primary segments: Consumer Legal Services, contributing £25.26 million, and Critical Care, accounting for £15.37 million.

Market Cap: £33.74M

NAHL Group Plc, with a market cap of £33.74 million, shows promising financial health for a penny stock. Its operating cash flow comfortably covers debt, and both short and long-term liabilities are exceeded by current assets. Earnings have grown significantly at 172.9% over the past year, surpassing industry averages, while profit margins improved from 0.7% to 2%. Debt levels have decreased with a satisfactory net debt to equity ratio of 15.3%, and interest payments are well covered by EBIT at 4.5 times coverage. The company trades below its estimated fair value but has low return on equity at 4.9%.

- Dive into the specifics of NAHL Group here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into NAHL Group's future.

Quartix Technologies (AIM:QTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quartix Technologies plc designs, develops, markets, and delivers vehicle telematics services across the United Kingdom, France, the United States, and European Territories with a market cap of £75.49 million.

Operations: Quartix Technologies generates revenue from its vehicle telematics services with £18.36 million from the United Kingdom, £7.50 million from France, £3.26 million from the United States of America, and £2.24 million from New European Territories.

Market Cap: £75.49M

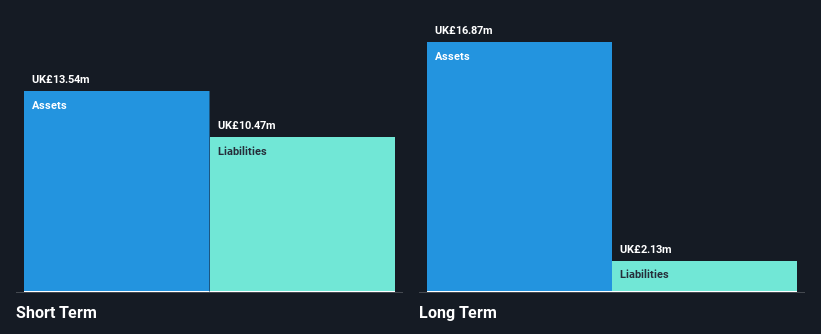

Quartix Technologies plc, with a market cap of £75.49 million, operates without debt, alleviating concerns over interest coverage and cash flow pressures. Despite being unprofitable and experiencing increased losses over the past five years at 25.3% annually, the company trades at 46.7% below estimated fair value. Its short-term assets of £13.5 million exceed both short-term (£10.5M) and long-term liabilities (£2.1M), indicating solid liquidity management for a penny stock. However, the board's inexperience is notable with an average tenure of 1.2 years, potentially impacting strategic direction amidst forecasted earnings growth of 58.63% per year.

- Click here and access our complete financial health analysis report to understand the dynamics of Quartix Technologies.

- Learn about Quartix Technologies' future growth trajectory here.

Steppe Cement (AIM:STCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Steppe Cement Ltd. is an investment holding company involved in the production and sale of cement and clinkers in Kazakhstan, with a market cap of £33.95 million.

Operations: The company's revenue is derived entirely from its operations in the production and sale of cement, amounting to $79.26 million.

Market Cap: £33.95M

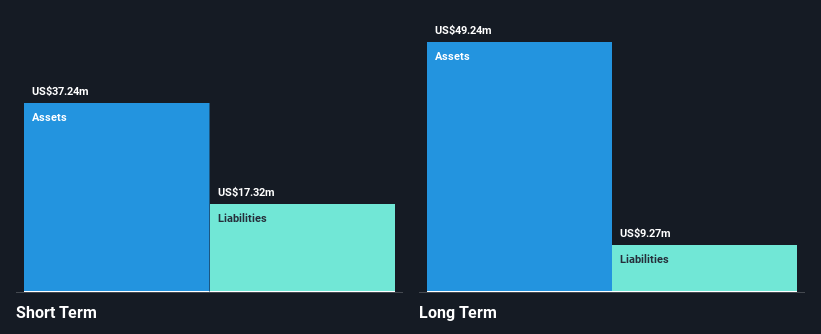

Steppe Cement Ltd., with a market cap of £33.95 million, faces challenges as its net profit margins have declined to 1.2% from 9.6% last year, and earnings growth has been negative at -87.5%. Despite these hurdles, the company maintains a satisfactory net debt to equity ratio of 5.6%, and its short-term assets exceed both short-term and long-term liabilities, suggesting sound liquidity management for a penny stock. Recent announcements include a capital reduction proposal and special dividend distribution after generating third-quarter revenue of approximately US$32 million, marking a slight increase from the previous year’s quarter results.

- Get an in-depth perspective on Steppe Cement's performance by reading our balance sheet health report here.

- Explore historical data to track Steppe Cement's performance over time in our past results report.

Key Takeaways

- Unlock our comprehensive list of 471 UK Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NAHL Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NAH

NAHL Group

Provides products and services to individuals and businesses in the consumer legal services and catastrophic injury markets in the United Kingdom.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives