- United Kingdom

- /

- Media

- /

- AIM:NAH

Discover 3 UK Penny Stocks With Market Caps Under £40M

Reviewed by Simply Wall St

As the FTSE 100 index faces challenges due to weak trade data from China, investors are increasingly looking for opportunities beyond traditional blue-chip stocks. Penny stocks, despite being an older term, continue to represent smaller or less-established companies that might offer significant value. By focusing on those with solid financials and potential growth, investors can uncover promising opportunities in the UK market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.215 | £834.53M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £169.38M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £415.73M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.89 | £67.4M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.23 | £104.97M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.215 | £411.4M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.404 | $234.86M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.40 | £209.85M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

essensys (AIM:ESYS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Essensys plc provides mission-critical software-as-a-service platforms and on-demand cloud services for the flexible workspace segment of the commercial real estate industry across the UK, Europe, North America, and Asia-Pacific, with a market cap of £20.70 million.

Operations: Revenue segments for this company have not been reported.

Market Cap: £20.7M

Essensys plc, with a market cap of £20.70 million, remains unprofitable despite reporting sales of £24.13 million for the year ended July 31, 2024. While losses have narrowed significantly from the previous year, the company faces challenges such as limited cash runway and a relatively new management team with an average tenure of 1.8 years. However, Essensys is debt-free and has strong short-term asset coverage over liabilities. Recent executive changes include appointing Greg Price as CFO to strengthen financial leadership amidst ongoing efforts to stabilize operations in the flexible workspace software sector.

- Dive into the specifics of essensys here with our thorough balance sheet health report.

- Gain insights into essensys' future direction by reviewing our growth report.

NAHL Group (AIM:NAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NAHL Group Plc operates in the United Kingdom, offering products and services in consumer legal services and catastrophic injury markets, with a market cap of £32.79 million.

Operations: The company's revenue is derived from two main segments: Consumer Legal Services, which generated £25.26 million, and Critical Care, contributing £15.37 million.

Market Cap: £32.79M

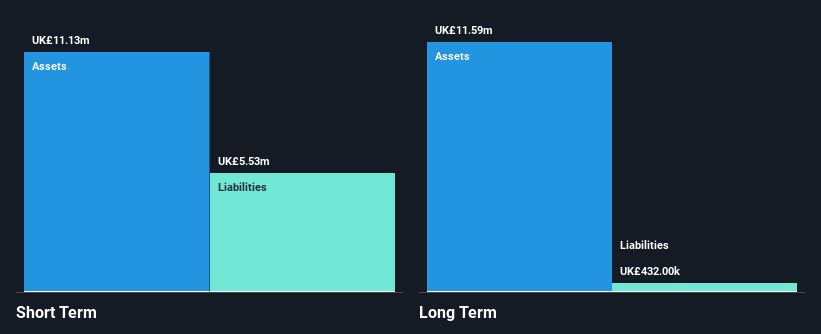

NAHL Group Plc, with a market cap of £32.79 million, has shown positive earnings momentum. For the half year ended June 30, 2024, it reported sales of £19.39 million and net income of £0.333 million, reversing a loss from the previous year. The company's interest payments are well-covered by EBIT at 4.5x coverage and its debt level is satisfactory with a net debt to equity ratio of 15.3%. Earnings have grown significantly by 172.9% over the past year and are forecasted to grow further at an impressive rate annually, suggesting potential for future profitability in its sectors.

- Click here to discover the nuances of NAHL Group with our detailed analytical financial health report.

- Learn about NAHL Group's future growth trajectory here.

OPG Power Ventures (AIM:OPG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OPG Power Ventures Plc, along with its subsidiaries, develops, owns, operates, and maintains private sector power projects in India with a market cap of £18.03 million.

Operations: The company generates revenue of £155.69 million from its thermal power operations.

Market Cap: £18.03M

OPG Power Ventures, with a market cap of £18.03 million, operates in the thermal power sector and reported revenues of £155.69 million for the year ending March 31, 2024. Despite a decline in net income to £4.11 million from £7.25 million the previous year, OPG maintains satisfactory debt levels with its net debt to equity ratio at 4.1%. The company's interest payments are well-covered by EBIT at 4.4x coverage, and it has high-quality earnings despite experiencing negative earnings growth over the past year. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating financial stability amidst share price volatility.

- Jump into the full analysis health report here for a deeper understanding of OPG Power Ventures.

- Gain insights into OPG Power Ventures' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Access the full spectrum of 464 UK Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NAHL Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NAH

NAHL Group

Provides products and services to individuals and businesses in the consumer legal services and catastrophic injury markets in the United Kingdom.

Flawless balance sheet with solid track record.