- United Kingdom

- /

- IT

- /

- AIM:MTEC

Gaming Realms Leads 3 Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced turbulence, with the FTSE 100 index faltering due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these challenges, certain investment opportunities remain appealing, particularly in niche areas like penny stocks. While the term "penny stocks" may seem outdated, these smaller or newer companies offer potential for growth and value when supported by strong financials and a clear growth trajectory.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.19 | £825.11M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.275 | £425.17M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.69 | £70.37M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £1.00 | £75.73M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.25 | £202.69M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.407 | $236.6M | ★★★★★★ |

| Central Asia Metals (AIM:CAML) | £1.624 | £282.53M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Gaming Realms (AIM:GMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gaming Realms plc develops, publishes, and licenses mobile gaming content across various regions including the United Kingdom, the United States, Isle of Man, Malta, Gibraltar, and internationally with a market cap of £108.79 million.

Operations: The company generates revenue primarily through Licensing, which accounts for £21.65 million, and Social Publishing (excluding Licensing), contributing £3.81 million.

Market Cap: £108.79M

Gaming Realms plc has demonstrated robust financial performance, with half-year sales reaching £13.58 million and net income of £3.3 million, reflecting growth from the previous year. The company is debt-free, reducing financial risk and enhancing its appeal as a penny stock. Despite high share price volatility, Gaming Realms offers high-quality earnings and a strong Return on Equity of 23.9%. Short-term assets comfortably cover liabilities, indicating sound financial health. However, the management team and board are relatively inexperienced with average tenures under two years, which could impact strategic execution in the future.

- Click here to discover the nuances of Gaming Realms with our detailed analytical financial health report.

- Evaluate Gaming Realms' prospects by accessing our earnings growth report.

K3 Business Technology Group (AIM:KBT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: K3 Business Technology Group plc, along with its subsidiaries, offers computer software and consultancy services across various regions including the United Kingdom, the Netherlands, Ireland, Europe, the Middle East, Asia, and the United States with a market capitalization of £27.94 million.

Operations: The company's revenue is derived from two main segments: K3 Products, contributing £13.10 million, and Third Party Solutions, generating £25.88 million.

Market Cap: £27.94M

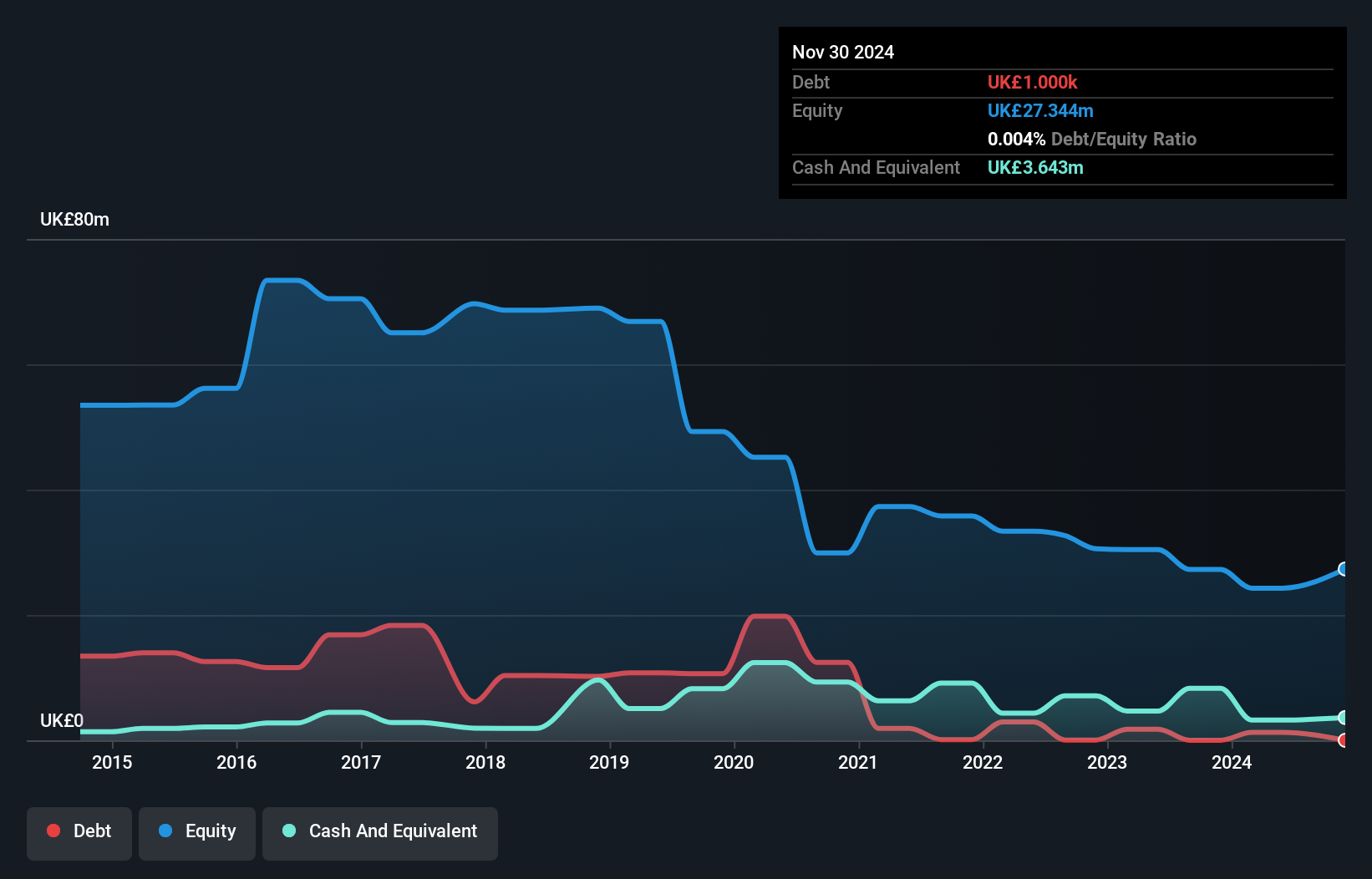

K3 Business Technology Group plc, with a market cap of £27.94 million, presents an intriguing profile within the penny stock landscape. Despite being unprofitable, it has successfully reduced losses by 8.8% annually over five years and maintains a stable weekly volatility of 3%. The company holds more cash than debt and has improved its debt-to-equity ratio significantly over time. However, short-term assets of £10.3 million fall short of covering liabilities (£14 million), posing potential liquidity challenges. Recent board changes include Tom Crawford assuming the role of Audit Committee Chair following Pernille Fabricius's departure.

- Navigate through the intricacies of K3 Business Technology Group with our comprehensive balance sheet health report here.

- Learn about K3 Business Technology Group's historical performance here.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Made Tech Group Plc offers digital, data, and technology services to the UK public sector with a market cap of £33.85 million.

Operations: The company generates £38.57 million in revenue from its Computer Graphics segment.

Market Cap: £33.85M

Made Tech Group Plc, with a market cap of £33.85 million, operates in the UK public sector and reported revenue of £38.57 million for the year ending May 2024, though it remains unprofitable with increasing losses. The company has no debt and maintains a cash runway exceeding three years despite its high volatility compared to other UK stocks. Recent developments include securing a £13.2 million contract with the Department for Education, expected to positively impact current financials, alongside guidance suggesting FY25 revenue will surpass market expectations of £35.2 million. However, management's limited experience may pose operational challenges moving forward.

- Jump into the full analysis health report here for a deeper understanding of Made Tech Group.

- Understand Made Tech Group's earnings outlook by examining our growth report.

Seize The Opportunity

- Explore the 465 names from our UK Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MTEC

Made Tech Group

Through its subsidiaries, provides digital, data, and technology services to the public sector in the United Kingdom.

Excellent balance sheet very low.

Market Insights

Community Narratives