- United Kingdom

- /

- Entertainment

- /

- AIM:GMR

Avingtrans And 2 Other Penny Stocks To Watch On The UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China impacting companies closely tied to its economy. Amid such broader market fluctuations, investors often look for opportunities in less prominent areas like penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still present intriguing investment possibilities when supported by solid financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.045 | £770.58M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £434.2M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.254 | £193.4M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.685 | £366.5M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.47 | $273.22M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.475 | £316.24M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Avingtrans (AIM:AVG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Avingtrans plc, with a market cap of £129.85 million, operates through its subsidiaries to deliver engineered components, systems, and services across the energy, medical, and infrastructure sectors globally.

Operations: The company's revenue is primarily derived from its Energy Advanced Engineering Systems segment, contributing £132.94 million, and its Medical and Industrial Imaging segment, which adds £3.68 million.

Market Cap: £129.85M

Avingtrans plc, with a market cap of £129.85 million, operates in the energy and medical sectors. The company's earnings have grown significantly over the past five years but faced negative growth last year, affecting comparisons to industry averages. Despite this setback, earnings are forecast to grow substantially at 38.01% per year. A satisfactory net debt to equity ratio of 1.6% and well-covered interest payments by EBIT indicate financial stability, although operating cash flow does not adequately cover debt levels. The seasoned management team and board bring experience to navigate these challenges while maintaining high-quality earnings without shareholder dilution recently.

- Click here to discover the nuances of Avingtrans with our detailed analytical financial health report.

- Assess Avingtrans' future earnings estimates with our detailed growth reports.

Gaming Realms (AIM:GMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gaming Realms plc develops, publishes, and licenses mobile gaming content across various regions including the United Kingdom, the United States, and internationally, with a market cap of £109.38 million.

Operations: The company generates revenue primarily from Licensing (£21.65 million) and Social Publishing excluding Licensing (£3.81 million).

Market Cap: £109.38M

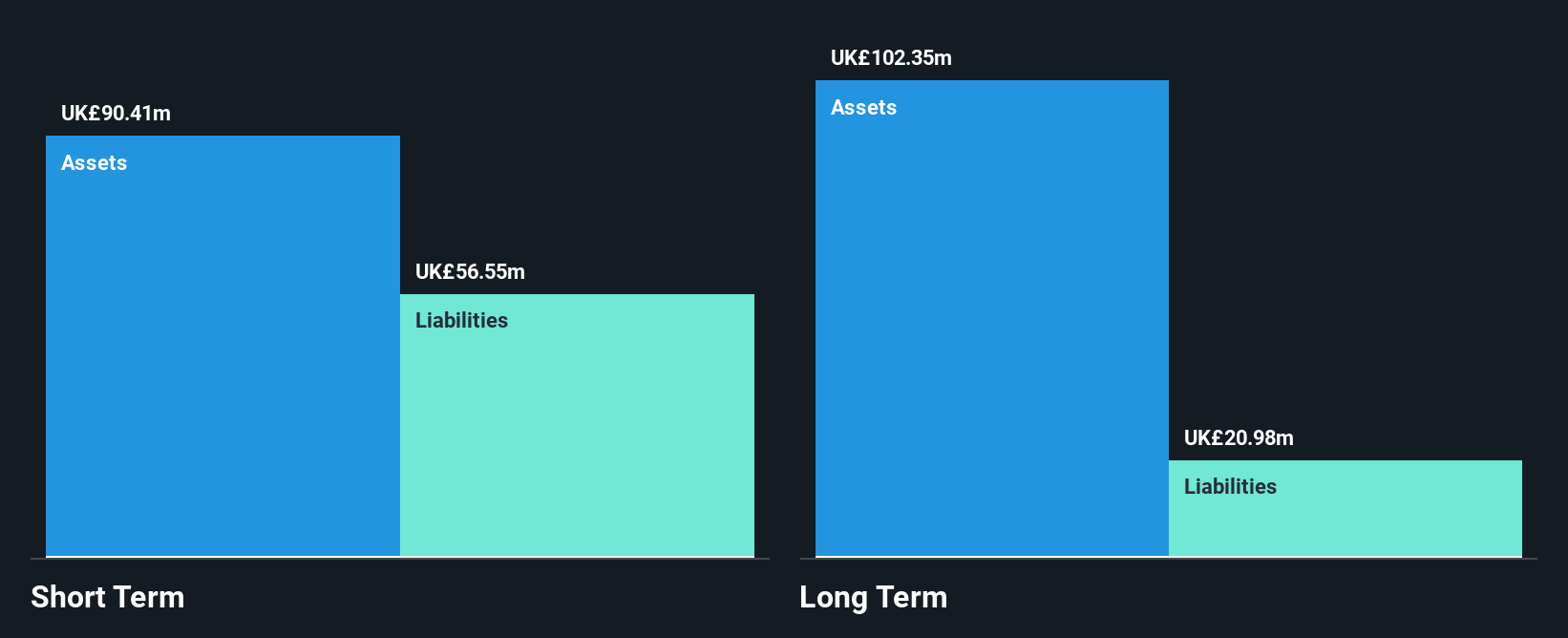

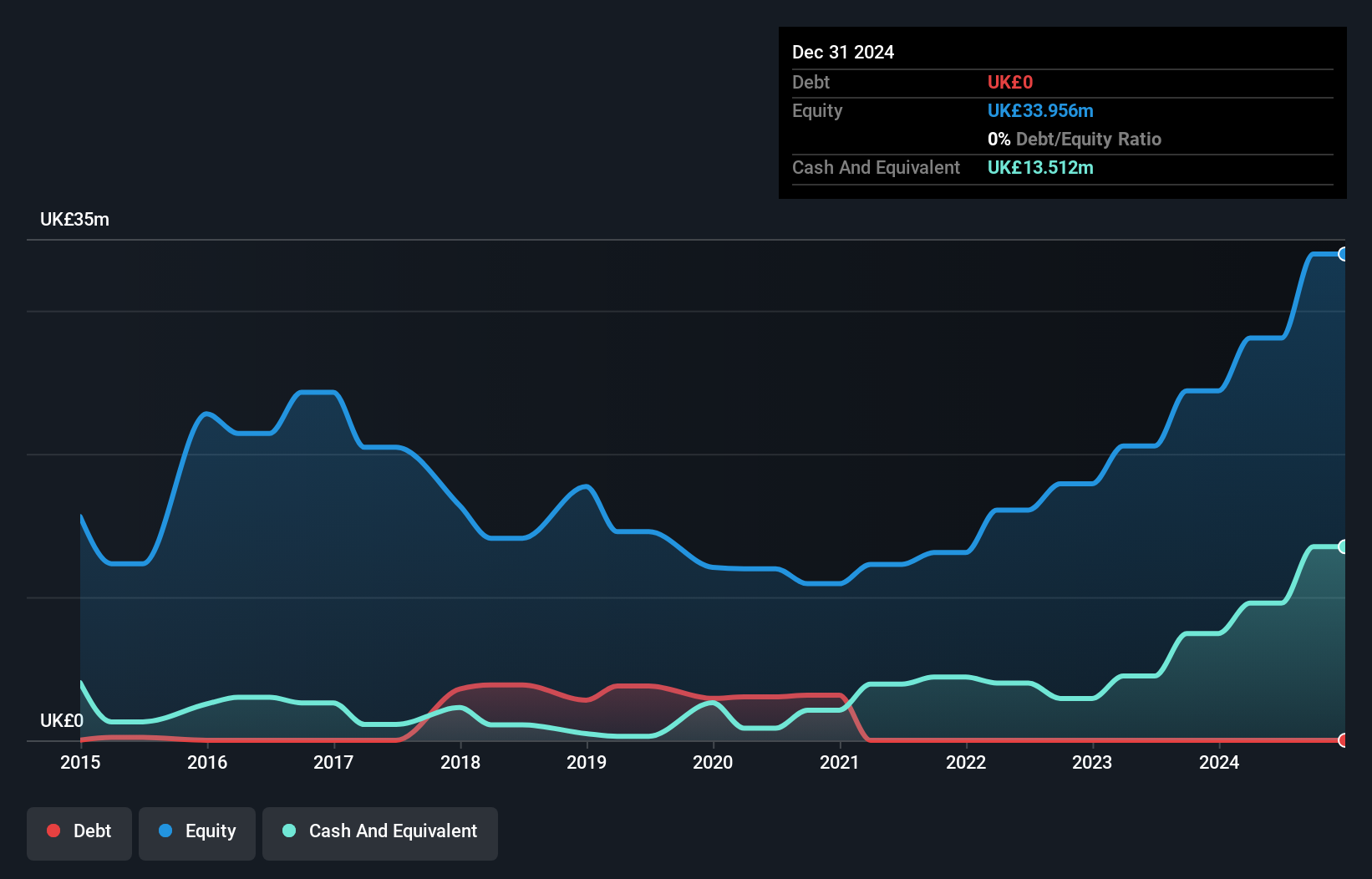

Gaming Realms plc, with a market cap of £109.38 million, has demonstrated robust profitability growth over the past five years, achieving an average annual earnings increase of 75.6%. Despite a slowdown to 41.8% last year, this growth still surpasses the entertainment industry's decline. The company is debt-free and maintains strong financial health with short-term assets exceeding both short- and long-term liabilities. High-quality earnings and a net profit margin improvement to 26.3% reflect operational efficiency. Analysts expect continued revenue growth at 22.07% annually, supported by stable shareholding without significant dilution and trading below estimated fair value.

- Click to explore a detailed breakdown of our findings in Gaming Realms' financial health report.

- Learn about Gaming Realms' future growth trajectory here.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Time Finance plc, along with its subsidiaries, offers financial products and services to consumers and businesses in the United Kingdom and has a market cap of £59.37 million.

Operations: Time Finance generates revenue primarily through its Asset Finance segment, contributing £18.75 million, and its Invoice Finance segment, which adds £14.32 million.

Market Cap: £59.37M

Time Finance plc, with a market cap of £59.37 million, has shown impressive earnings growth of 32.3% over the past year, outpacing the Diversified Financial industry. The company maintains strong liquidity with short-term assets (£180M) exceeding both short- and long-term liabilities (£80M and £63.6M respectively). While its debt-to-equity ratio has improved to 2% from 7% over five years, operating cash flow remains negative, indicating potential challenges in covering debt through cash generation. The Price-To-Earnings ratio (13.4x) is below the UK market average, suggesting potential undervaluation despite low Return on Equity at 6.7%.

- Unlock comprehensive insights into our analysis of Time Finance stock in this financial health report.

- Gain insights into Time Finance's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Embark on your investment journey to our 466 UK Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GMR

Gaming Realms

Develops, publishes, and licenses mobile gaming content in the United Kingdom, the United States, Isle of Man, Malta, Gibraltar, and internationally.

Flawless balance sheet with solid track record.