- United Kingdom

- /

- Entertainment

- /

- AIM:FDEV

UK Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The UK market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market trends, investors may find opportunities in penny stocks—an investment area that continues to hold relevance for those interested in smaller or newer companies. These stocks can sometimes offer surprising value and potential growth when backed by strong financial health, making them an intriguing option for those looking beyond established names.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.40 | £274.68M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.68 | £418.58M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.825 | £280.96M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.245 | £409.2M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.916 | £145.98M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.799 | £67.73M | ★★★★★★ |

| RTC Group (AIM:RTC) | £1.00 | £13.61M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.374 | £211.91M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.06 | £146.97M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc develops and publishes video games for the interactive entertainment sector, with a market cap of £75.77 million.

Operations: The company generates revenue from its Computer Graphics segment, amounting to £88.88 million.

Market Cap: £75.77M

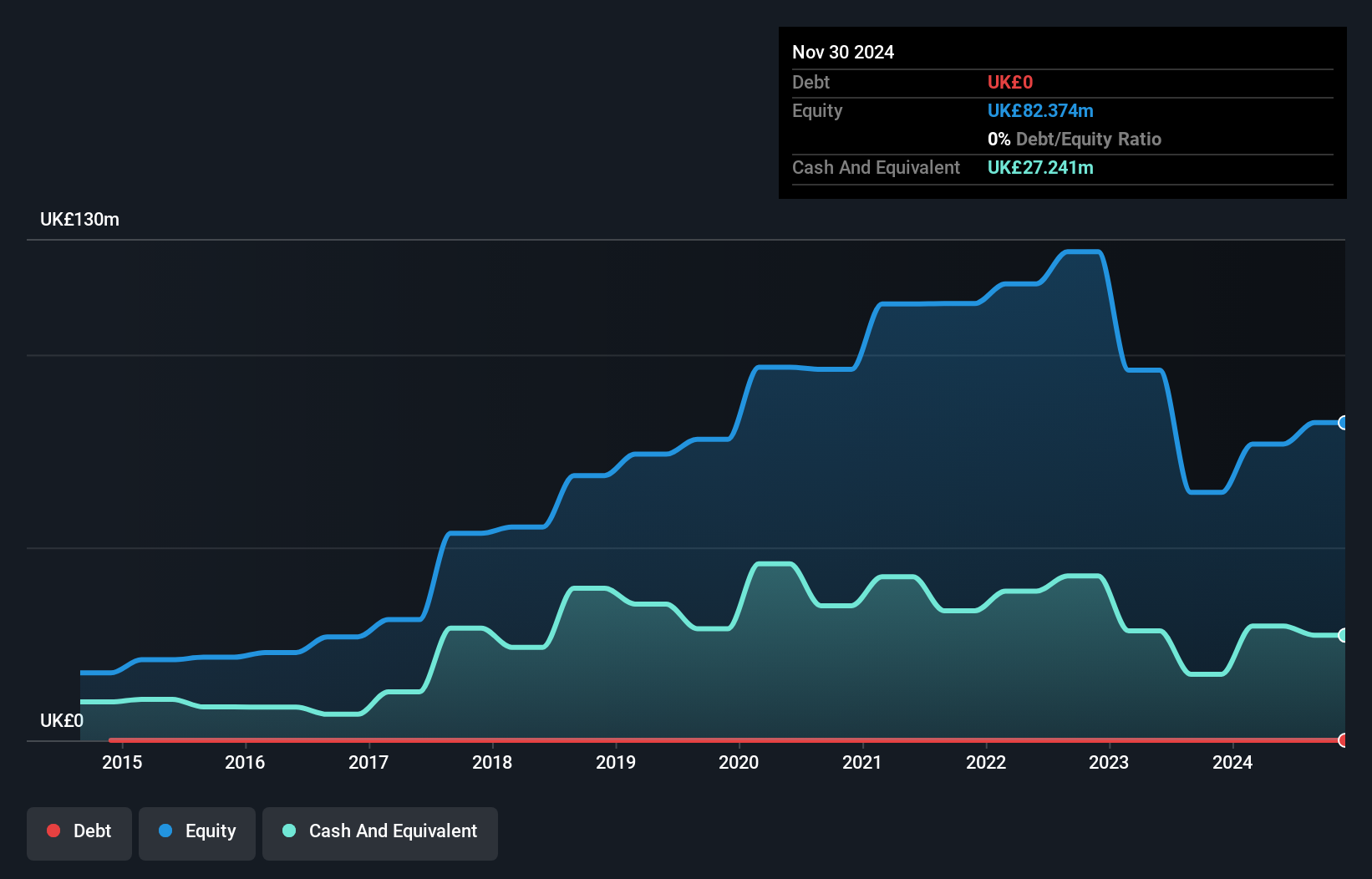

Frontier Developments has recently turned profitable, reporting a net income of £4.4 million for the half year ending November 30, 2024, compared to a loss the previous year. Despite its profitability and no debt burden, its share price remains highly volatile. The company’s short-term assets comfortably cover both short and long-term liabilities. However, earnings are forecasted to decline significantly over the next three years. While Frontier's Price-to-Earnings ratio of 4.7x suggests it may be undervalued relative to the UK market average of 15.2x, investors should consider its high volatility and projected earnings decline carefully.

- Unlock comprehensive insights into our analysis of Frontier Developments stock in this financial health report.

- Review our growth performance report to gain insights into Frontier Developments' future.

M.T.I Wireless Edge (AIM:MWE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: M.T.I Wireless Edge Ltd. is involved in the design, development, manufacture, and marketing of antennas for both civilian and military sectors, with a market cap of £58.61 million.

Operations: The company generates revenue through its key segments: Antennas ($13.55 million), Water Solutions ($16.50 million), and Distribution & Consultation ($15.98 million).

Market Cap: £58.61M

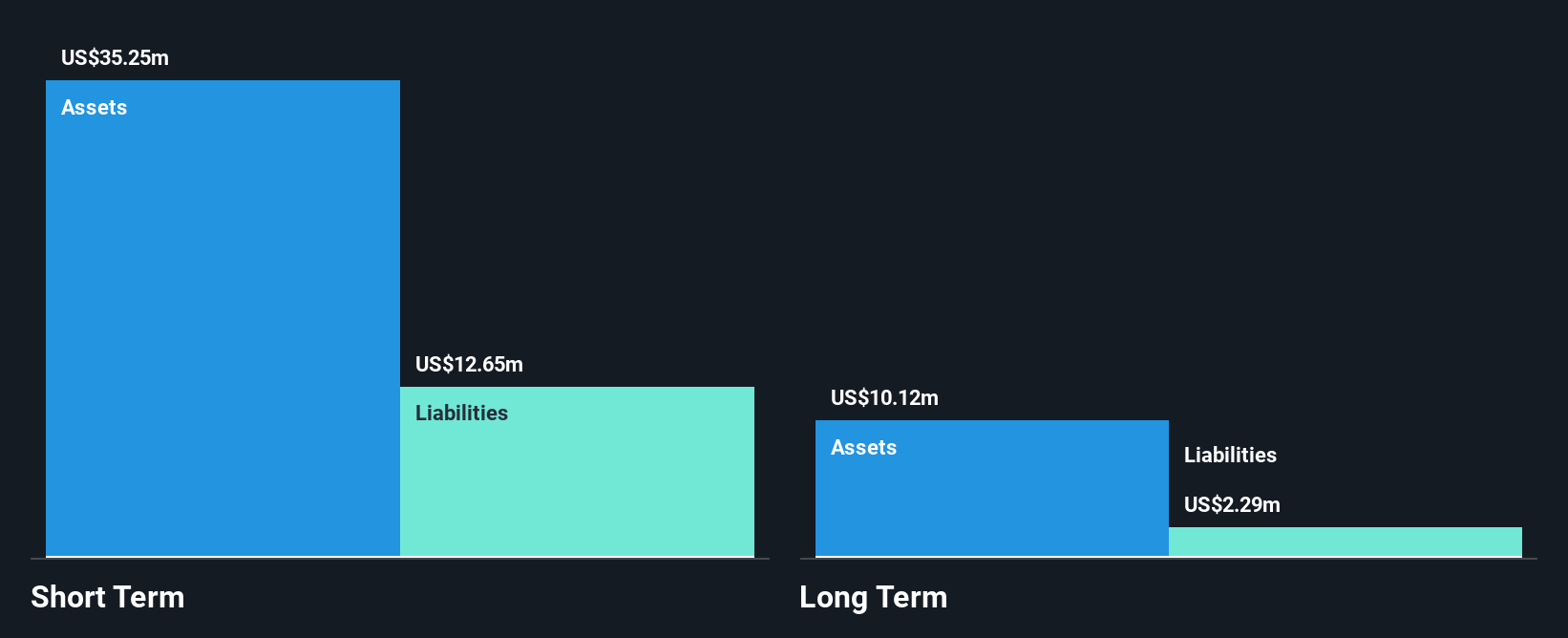

M.T.I Wireless Edge Ltd. shows promise in the penny stock segment with a market cap of £58.61 million, supported by a diversified revenue stream across Antennas (US$13.55 million), Water Solutions (US$16.50 million), and Distribution & Consultation (US$15.98 million). The company recently secured significant military antenna orders worth US$5 million from Israel, indicating strong demand in its Antenna division. Despite having low return on equity at 15%, M.T.I's debt is well-managed with operating cash flow coverage at 952%. However, its dividend yield of 3.52% is not fully covered by free cash flows, presenting potential sustainability concerns for income-focused investors.

- Dive into the specifics of M.T.I Wireless Edge here with our thorough balance sheet health report.

- Gain insights into M.T.I Wireless Edge's outlook and expected performance with our report on the company's earnings estimates.

easyJet (LSE:EZJ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: easyJet plc operates as a low-cost airline carrier in Europe with a market cap of £3.64 billion.

Operations: The company generates revenue primarily through its Airline segment, which accounts for £8.17 billion, and its Holidays segment, contributing £1.52 billion.

Market Cap: £3.64B

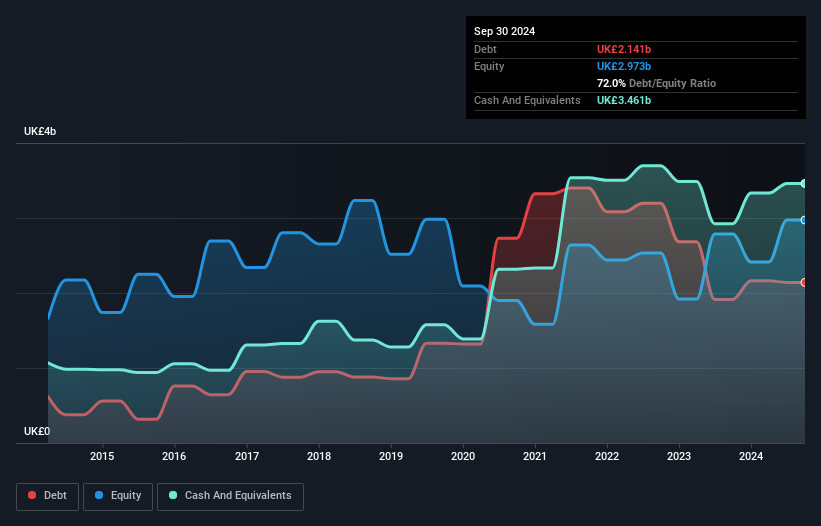

easyJet plc, with a market cap of £3.64 billion, demonstrates stability and growth potential within the penny stock category. The company's revenue streams from its Airline (£8.17 billion) and Holidays (£1.52 billion) segments underscore its robust business model. Recent guidance indicates anticipated ASK capacity growth of 8% for 2025, alongside a projected 25% increase in holiday customers, suggesting strategic expansion efforts. Financially, easyJet's debt is well-covered by cash flow (70%), though Return on Equity remains low at 15.2%. Management changes are underway with Sue Clark assuming the role of Chair of the Remuneration Committee post-AGM in February 2025.

- Click here to discover the nuances of easyJet with our detailed analytical financial health report.

- Evaluate easyJet's prospects by accessing our earnings growth report.

Next Steps

- Discover the full array of 444 UK Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FDEV

Frontier Developments

Develops and publishes video games for interactive entertainment sector.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives