- United Kingdom

- /

- Entertainment

- /

- AIM:FDEV

Here's Why I Think Frontier Developments (LON:FDEV) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Frontier Developments (LON:FDEV). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Frontier Developments

How Fast Is Frontier Developments Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Frontier Developments has managed to grow EPS by 33% per year over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

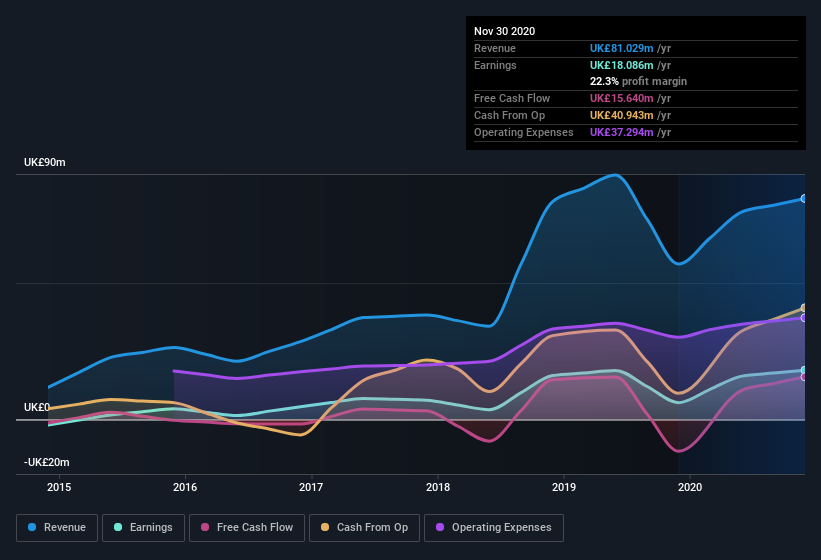

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Frontier Developments shareholders can take confidence from the fact that EBIT margins are up from 12% to 24%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Frontier Developments's forecast profits?

Are Frontier Developments Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Frontier Developments insiders have a significant amount of capital invested in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at UK£373m. Coming in at 35% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Frontier Developments with market caps between UK£726m and UK£2.3b is about UK£977k.

The Frontier Developments CEO received total compensation of just UK£390k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Frontier Developments To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Frontier Developments's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Each to their own, but I think all this makes Frontier Developments look rather interesting indeed. Of course, profit growth is one thing but it's even better if Frontier Developments is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Frontier Developments, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:FDEV

Frontier Developments

Develops and publishes video games for the interactive entertainment sector.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks