- United Kingdom

- /

- Entertainment

- /

- AIM:FDEV

Frontier Developments Leads The Pack Of 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a decline due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market fluctuations, investors often seek opportunities in smaller or newer companies that can offer unique value propositions. Penny stocks, although an older term, remain relevant as they can provide potential growth and stability when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.55 | £509.4M | ✅ 4 ⚠️ 0 View Analysis > |

| Nexteq (AIM:NXQ) | £0.78 | £46.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.41 | £425.14M | ✅ 4 ⚠️ 1 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.76 | £283.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.175 | £114.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.18 | £187.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.45 | £74.65M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.874 | £707.85M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 300 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc develops and publishes video games for the interactive entertainment sector, with a market cap of £143.41 million.

Operations: Revenue segment information is not reported for this company.

Market Cap: £143.41M

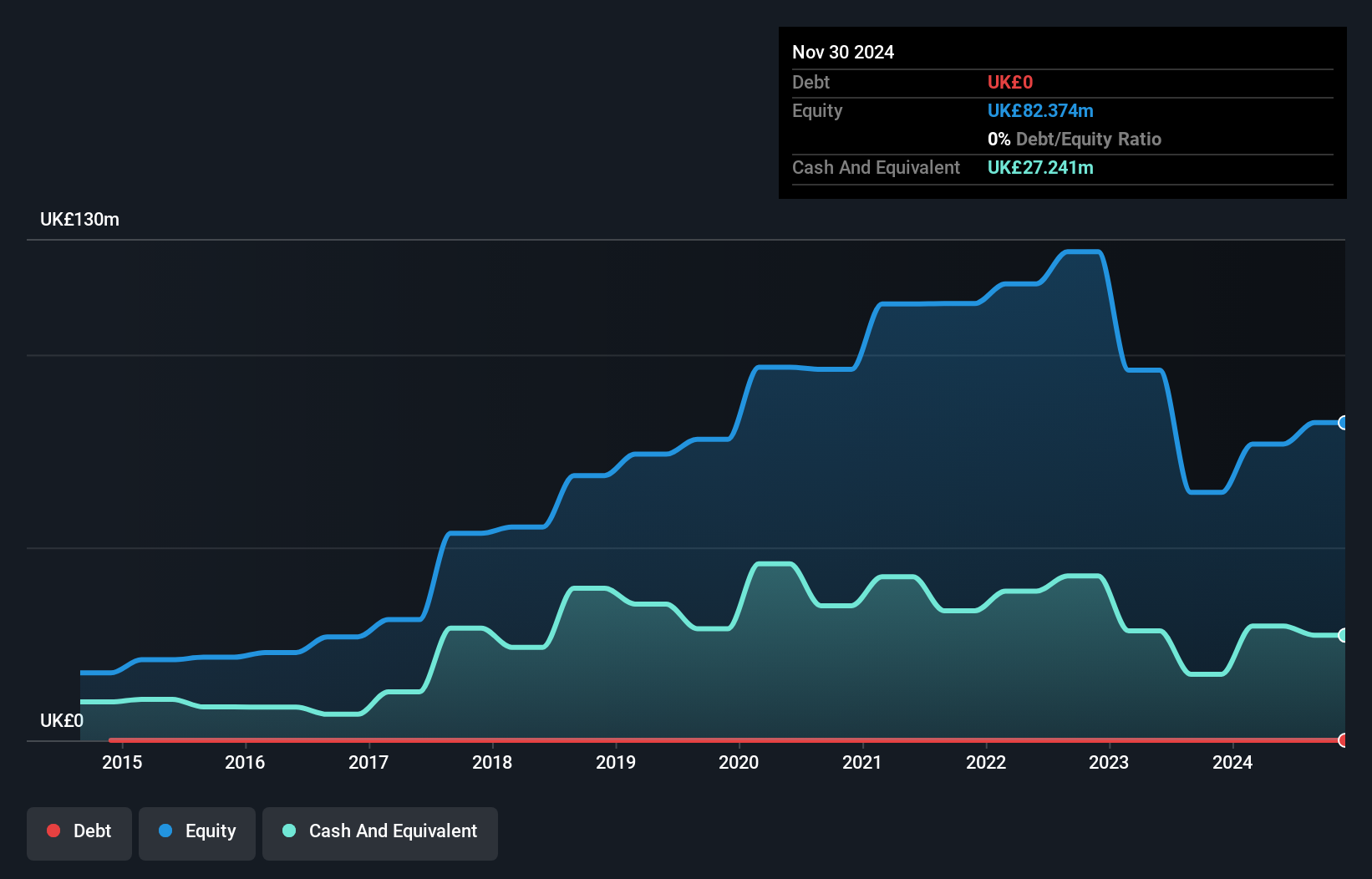

Frontier Developments has recently turned profitable, reporting a net income of £16.39 million for the year ending May 2025, compared to a loss in the previous year. The company has no debt and its short-term assets significantly exceed both short and long-term liabilities, indicating solid financial health. A share buyback program aims to enhance shareholder value by reducing share capital and increasing earnings per share. Despite insider selling over the past three months, Frontier's management team is experienced, with an average tenure of 5.8 years, supporting strategic growth initiatives within the video game sector.

- Get an in-depth perspective on Frontier Developments' performance by reading our balance sheet health report here.

- Gain insights into Frontier Developments' outlook and expected performance with our report on the company's earnings estimates.

Public Policy Holding Company (AIM:PPHC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Public Policy Holding Company, Inc. offers consulting services in the United States and has a market cap of £229.35 million.

Operations: No specific revenue segments have been reported for Public Policy Holding Company, Inc.

Market Cap: £229.35M

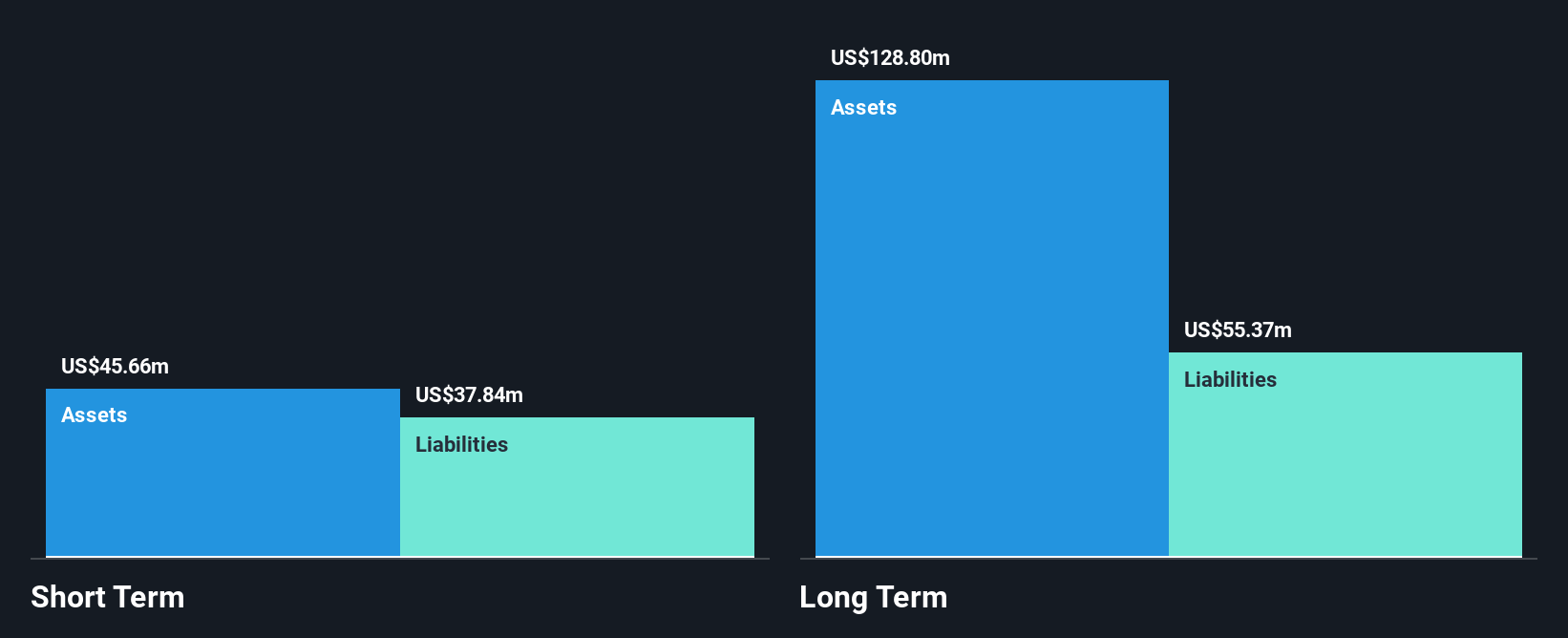

Public Policy Holding Company, Inc. reported half-year sales of US$87.9 million, up from US$71.13 million the previous year, yet it remains unprofitable with a net loss of US$16.35 million. Its net debt to equity ratio is satisfactory at 21.5%, but its short-term assets do not cover long-term liabilities. The company plans a U.S. IPO to enhance capital access and shareholder liquidity while maintaining its AIM listing in the UK. Despite positive free cash flow and a sufficient cash runway for over three years, management's inexperience may impact strategic execution as they seek growth opportunities.

- Take a closer look at Public Policy Holding Company's potential here in our financial health report.

- Understand Public Policy Holding Company's earnings outlook by examining our growth report.

W.A.G payment solutions (LSE:EWG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform for the commercial road transportation industry in Europe, with a market cap of £755.62 million.

Operations: The company's revenue is primarily generated from its Payment Solutions segment, which accounts for €2.12 billion, followed by Mobility Solutions contributing €128.60 million.

Market Cap: £755.62M

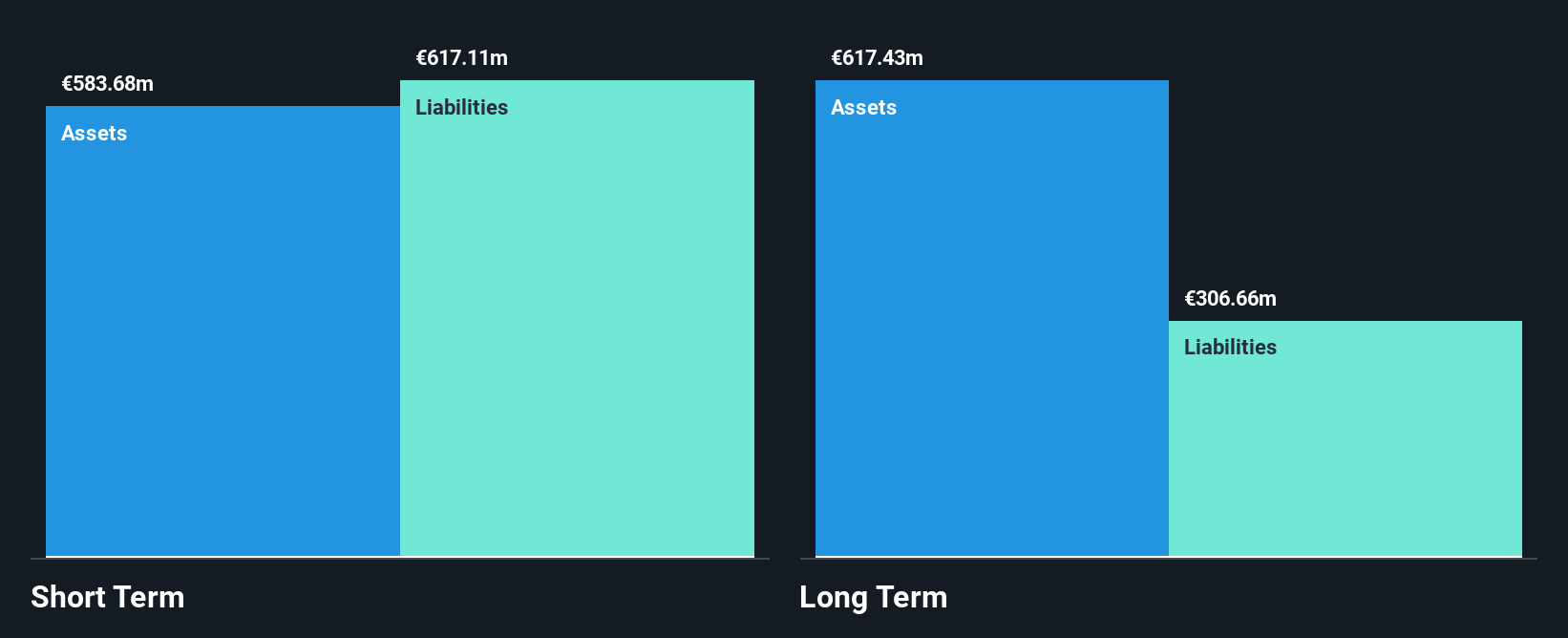

W.A.G payment solutions plc, with a market cap of £755.62 million, has recently become profitable, reporting a net income of €10.54 million for H1 2025 compared to €2.43 million the previous year. The company is pursuing bolt-on acquisitions to enhance its platform offerings and cross-sell opportunities. Despite high volatility in share price and a large one-off loss impacting recent financials, W.A.G's debt situation has improved over five years, though short-term liabilities exceed assets slightly. Its board lacks experience with an average tenure under three years, which may influence strategic decisions moving forward.

- Click here to discover the nuances of W.A.G payment solutions with our detailed analytical financial health report.

- Review our growth performance report to gain insights into W.A.G payment solutions' future.

Make It Happen

- Jump into our full catalog of 300 UK Penny Stocks here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 23 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FDEV

Frontier Developments

Develops and publishes video games for the interactive entertainment sector.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives