- United Kingdom

- /

- Entertainment

- /

- AIM:FDEV

Frontier Developments Leads 3 UK Penny Stocks Worth Watching

Reviewed by Simply Wall St

The London market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. In such fluctuating conditions, discerning investors might look toward penny stocks as a potential avenue for growth. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer significant opportunities when backed by solid financials and strong fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.205 | £418.21M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.59 | £68.47M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.89 | £67.4M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.74 | £202.9M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.2525 | £106.89M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.325 | £168.74M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.335 | £426.76M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.40 | $232.53M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc is a company that develops and publishes video games for the interactive entertainment sector, with a market cap of £87.08 million.

Operations: The company generates revenue from its Computer Graphics segment, amounting to £89.27 million.

Market Cap: £87.08M

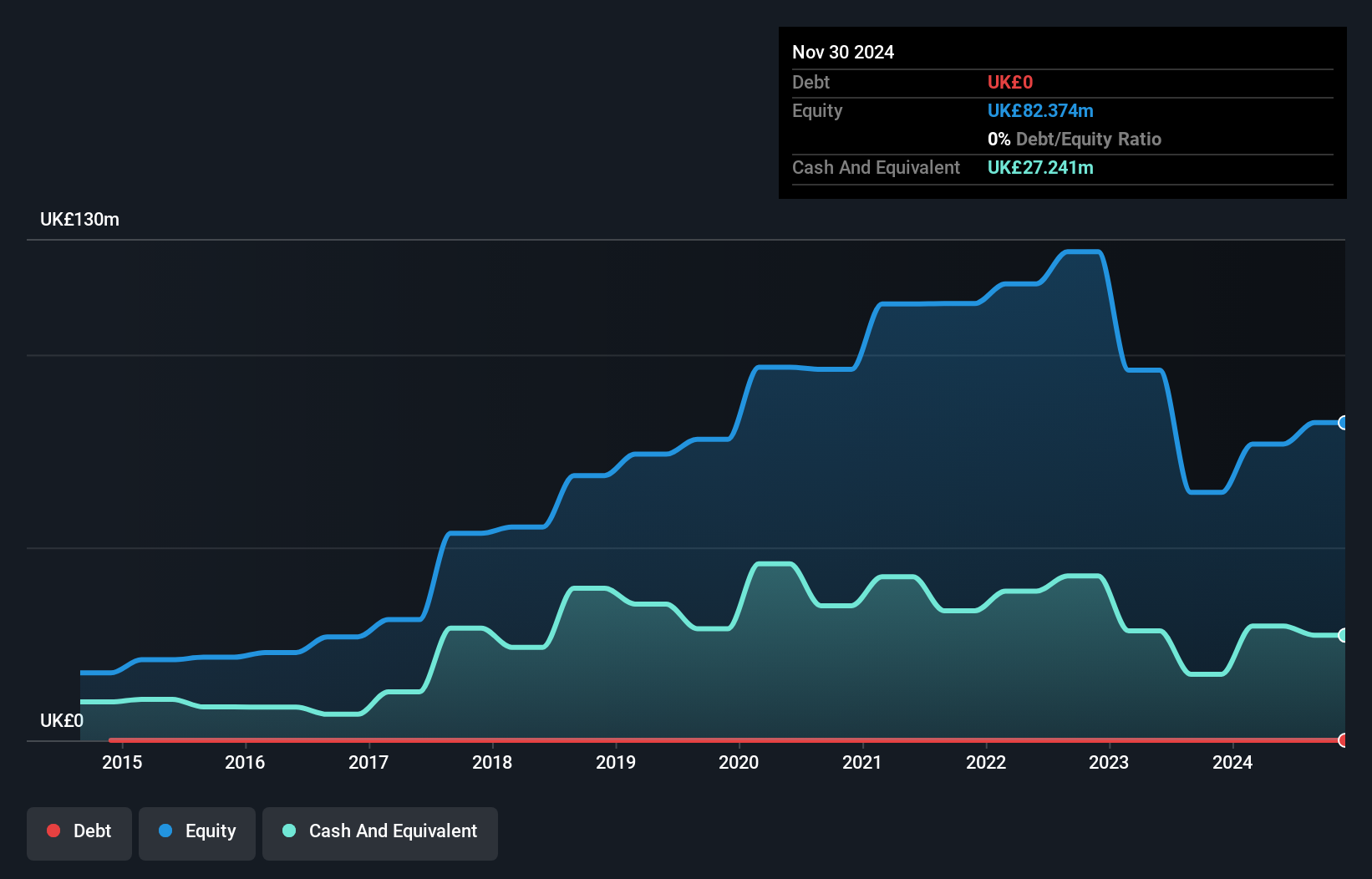

Frontier Developments plc, with a market cap of £87.08 million, is unprofitable and has seen increased losses over the past five years. Despite this, it maintains a solid financial position with short-term assets exceeding both short- and long-term liabilities and operates debt-free. The company's management and board are experienced, which may provide stability amid its high share price volatility. While revenue declined to £89.27 million from the previous year, earnings are forecasted to grow significantly at 123.3% per year. Shareholders have not faced significant dilution recently, suggesting some level of share value retention amidst challenges.

- Unlock comprehensive insights into our analysis of Frontier Developments stock in this financial health report.

- Evaluate Frontier Developments' prospects by accessing our earnings growth report.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Netcall plc is involved in the design, development, sale, and support of software products and services both in the United Kingdom and internationally, with a market cap of £168.42 million.

Operations: The company generates £39.06 million from its segment focused on software products and services.

Market Cap: £168.42M

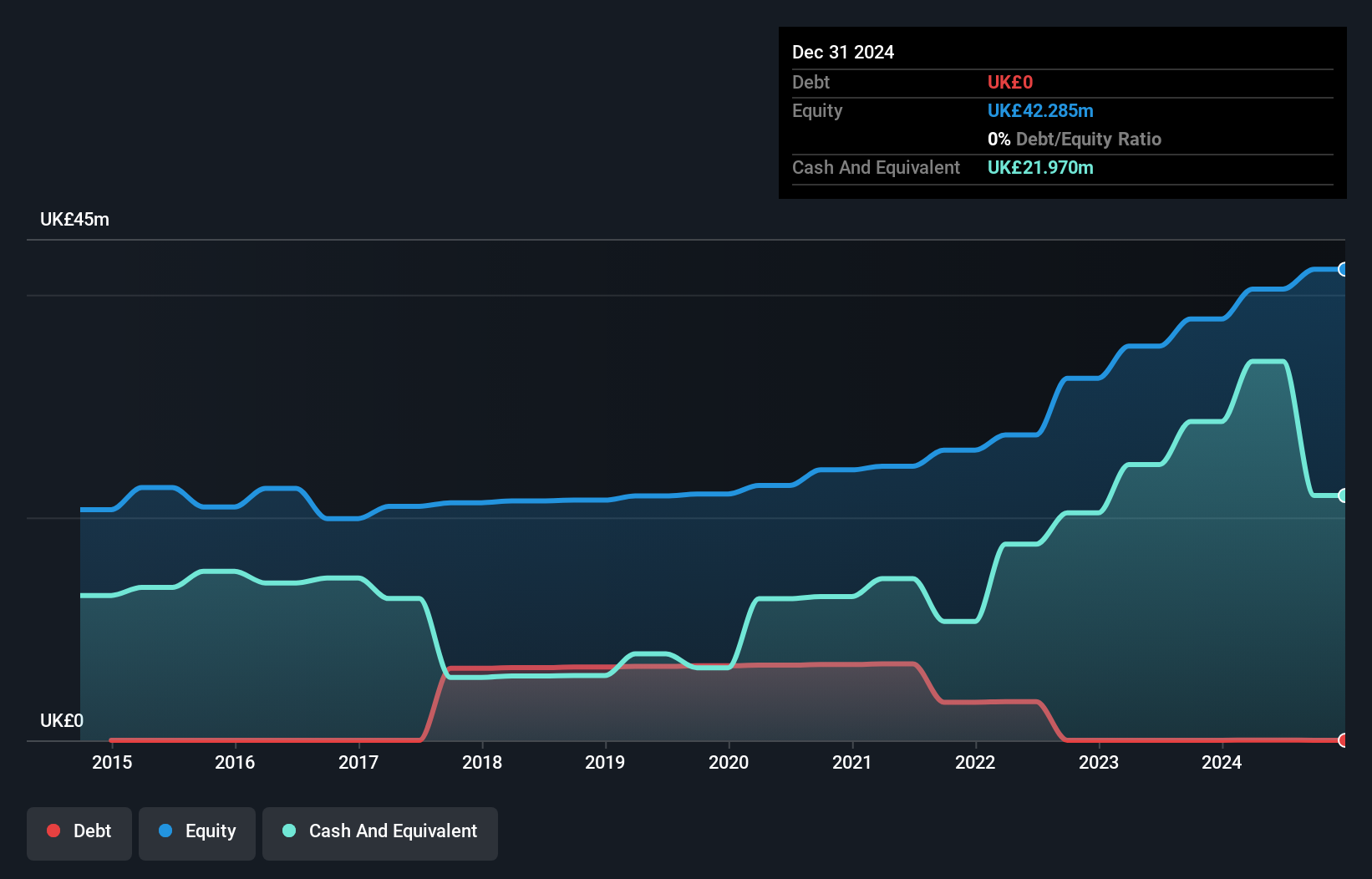

Netcall plc, with a market cap of £168.42 million, has demonstrated significant earnings growth over the past five years, averaging 48% annually. Recent financial results show sales increased to £39.06 million and net income rose to £5.85 million for the year ended June 30, 2024. The company maintains a strong balance sheet with short-term assets exceeding liabilities and reduced its debt-to-equity ratio significantly over five years. However, shareholders experienced some dilution recently with shares outstanding growing by 2.9%. A proposed dividend increase reflects confidence in ongoing profitability despite a low return on equity at 14.5%.

- Jump into the full analysis health report here for a deeper understanding of Netcall.

- Learn about Netcall's future growth trajectory here.

Software Circle (AIM:SFT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Software Circle plc, along with its subsidiaries, operates in the licensing of various software across the United Kingdom, Ireland, Europe, and internationally with a market cap of £91.67 million.

Operations: The company's revenue segments include Graphics & Ecommerce (£10.45 million), Health & Social Care (£2.63 million), Property (£1.55 million), Professional & Financial Services (£1.41 million), and Education (£0.13 million).

Market Cap: £91.67M

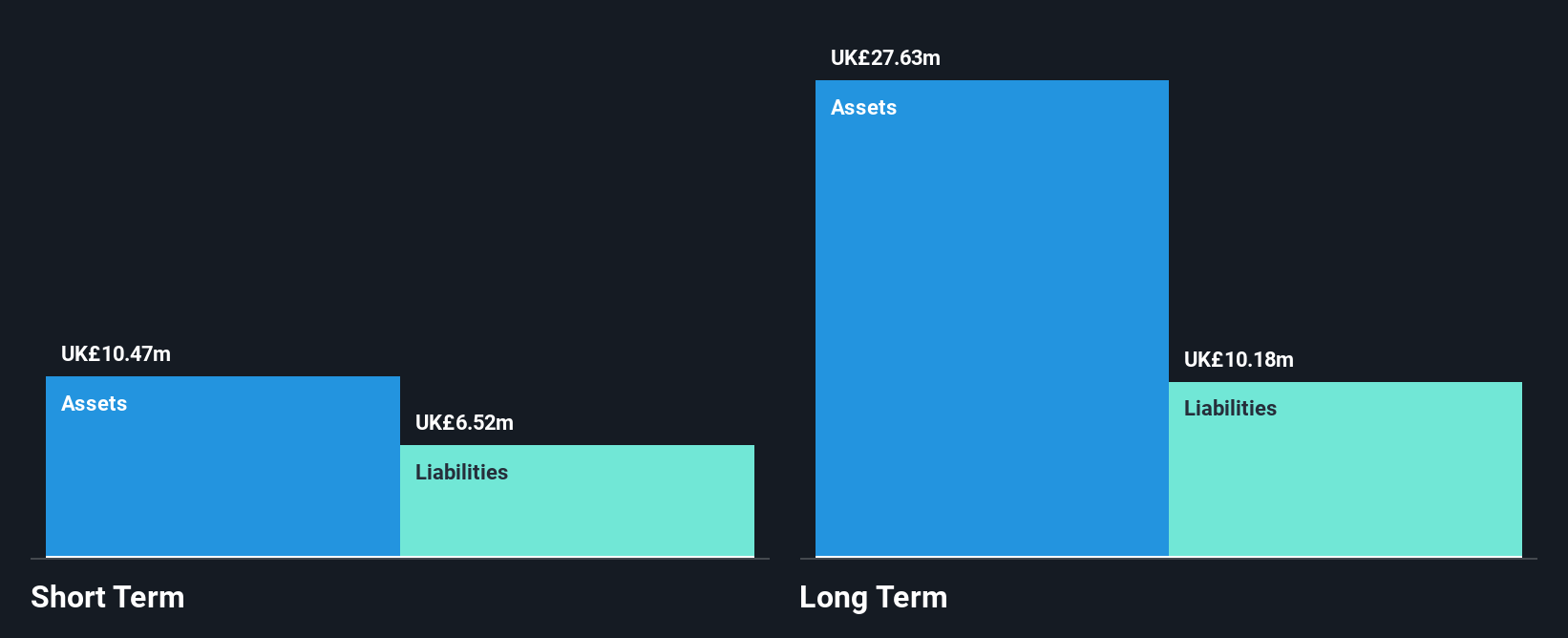

Software Circle plc, with a market cap of £91.67 million, is currently unprofitable but maintains financial stability due to positive and growing free cash flow, ensuring a cash runway exceeding three years. The company’s short-term assets (£17.8M) surpass both its short-term (£4.7M) and long-term liabilities (£8.1M), indicating sound liquidity management despite a negative return on equity (-10.93%). While the debt-to-equity ratio has increased over five years, Software Circle holds more cash than total debt and trades significantly below estimated fair value without recent shareholder dilution. Recent board changes include appointing Brad Ormsby as Non-Executive Director in September 2024.

- Click here to discover the nuances of Software Circle with our detailed analytical financial health report.

- Assess Software Circle's previous results with our detailed historical performance reports.

Summing It All Up

- Click through to start exploring the rest of the 461 UK Penny Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FDEV

Frontier Developments

Develops and publishes video games for interactive entertainment sector.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives